Navigating the 2025 Bi-Weekly Payroll Calendar: A Comprehensive Guide for Employers and Employees

Related Articles: Navigating the 2025 Bi-Weekly Payroll Calendar: A Comprehensive Guide for Employers and Employees

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the 2025 Bi-Weekly Payroll Calendar: A Comprehensive Guide for Employers and Employees. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 Bi-Weekly Payroll Calendar: A Comprehensive Guide for Employers and Employees

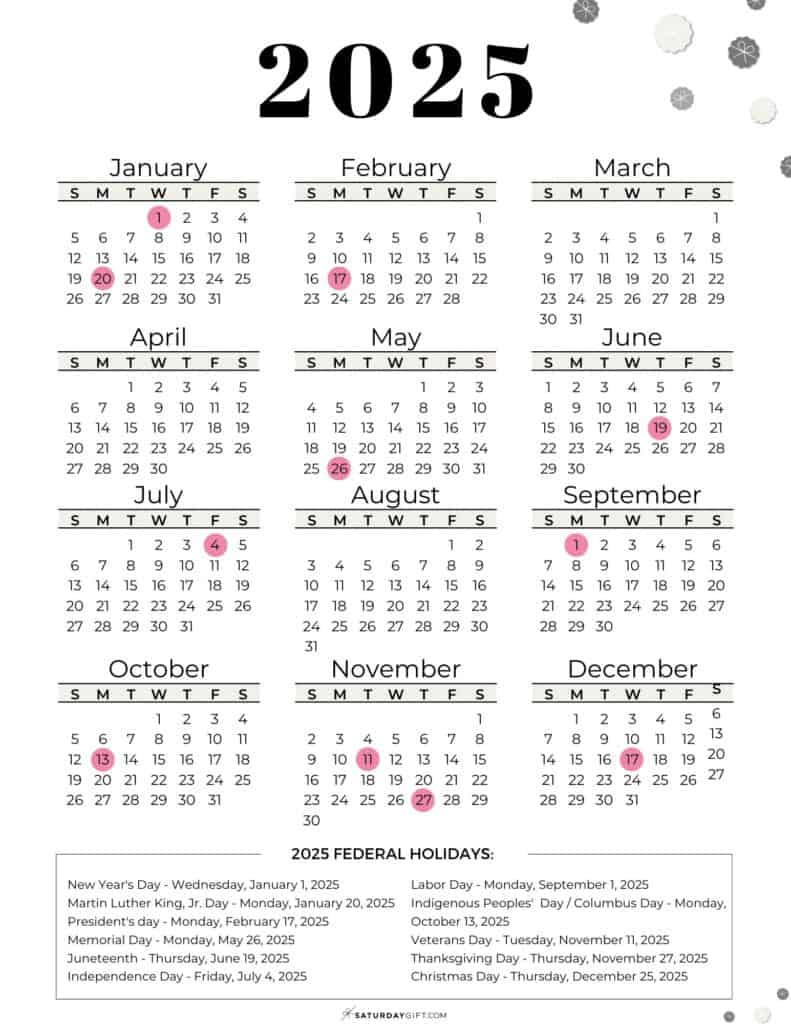

The year 2025 is fast approaching, and with it comes the need for careful planning, especially concerning payroll. For businesses operating on a bi-weekly payroll schedule, understanding the precise payment dates is crucial for smooth financial operations and employee satisfaction. This comprehensive guide provides a detailed breakdown of a potential 2025 bi-weekly payroll calendar, highlighting key considerations for both employers and employees. While specific dates will depend on the chosen starting point and any company-specific adjustments, this article offers a framework and valuable insights for navigating the complexities of bi-weekly payroll.

Understanding the Bi-Weekly Payroll System:

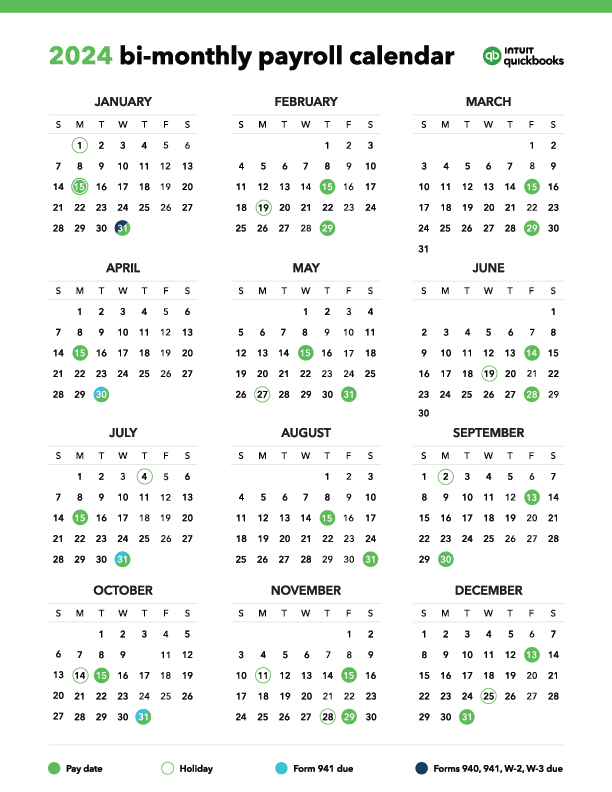

A bi-weekly payroll system means employees are paid twice a month, typically every two weeks. This differs from semi-monthly payroll, which involves two payments per month, but on fixed dates (e.g., the 15th and the last day of the month). The advantage of bi-weekly pay is the consistent frequency, offering employees a predictable income stream. However, the exact dates shift throughout the year due to the varying number of days in each month.

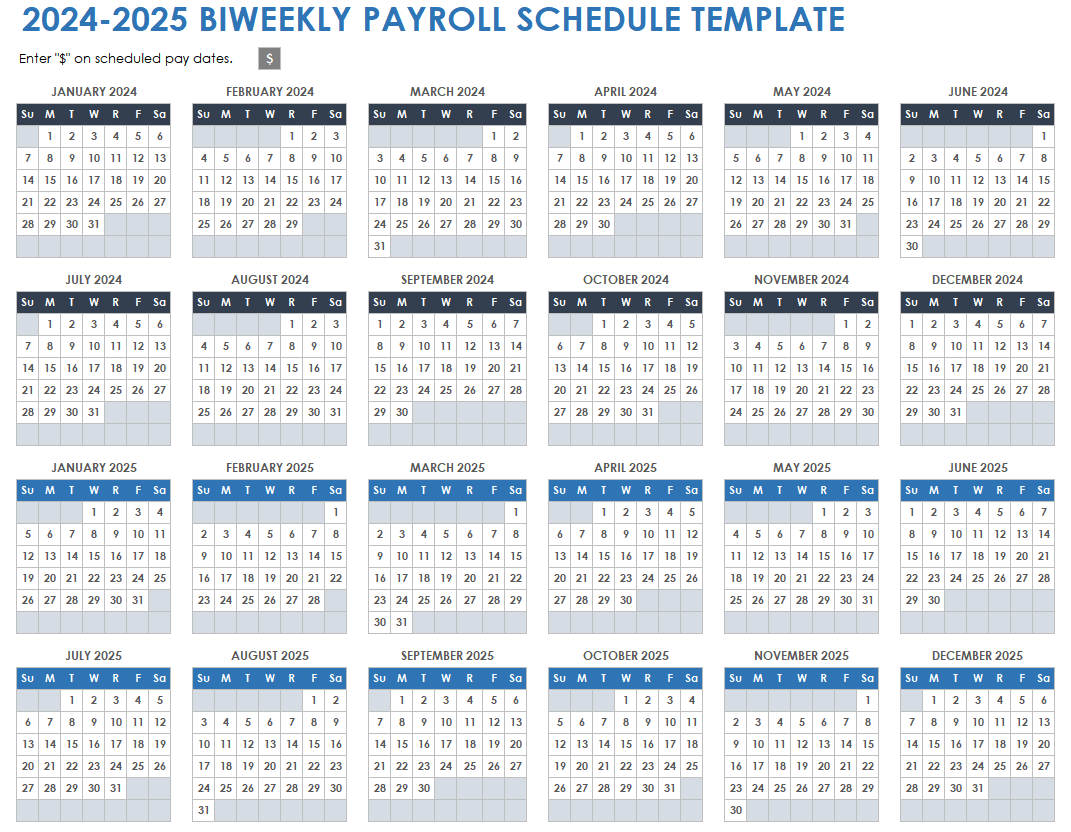

Constructing a Sample 2025 Bi-Weekly Payroll Calendar:

To illustrate, let’s construct a sample 2025 bi-weekly payroll calendar. We’ll assume a starting payday of Friday, January 3rd, 2025. This means the pay period covers the dates from December 21st, 2024, to January 3rd, 2025. Subsequent pay periods will follow a two-week interval. This is just an example; your company’s calendar may differ based on its specific needs and chosen start date.

(Note: The following calendar is a sample and should not be used for actual payroll processing. Always consult your payroll software or a payroll professional to determine accurate payment dates.)

