The Essential Guide to Jewellery Bill Book Format: A Comprehensive Overview for Accurate Record-Keeping

Related Articles: The Essential Guide to Jewellery Bill Book Format: A Comprehensive Overview for Accurate Record-Keeping

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Essential Guide to Jewellery Bill Book Format: A Comprehensive Overview for Accurate Record-Keeping. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Essential Guide to Jewellery Bill Book Format: A Comprehensive Overview for Accurate Record-Keeping

In the intricate world of jewellery retail, maintaining meticulous records is not just a matter of compliance; it’s a cornerstone of success. A well-structured bill book serves as the backbone of financial management, ensuring transparency, accountability, and ultimately, profitability. This comprehensive guide delves into the intricacies of jewellery bill book format, illuminating its importance, benefits, and best practices for effective implementation.

Understanding the Significance of a Jewellery Bill Book

A jewellery bill book, often referred to as a sales register or invoice book, is a specialized ledger designed specifically for the jewellery industry. It captures every transaction, providing a detailed record of sales, purchases, and inventory movements. Its significance lies in its ability to:

- Facilitate Accurate Sales Tracking: Each entry meticulously documents the date, customer details, items purchased, price, and any applicable discounts or taxes. This granular level of information allows for precise sales analysis, identifying trends, popular items, and customer preferences.

- Streamline Inventory Management: The bill book acts as a real-time inventory tracker. As sales are recorded, the corresponding items are deducted from the inventory, providing a clear picture of available stock and preventing potential shortages.

- Enhance Financial Reporting: By consolidating all financial transactions, the bill book provides a comprehensive overview of revenue generation, expenses, and profitability. This data is crucial for generating accurate financial statements, making informed business decisions, and navigating tax compliance.

- Improve Customer Satisfaction: A well-maintained bill book ensures accurate billing and transparent pricing, fostering trust and satisfaction among customers. It also allows for seamless handling of returns, exchanges, and warranty claims.

- Strengthen Business Operations: The bill book serves as a vital reference point for managing customer relationships, tracking supplier interactions, and analyzing overall business performance. It empowers informed decision-making, fostering growth and sustainability.

