Navigating the Oregon PSW Payroll Calendar 2025: A Comprehensive Guide for Personal Support Workers

Related Articles: Navigating the Oregon PSW Payroll Calendar 2025: A Comprehensive Guide for Personal Support Workers

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Oregon PSW Payroll Calendar 2025: A Comprehensive Guide for Personal Support Workers. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Oregon PSW Payroll Calendar 2025: A Comprehensive Guide for Personal Support Workers

The Oregon Personal Support Worker (PSW) profession plays a crucial role in providing vital care to individuals in need. Understanding the payroll calendar is essential for PSWs to effectively manage their finances and ensure timely payment for their dedicated services. This comprehensive guide delves into the intricacies of the Oregon PSW payroll calendar for 2025, offering valuable insights and practical tips for navigating the system. While a specific, publicly available, official 2025 calendar doesn’t exist yet (as it’s too far in advance), this article will provide a framework based on previous years’ calendars and common payroll practices, allowing you to anticipate and prepare for the upcoming year.

Understanding the Payroll Cycle:

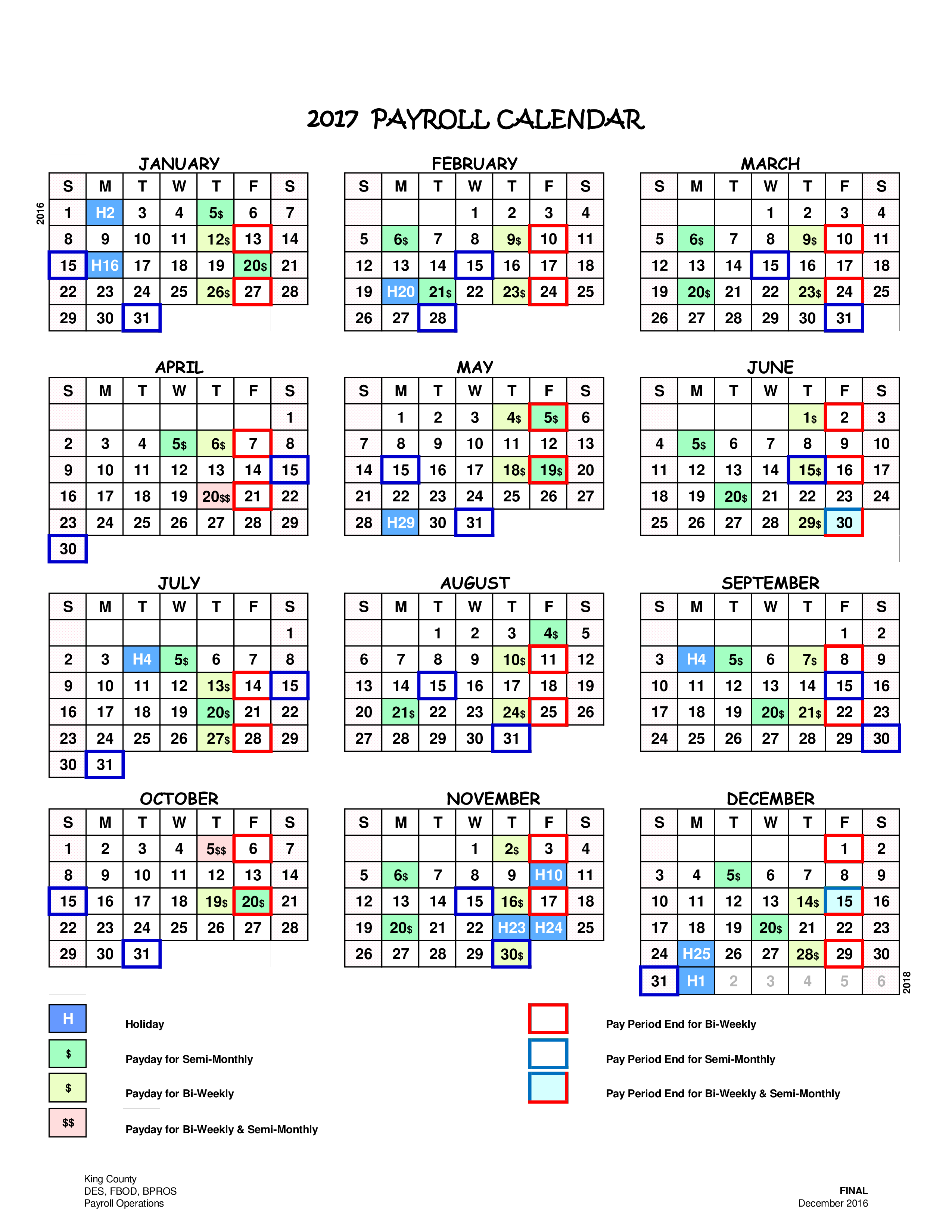

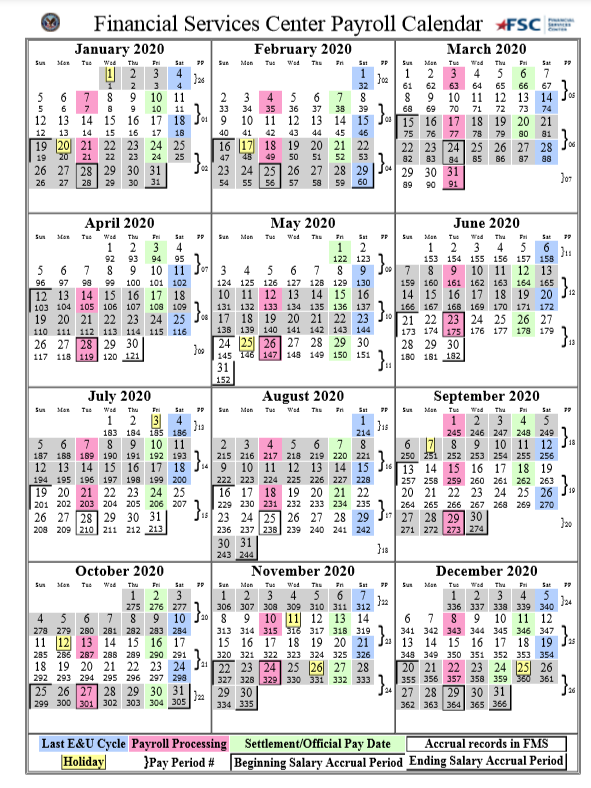

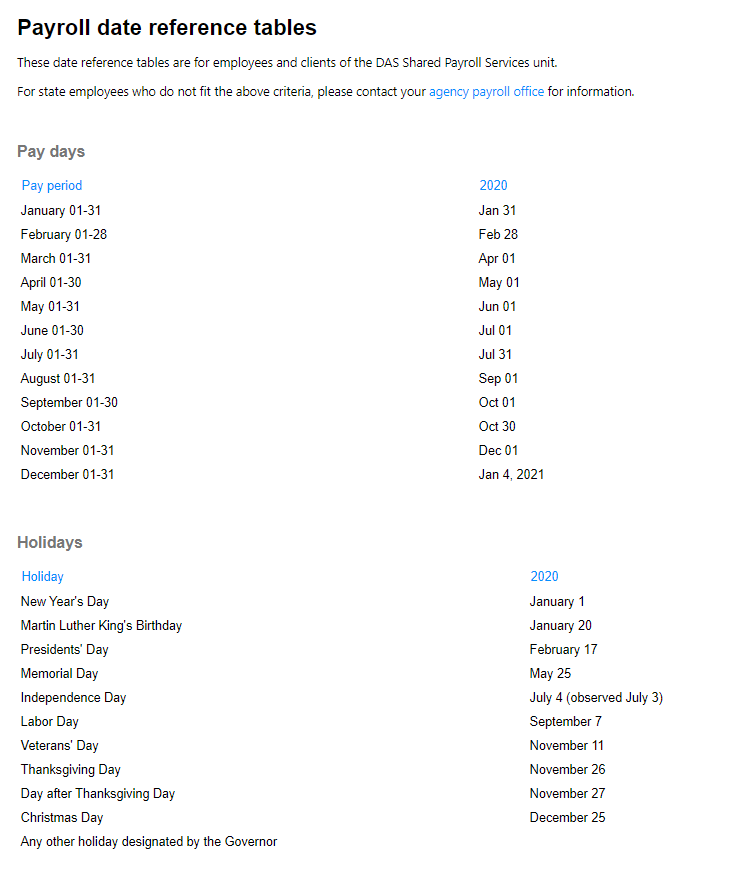

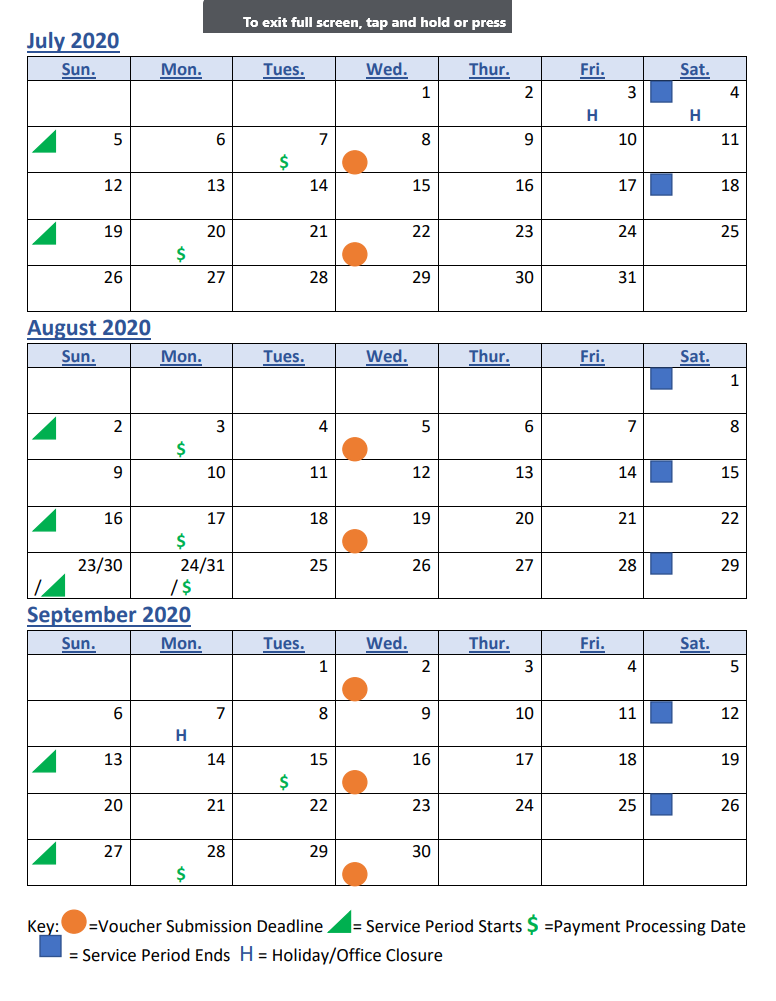

Oregon PSW payroll systems vary depending on the employing agency – whether it’s a private home care agency, a non-profit organization, or a public entity. However, most follow a consistent bi-weekly or semi-monthly schedule. This means paychecks are issued either every two weeks or twice a month on predetermined dates. Knowing your specific employer’s payroll cycle is crucial. This information is typically found in your employment contract or employee handbook.

Key Factors Influencing the 2025 Payroll Calendar:

Several factors influence the exact dates of your 2025 payroll:

-

Payroll Frequency: As mentioned, this is the most significant factor. Bi-weekly pay periods result in 26 paychecks annually, while semi-monthly pay periods yield 24.

-

