Navigating the 2024 Bi-Weekly Payroll Calendar: A Comprehensive Guide

Related Articles: Navigating the 2024 Bi-Weekly Payroll Calendar: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the 2024 Bi-Weekly Payroll Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2024 Bi-Weekly Payroll Calendar: A Comprehensive Guide

The accurate and timely processing of payroll is a cornerstone of any successful business. For organizations employing a bi-weekly payroll schedule, meticulous planning and a clear understanding of the calendar are paramount. This article provides a comprehensive guide to navigating the 2024 bi-weekly payroll calendar, offering insights into its structure, potential challenges, and strategies for effective management.

Understanding the Bi-Weekly Payroll Cycle

A bi-weekly payroll cycle means employees are paid every two weeks. This contrasts with semi-monthly payroll, which involves payments twice a month (typically on the 15th and the last day of the month). The bi-weekly schedule offers several advantages, including:

- Predictable Cash Flow: Employees receive consistent income every two weeks, facilitating better budgeting and financial planning.

- Simplified Accounting: While requiring more payroll runs annually, the consistent interval simplifies record-keeping and accounting processes.

- Reduced Administrative Burden: Compared to weekly payroll, bi-weekly processing reduces administrative workload.

However, the bi-weekly schedule also presents some challenges:

- Varying Pay Periods: The number of days in each pay period fluctuates, leading to variations in gross pay even for employees with consistent hourly rates or salaries.

- Year-End Adjustments: The year doesn’t divide neatly into a whole number of bi-weekly periods, requiring careful attention to year-end payroll processing and tax reporting.

- Holiday Considerations: Holidays falling within a pay period can complicate calculations and require adjustments to payroll processing.