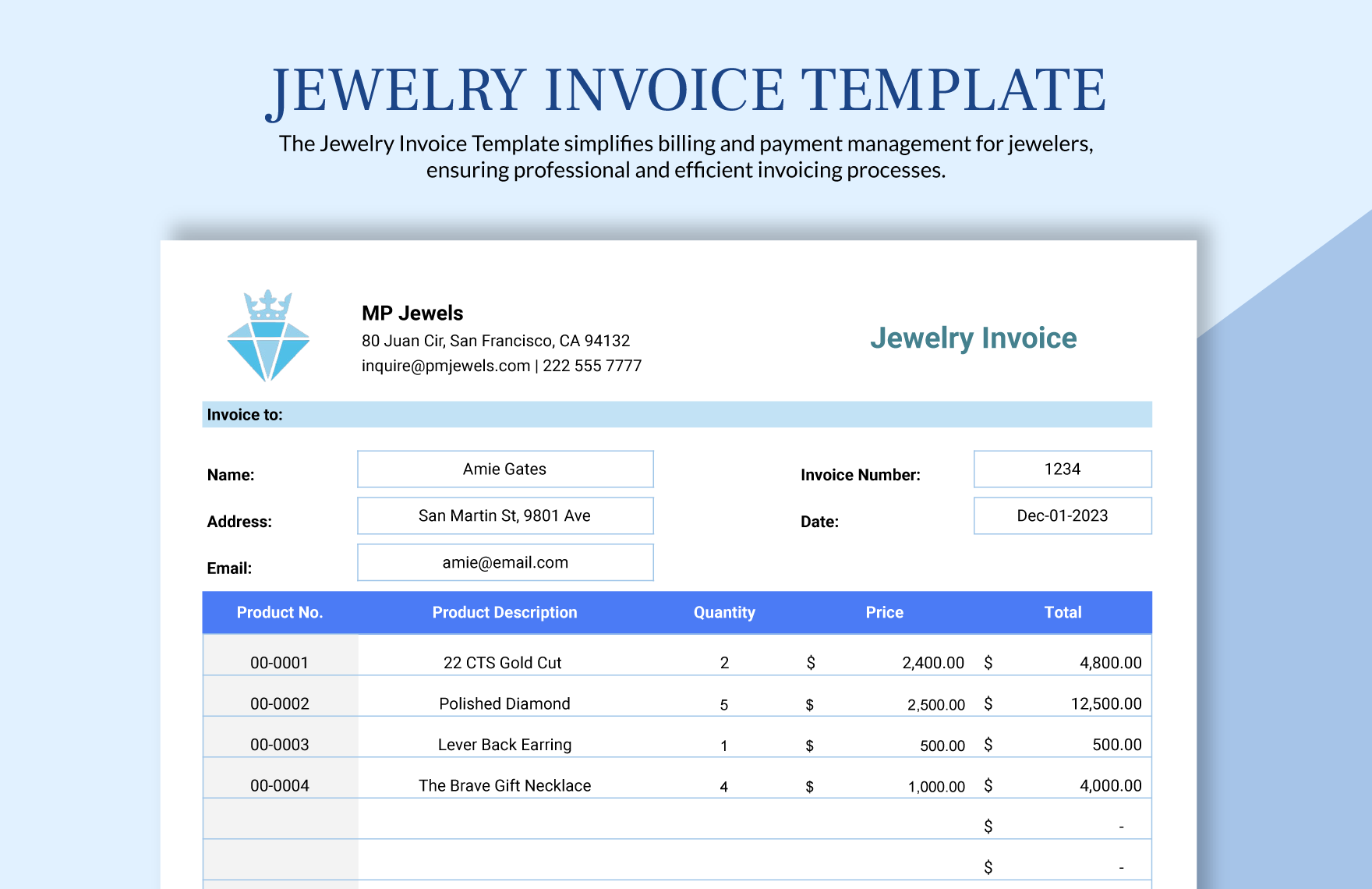

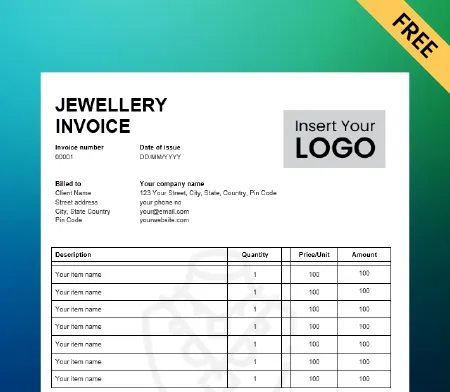

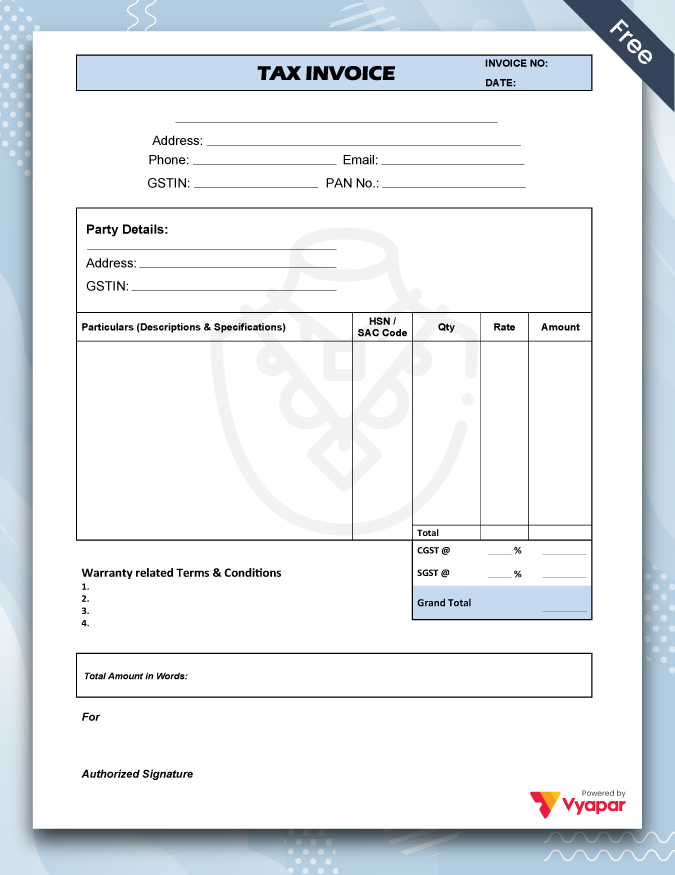

Essential Components of a Jewellery Bill Book Format

A standardized format ensures consistency and clarity in record-keeping. The following components are typically included in a jewellery bill book:

- Bill Number: A unique identifier assigned to each transaction, facilitating easy retrieval and reference.

- Date: The date of the transaction, crucial for tracking sales trends and analyzing seasonal variations.

