Navigating the Complexities of Hawaii’s Tax Landscape: A Comprehensive Guide

Related Articles: Navigating the Complexities of Hawaii’s Tax Landscape: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Complexities of Hawaii’s Tax Landscape: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Complexities of Hawaii’s Tax Landscape: A Comprehensive Guide

The Hawaiian Islands, renowned for their breathtaking beauty and vibrant culture, also present a unique tax landscape. Understanding the intricacies of Hawaii’s tax system is crucial for both residents and businesses, ensuring compliance and maximizing financial benefits. This article delves into the Hawaii Tax Key Map, a valuable tool for navigating these complexities, providing a clear and concise explanation of its significance and practical applications.

Understanding the Hawaii Tax Key Map: A Foundation for Tax Compliance

The Hawaii Tax Key Map is a comprehensive, visual representation of the state’s tax structure. It serves as a roadmap for individuals and businesses, guiding them through the various taxes levied within the state. This map simplifies a potentially overwhelming system, providing a clear understanding of:

- Taxable Income: The map outlines the different types of income subject to taxation in Hawaii, including wages, salaries, business profits, and investment income.

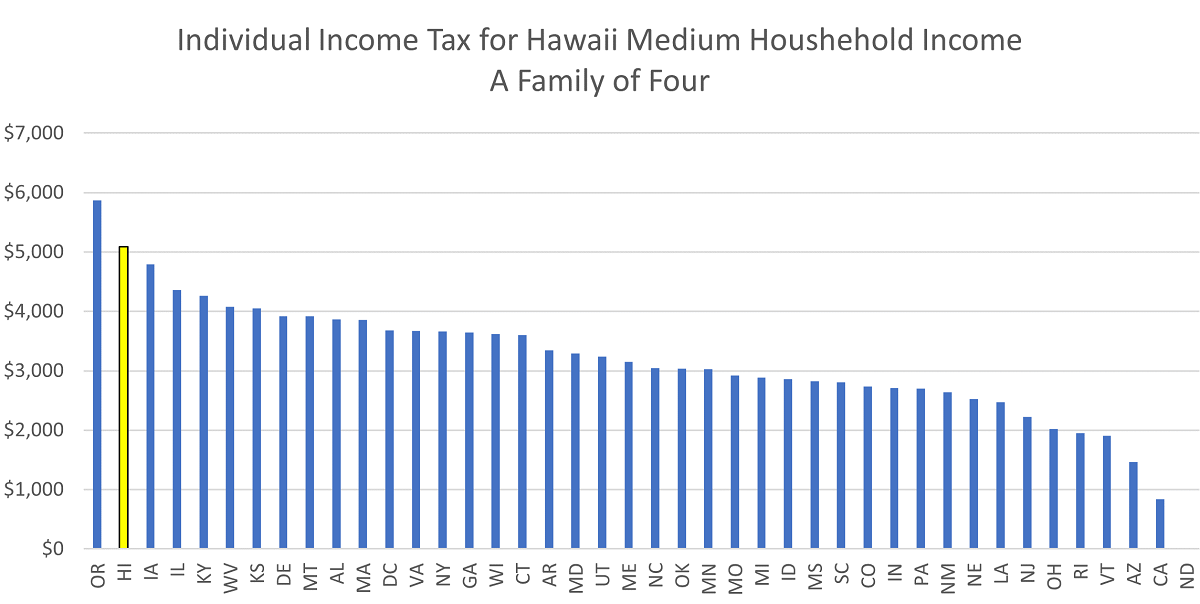

- Tax Rates: It clearly displays the progressive tax rates applied to different income brackets, enabling taxpayers to calculate their tax liability accurately.

- Exemptions and Deductions: The map highlights various exemptions and deductions available to taxpayers, including those for dependents, medical expenses, and charitable contributions.

- Tax Credits: It identifies specific tax credits offered by the state, such as the Earned Income Tax Credit and the Child Tax Credit, providing potential tax savings.

- Tax Filing Requirements: The map clarifies the necessary steps for filing taxes in Hawaii, including deadlines, forms, and payment methods.

