Navigating the 2024 Bi-Weekly Payroll Calendar: A Comprehensive Guide

Related Articles: Navigating the 2024 Bi-Weekly Payroll Calendar: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the 2024 Bi-Weekly Payroll Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2024 Bi-Weekly Payroll Calendar: A Comprehensive Guide

The efficient and accurate processing of payroll is crucial for any organization, regardless of size. A well-planned payroll calendar is the cornerstone of this process, ensuring timely payments to employees and minimizing administrative headaches. For businesses operating on a bi-weekly payroll schedule, understanding and utilizing a 2024 bi-weekly payroll calendar is paramount. This article provides a comprehensive guide to creating, understanding, and utilizing such a calendar, covering various aspects and considerations.

Understanding Bi-Weekly Payroll:

Bi-weekly payroll, as the name suggests, means employees are paid every two weeks. This contrasts with semi-monthly payroll, which involves payment twice a month (typically on the 15th and the last day of the month). The bi-weekly schedule results in 26 pay periods per year, instead of the 24 found in semi-monthly systems. This slight difference can impact budgeting and year-end calculations.

Creating a 2024 Bi-Weekly Payroll Calendar:

There’s no single "official" 2024 bi-weekly payroll calendar. The specific dates depend on your chosen starting point – the first pay period. The key is consistency. Once you establish a start date, the subsequent pay periods follow a fixed two-week interval.

Several methods can be used to create your calendar:

-

Spreadsheet Software (Excel, Google Sheets): This is the most common and versatile method. You can easily input the start date and use formulas to automatically calculate subsequent pay periods. Features like date formatting and conditional formatting can enhance readability.

-

Payroll Software: Most payroll software packages include calendar generation features. This often integrates directly with payroll processing, minimizing the risk of errors.

-

Online Calendar Generators: Several websites offer free payroll calendar generators. Simply input your desired start date and pay frequency (bi-weekly), and the generator will produce a calendar. However, always verify the accuracy of the generated dates.

Key Considerations When Creating Your Calendar:

-

Start Date: Choose a date that aligns with your business needs and employee expectations. Consider factors like accounting cycles and the timing of other financial processes.

-

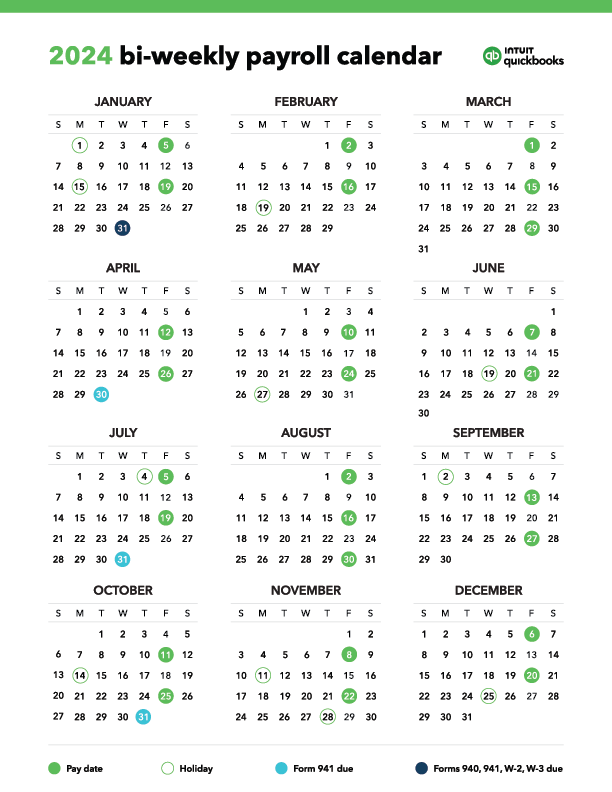

Payday: Decide on a specific day of the week for payday (e.g., Friday). Consistency is vital for employee planning.

-

Holiday Adjustments: Account for holidays. If a payday falls on a holiday, you’ll need to decide whether to pay early or late. Clearly indicate these adjustments on your calendar.

-

Year-End Adjustments: Remember that a bi-weekly schedule results in 26 pay periods. This means there will be two extra pay periods compared to a semi-monthly schedule. Plan for this discrepancy in your annual budget and accounting.

-

Accounting Periods: Align your payroll calendar with your accounting periods (e.g., monthly, quarterly) to simplify financial reporting.