Payday Cutoff: Each pay period has a cutoff date. This is the deadline for submitting your timesheets and any other required documentation to ensure timely payment. Missing this deadline can result in delays.

-

Holidays and Weekends: Paydays typically avoid falling on weekends or holidays. If a payday falls on a weekend or holiday, the payment is usually issued on the preceding Friday.

-

Employer’s Internal Processes: Internal procedures within your employing agency may influence the exact timing of payroll processing.

Anticipating the 2025 Calendar:

Since the official 2025 calendar is not yet available, we can make informed predictions based on past trends. We can expect the following:

-

Consistency: Most employers aim for consistency in their payroll schedules. Review your 2024 payroll calendar to identify patterns and anticipate similar dates for 2025.

-

Holiday Considerations: Major holidays like New Year’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving, and Christmas will significantly impact the payroll schedule. Expect adjustments around these dates.

-

Potential for Changes: While consistency is the norm, employers may occasionally make adjustments to their payroll schedules. Staying informed through regular communication with your employer is crucial.

Tips for Effective Payroll Management:

-

Maintain Accurate Records: Keep meticulous records of your hours worked, including start and end times, and ensure accurate submission of your timesheets.

-

Understand Your Pay Stub: Familiarize yourself with your pay stub’s details, including gross pay, deductions, net pay, and any other relevant information.

-

Budgeting and Financial Planning: Use your payroll calendar to create a personal budget and plan for your expenses throughout the year.

-

Communicate with Your Employer: If you have any questions or concerns regarding your payroll, contact your employer promptly. Open communication is essential for resolving any issues quickly.

-

Explore Payroll Software: Consider using payroll management software or apps to track your income and expenses effectively. Many free and paid options are available.

Addressing Potential Payroll Issues:

-