Benefits of Using the Hawaii Tax Key Map: A Streamlined Approach to Tax Management

The Hawaii Tax Key Map offers numerous benefits, streamlining the tax management process and minimizing potential errors:

- Clarity and Organization: The visual representation of the tax system provides a clear and organized framework for understanding Hawaii’s tax regulations.

- Enhanced Compliance: By accurately identifying taxable income, applicable rates, and available deductions, the map facilitates compliance with tax laws, reducing the risk of penalties.

- Informed Decision-Making: The map empowers taxpayers to make informed financial decisions by providing a comprehensive overview of their tax obligations and potential savings opportunities.

- Reduced Stress and Confusion: By simplifying the complex tax system, the map reduces stress and confusion associated with tax preparation, allowing taxpayers to focus on other financial priorities.

Navigating the Map: A Step-by-Step Guide

The Hawaii Tax Key Map is organized logically, making it easy to navigate and understand:

- Taxable Income: The map begins by outlining the various sources of income subject to taxation in Hawaii. This section clarifies what constitutes taxable income and provides examples for different income types.

- Tax Rates: The map then presents the progressive tax rates applied to different income brackets. This information enables taxpayers to calculate their tax liability based on their specific income level.

- Exemptions and Deductions: The map details various exemptions and deductions available to reduce taxable income. This section provides a comprehensive list of eligible deductions and their applicable limits.

- Tax Credits: The map highlights specific tax credits offered by the state to reduce tax liability. This section outlines the criteria for claiming each credit and the potential tax savings.

- Tax Filing Requirements: The map concludes by outlining the necessary steps for filing taxes in Hawaii, including deadlines, forms, and payment methods. This section provides practical information for ensuring timely and accurate tax filing.

FAQs by Hawaii Tax Key Map:

1. What is the difference between a tax deduction and a tax credit?

- Tax Deduction: A tax deduction reduces your taxable income, thereby lowering your tax liability. For example, a deduction for charitable contributions reduces the amount of income subject to taxation.

- Tax Credit: A tax credit directly reduces your tax liability. For example, the Earned Income Tax Credit provides a direct reduction in your overall tax bill.

2. What are the most common tax credits available in Hawaii?

- Earned Income Tax Credit (EITC): This credit is available to low- and moderate-income working individuals and families.

- Child Tax Credit: This credit provides a tax break for families with qualifying children.

- Hawaii Housing Credit: This credit incentivizes the development of affordable housing in the state.

3. What are the deadlines for filing taxes in Hawaii?

- Individual Income Tax: The deadline for filing individual income tax returns in Hawaii is the same as the federal deadline, which is typically April 15th.

- Business Taxes: Deadlines for business taxes vary depending on the specific tax type. It is essential to refer to the Hawaii Department of Taxation website for accurate information.

4. Where can I find the Hawaii Tax Key Map?

- The Hawaii Tax Key Map is readily available on the website of the Hawaii Department of Taxation. It is also often provided by tax preparation services and financial advisors.

Tips by Hawaii Tax Key Map:

- Keep Accurate Records: Maintaining detailed records of income, expenses, and other relevant financial information is crucial for accurate tax filing.

- Seek Professional Guidance: If you are unsure about any aspect of Hawaii’s tax system, consider consulting with a qualified tax professional.

- Stay Updated on Tax Laws: Tax laws are subject to change, so it is essential to stay informed about any updates or modifications.

- Utilize Available Resources: The Hawaii Department of Taxation website provides a wealth of information and resources to assist taxpayers.

Conclusion by Hawaii Tax Key Map:

The Hawaii Tax Key Map serves as a valuable tool for navigating the complexities of Hawaii’s tax system. By providing a clear and organized framework for understanding tax regulations, it empowers individuals and businesses to comply with tax laws, make informed financial decisions, and maximize potential savings. By utilizing this map and staying informed about relevant tax information, taxpayers can effectively manage their tax obligations and navigate the unique tax landscape of the Hawaiian Islands.

.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Complexities of Hawaii’s Tax Landscape: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!