- Customer Details: Name, address, contact information, and any relevant customer identification details.

- Item Description: A detailed description of each item purchased, including the metal type, gemstone details, weight, purity, and any other relevant specifications.

- Quantity: The number of units sold for each item.

- Unit Price: The price per unit of each item, clearly stated to avoid confusion.

- Total Price: The total cost of each item, calculated by multiplying the quantity by the unit price.

- Discounts: Any discounts applied to the purchase, clearly specified.

- Taxes: All applicable taxes, including sales tax, VAT, or GST, are meticulously documented.

- Total Amount Due: The final amount payable by the customer, inclusive of all charges and taxes.

- Payment Method: The method used for payment, whether cash, card, cheque, or other payment options.

- Payment Details: Specific details of the payment, such as card number, cheque number, or bank transfer information.

- Salesperson: The name of the salesperson responsible for the transaction, facilitating performance tracking and customer service.

- Remarks: Any additional notes or comments relevant to the transaction, such as special instructions or customer requests.

Types of Jewellery Bill Book Formats

Depending on the specific requirements and scale of operations, various formats can be employed for the jewellery bill book. Some common types include:

- Manual Bill Book: A traditional approach using physical notebooks, where each transaction is manually recorded. This method is cost-effective but can be prone to errors and time-consuming.

- Spreadsheet-Based Bill Book: Utilizing spreadsheet software like Microsoft Excel or Google Sheets, this format offers flexibility and easy data manipulation. However, it requires technical proficiency and may not be as secure as dedicated software.

- Dedicated Jewellery Software: Specialized software solutions designed for jewellery retailers provide comprehensive bill book functionalities along with inventory management, accounting, and customer relationship management (CRM) tools. While these solutions are typically more expensive, they offer enhanced security, automation, and analytical capabilities.

Tips for Effective Jewellery Bill Book Management

To maximize the benefits of a jewellery bill book, consider these best practices:

- Choose the Right Format: Carefully evaluate the needs of your business, considering factors like size, budget, and technical expertise, to select the most suitable format.

- Maintain Consistency: Adhere to a standardized format for all entries, ensuring consistency and ease of data analysis.

- Complete All Fields: Fill in all required fields accurately, leaving no room for ambiguity or missing information.

- Use Clear and Concise Language: Employ precise language to describe items, avoid jargon, and ensure clarity in all entries.

- Store Securely: Protect the bill book from damage, loss, or unauthorized access by implementing secure storage practices.

- Back Up Regularly: Create regular backups of the bill book data to mitigate the risk of data loss.

- Regularly Review and Audit: Conduct periodic reviews of the bill book to identify any discrepancies, errors, or areas for improvement.

FAQs About Jewellery Bill Book Format

1. Can I use a generic bill book for jewellery sales?

While a generic bill book might seem sufficient, it may lack the specific details required for accurate jewellery record-keeping. A specialized jewellery bill book format ensures comprehensive information capture, including details like metal type, gemstone specifications, and purity, which are crucial for accurate inventory management and pricing.

2. Is it necessary to include customer details in the bill book?

Yes, recording customer details is essential for building customer relationships, managing returns and exchanges, and complying with legal requirements. It also enables targeted marketing efforts and personalized customer service.

3. How often should I reconcile the bill book with my inventory?

Regular reconciliation is crucial for maintaining accurate inventory records. Aim for a daily or weekly reconciliation process, depending on the volume of transactions and inventory turnover rate.

4. What are the legal implications of maintaining a jewellery bill book?

Maintaining a detailed and accurate bill book is essential for complying with tax regulations, ensuring transparent pricing, and protecting against potential legal disputes.

5. Can I use a digital bill book for jewellery sales?

Digital bill books offer numerous advantages, including enhanced security, automated calculations, and easy data sharing. However, it is essential to ensure compliance with local regulations regarding digital records and electronic signatures.

Conclusion: The Importance of a Well-Structured Jewellery Bill Book

A meticulously maintained jewellery bill book serves as the foundation for a successful and transparent business. It fosters accurate record-keeping, streamlined inventory management, and informed decision-making, contributing significantly to business growth and sustainability. By embracing best practices and leveraging appropriate tools, jewellery retailers can harness the power of a well-structured bill book to navigate the complexities of the industry and achieve long-term success.

Closure

Thus, we hope this article has provided valuable insights into The Essential Guide to Jewellery Bill Book Format: A Comprehensive Overview for Accurate Record-Keeping. We thank you for taking the time to read this article. See you in our next article!