Sample 2025 Bi-Weekly Payroll Calendar (Starting January 3rd, 2025):

| Pay Period | Pay Period Dates | Payday (Friday) |

|---|---|---|

| 1 | Dec 21, 2024 – Jan 3, 2025 | Jan 3, 2025 |

| 2 | Jan 4, 2025 – Jan 17, 2025 | Jan 17, 2025 |

| 3 | Jan 18, 2025 – Jan 31, 2025 | Jan 31, 2025 |

| 4 | Feb 1, 2025 – Feb 14, 2025 | Feb 14, 2025 |

| 5 | Feb 15, 2025 – Feb 28, 2025 | Feb 28, 2025 |

| 6 | Mar 1, 2025 – Mar 14, 2025 | Mar 14, 2025 |

| 7 | Mar 15, 2025 – Mar 28, 2025 | Mar 28, 2025 |

| 8 | Mar 29, 2025 – Apr 11, 2025 | Apr 11, 2025 |

| 9 | Apr 12, 2025 – Apr 25, 2025 | Apr 25, 2025 |

| 10 | Apr 26, 2025 – May 9, 2025 | May 9, 2025 |

| 11 | May 10, 2025 – May 23, 2025 | May 23, 2025 |

| 12 | May 24, 2025 – June 6, 2025 | June 6, 2025 |

| 13 | June 7, 2025 – June 20, 2025 | June 20, 2025 |

| 14 | June 21, 2025 – July 4, 2025 | July 4, 2025 |

| 15 | July 5, 2025 – July 18, 2025 | July 18, 2025 |

| 16 | July 19, 2025 – Aug 1, 2025 | Aug 1, 2025 |

| 17 | Aug 2, 2025 – Aug 15, 2025 | Aug 15, 2025 |

| 18 | Aug 16, 2025 – Aug 29, 2025 | Aug 29, 2025 |

| 19 | Aug 30, 2025 – Sep 12, 2025 | Sep 12, 2025 |

| 20 | Sep 13, 2025 – Sep 26, 2025 | Sep 26, 2025 |

| 21 | Sep 27, 2025 – Oct 10, 2025 | Oct 10, 2025 |

| 22 | Oct 11, 2025 – Oct 24, 2025 | Oct 24, 2025 |

| 23 | Oct 25, 2025 – Nov 7, 2025 | Nov 7, 2025 |

| 24 | Nov 8, 2025 – Nov 21, 2025 | Nov 21, 2025 |

| 25 | Nov 22, 2025 – Dec 5, 2025 | Dec 5, 2025 |

| 26 | Dec 6, 2025 – Dec 19, 2025 | Dec 19, 2025 |

(This table continues until the end of the year. The pattern will continue with two-week intervals.)

Key Considerations for Employers:

- Payroll Software: Utilizing payroll software is essential for accurate and efficient processing. These programs automatically calculate pay based on hours worked, deductions, and tax obligations, minimizing manual errors.

- Tax Compliance: Stay updated on all federal, state, and local tax regulations. Incorrect tax withholdings can lead to significant penalties. Consult with a tax professional if needed.

- Time and Attendance Tracking: Implement a reliable system for tracking employee hours. Accurate timekeeping is crucial for accurate payroll calculations.

- Direct Deposit: Offering direct deposit is convenient for employees and streamlines the payroll process for employers.

- Year-End Reporting: Prepare for year-end payroll reporting requirements, including W-2 preparation and filing.

- Holiday Pay: Factor in holiday pay and any additional compensation for employees working on holidays. Clearly communicate holiday pay policies to employees.

- Accrual of Paid Time Off (PTO): Accurately track and manage employee PTO accrual and usage.

Key Considerations for Employees:

- Review Pay Stubs: Carefully review each pay stub to ensure accuracy in hours worked, deductions, and net pay. Report any discrepancies to your employer promptly.

- Understand Deductions: Familiarize yourself with all deductions from your paycheck, including taxes, insurance premiums, and any other voluntary deductions.

- Budgeting: The consistent bi-weekly pay schedule facilitates better budgeting. Plan your expenses accordingly based on your regular payment dates.

- Tax Planning: Understand your tax obligations and plan accordingly throughout the year. Consult with a tax professional if needed.

- Communication: Maintain open communication with your employer regarding any payroll-related questions or concerns.

Conclusion:

A well-planned bi-weekly payroll system is vital for both employers and employees. By understanding the intricacies of the calendar and adhering to best practices, businesses can ensure smooth financial operations and maintain positive employee relations. While this article provides a sample calendar and valuable insights, it’s crucial to remember that the specific dates will vary depending on the chosen starting point and any company-specific adjustments. Always consult with your payroll provider or a payroll professional for accurate and compliant payroll processing in 2025. Proactive planning and attention to detail will ensure a successful and stress-free payroll year.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Bi-Weekly Payroll Calendar: A Comprehensive Guide for Employers and Employees. We hope you find this article informative and beneficial. See you in our next article!