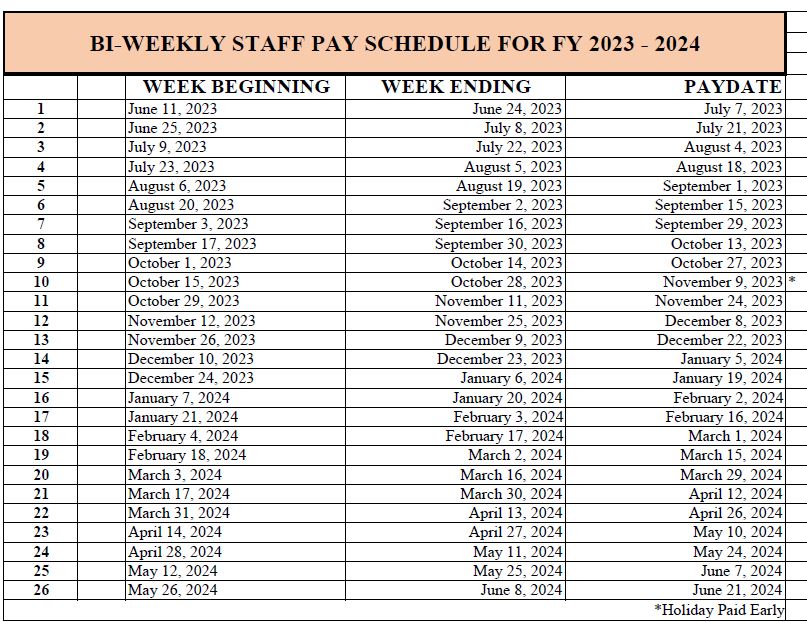

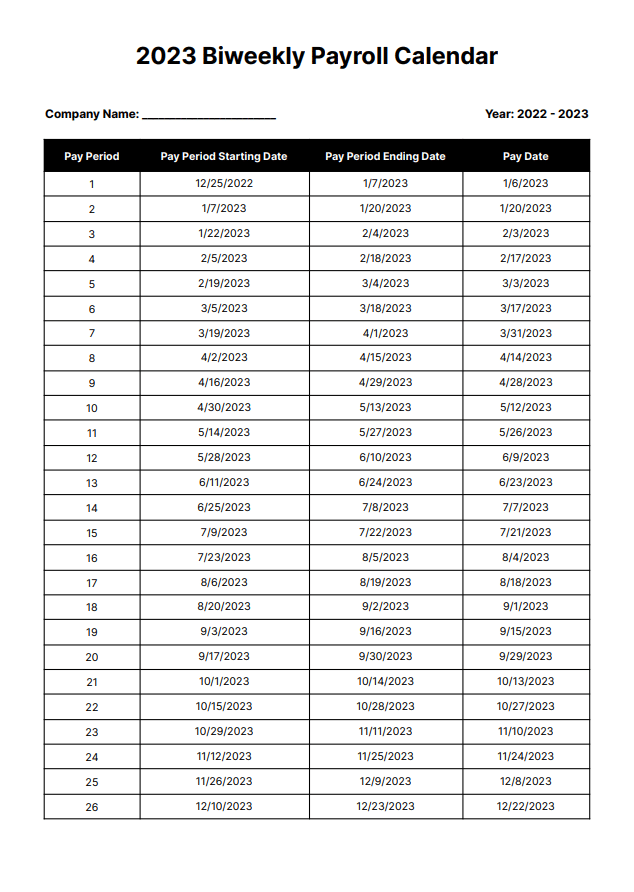

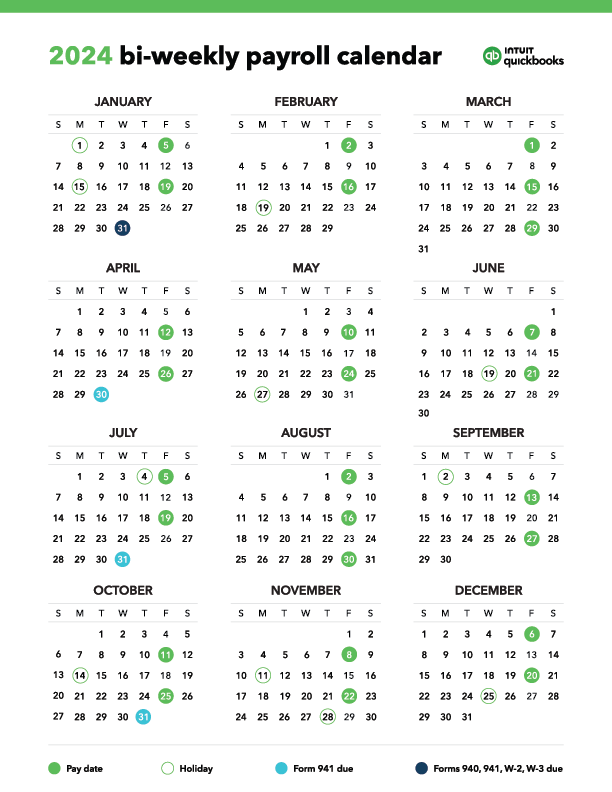

Constructing the 2024 Bi-Weekly Payroll Calendar

The 2024 bi-weekly payroll calendar can be constructed by selecting a starting date for the first pay period. This date determines all subsequent pay periods. The calendar will consist of 26 pay periods, with the final pay period potentially being shorter or longer than the others. There are several ways to approach creating this calendar:

- Spreadsheet Software: Programs like Microsoft Excel or Google Sheets are ideal for creating a bi-weekly payroll calendar. You can easily input the starting date and use formulas to automatically calculate subsequent pay dates.

- Payroll Software: Most payroll software packages include calendar features, automatically generating pay dates based on the selected pay frequency and start date.

- Online Calendars: Several online resources offer payroll calendar generators, allowing you to customize the starting date and generate a printable calendar.

Example 2024 Bi-Weekly Payroll Calendar (Starting January 6th, 2024):

(Note: This is a sample calendar. The actual dates will depend on your chosen starting date and any adjustments for holidays.)

| Pay Period | Pay Period Start Date | Pay Period End Date | Pay Date |

|---|---|---|---|

| 1 | January 6, 2024 | January 19, 2024 | January 20, 2024 |

| 2 | January 20, 2024 | February 2, 2024 | February 3, 2024 |

| 3 | February 3, 2024 | February 16, 2024 | February 17, 2024 |

| 4 | February 17, 2024 | March 1, 2024 | March 2, 2024 |

| 5 | March 2, 2024 | March 15, 2024 | March 16, 2024 |

| … | … | … | … |

| 26 | December 14, 2024 | December 27, 2024 | December 28, 2024 |

(Continue this table for all 26 pay periods)

Important Considerations for 2024:

- Holidays: The 2024 calendar includes several holidays that may fall within pay periods, requiring adjustments to payroll calculations. Ensure your payroll system accurately accounts for these holidays. Consider whether your company observes the holiday and whether employees are paid for it.

- Year-End Processing: The final pay period of 2024 will likely be shorter or longer than the standard two weeks. Careful planning is needed to ensure accurate year-end reporting and tax filings.

- Tax Implications: Understand the relevant tax laws and regulations for your location. Ensure your payroll system accurately calculates and withholds taxes throughout the year.

- Software Updates: If you use payroll software, ensure it’s updated to reflect any changes in tax laws or regulations for 2024.

- Employee Communication: Clearly communicate the payroll schedule to your employees, providing them with a calendar and explaining how holidays and variations in pay period length might affect their paychecks.

Strategies for Effective Bi-Weekly Payroll Management

- Automated Systems: Invest in payroll software that automates many aspects of payroll processing, reducing manual effort and the risk of errors.

- Regular Audits: Conduct regular audits of your payroll processes to identify and address any inconsistencies or potential problems.

- Employee Self-Service Portals: Provide employees with access to self-service portals where they can view their pay stubs, W-2 information, and other payroll-related data.

- Dedicated Payroll Personnel: If your business is large enough, consider assigning dedicated personnel to manage payroll, ensuring accuracy and efficiency.

- Training: Provide adequate training to your payroll personnel to ensure they are familiar with all aspects of payroll processing, including handling variations in pay periods and year-end adjustments.

Conclusion

The 2024 bi-weekly payroll calendar requires careful planning and management. By understanding the nuances of the bi-weekly cycle, utilizing appropriate software and strategies, and proactively addressing potential challenges, businesses can ensure accurate, timely, and efficient payroll processing throughout the year. Remember to consult with payroll professionals or tax advisors if you have any questions or concerns about specific aspects of your payroll processes. A well-managed payroll system contributes significantly to employee satisfaction and overall business success. The detailed calendar above should serve as a template, and you should always double-check your specific dates and adjust for any company-specific holidays or policies. Proactive planning is key to a smooth and successful 2024 payroll year.

![2024 Biweekly Payroll Calendar [3 Paycheck Months of 2024] - My Worthy](https://myworthypenny.com/wp-content/uploads/2023/03/1-4-1024x576.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2024 Bi-Weekly Payroll Calendar: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!