Late Payments: If your payment is late, contact your employer immediately to inquire about the delay. Understand the reasons and expected resolution timeframe.

-

Incorrect Payments: If you believe there’s an error in your payment, review your timesheets and pay stub carefully. Contact your employer to report the discrepancy and request correction.

-

Missing Pay Stubs: If you haven’t received your pay stub, contact your employer’s payroll department to request a copy.

The Importance of Professional Development:

Staying updated on Oregon PSW regulations and best practices is crucial for career advancement. Consider pursuing further training and certifications to enhance your skills and earning potential. Many organizations offer continuing education opportunities for PSWs.

Resources for Oregon PSWs:

Several resources are available to support Oregon PSWs:

-

Oregon Health Authority (OHA): The OHA provides information and resources related to healthcare and long-term care in Oregon.

-

Department of Human Services (DHS): The DHS oversees various social services programs, including those related to home care and personal support services.

-

Professional Organizations: Joining professional organizations can provide access to networking opportunities, training, and advocacy.

Conclusion:

While the precise 2025 Oregon PSW payroll calendar remains unavailable at this time, understanding the factors that influence it and adopting proactive financial management strategies are crucial for PSWs. By staying informed, maintaining accurate records, and communicating effectively with their employers, PSWs can ensure they receive timely and accurate payments for their valuable contributions to the well-being of others. Remember to check with your specific employer for their exact payroll schedule as it approaches 2025. This article serves as a guide to help you prepare and understand the general processes involved. Proactive planning and communication are key to navigating the payroll system successfully.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Oregon PSW Payroll Calendar 2025: A Comprehensive Guide for Personal Support Workers. We appreciate your attention to our article. See you in our next article!