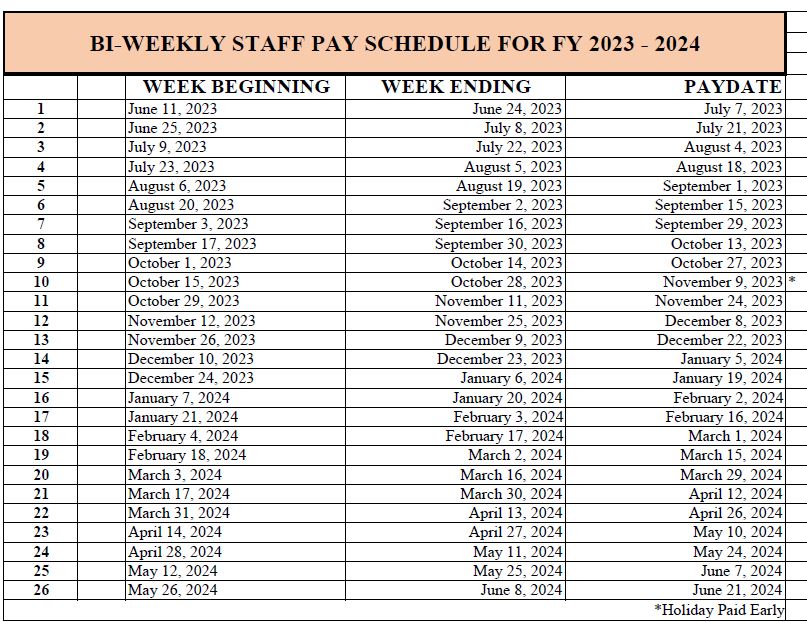

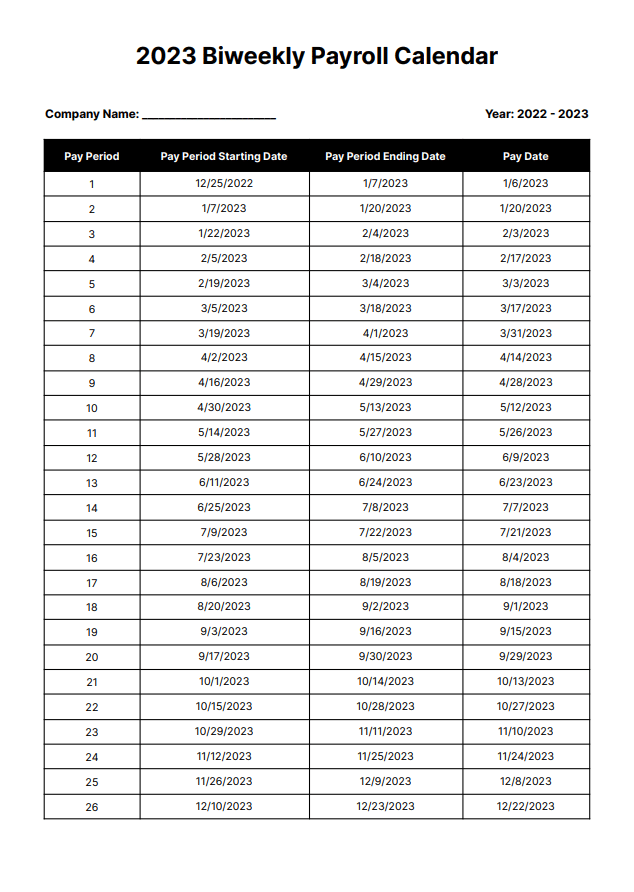

Sample 2024 Bi-Weekly Payroll Calendar (Starting January 6th, 2024, Friday Payday):

(Note: This is a sample calendar. You must create your own based on your chosen start date and payday.)

| Pay Period | Pay Period Start Date | Pay Period End Date | Payday |

|---|---|---|---|

| 1 | January 6, 2024 | January 19, 2024 | January 19, 2024 |

| 2 | January 20, 2024 | February 2, 2024 | February 2, 2024 |

| 3 | February 3, 2024 | February 16, 2024 | February 16, 2024 |

| 4 | February 17, 2024 | March 1, 2024 | March 1, 2024 |

| 5 | March 2, 2024 | March 15, 2024 | March 15, 2024 |

| … | … | … | … |

| 26 | December 14, 2024 | December 27, 2024 | December 27, 2024 |

(This table would continue for all 26 pay periods)

Utilizing the Bi-Weekly Payroll Calendar:

Once created, your calendar becomes a vital tool for:

-

Payroll Processing: It provides the precise dates for calculating wages, deductions, and net pay.

-

Budgeting and Forecasting: The calendar helps in accurately forecasting payroll expenses for the year.

-

Employee Communication: Share the calendar with employees to ensure they know when to expect their paychecks. This improves transparency and reduces employee inquiries.

-

Tax Withholding and Reporting: The calendar aids in accurately calculating and reporting payroll taxes.

-

Year-End Reconciliation: The calendar simplifies the year-end reconciliation process by providing a clear record of all pay periods.

Addressing Potential Challenges:

-

Holiday Pay: Clearly define your company’s policy regarding holiday pay and how it impacts the payroll calendar.

-

Overtime Calculation: Ensure your payroll system accurately calculates overtime based on the bi-weekly pay periods.

-

Software Integration: If using multiple software systems, ensure seamless integration to avoid data discrepancies.

-

Accuracy: Double-check all dates and calculations to minimize errors.

Conclusion:

A well-structured 2024 bi-weekly payroll calendar is an essential tool for any organization. By carefully considering the factors outlined above and utilizing appropriate software or methods, businesses can create a reliable and efficient payroll system that minimizes errors, improves employee satisfaction, and streamlines financial management. Remember, consistency and accuracy are key to successful payroll processing. Regularly review and update your calendar to account for any changes or unforeseen circumstances. By proactively managing your bi-weekly payroll calendar, you can ensure a smooth and stress-free payroll process throughout the entire year.

![2024 Biweekly Payroll Calendar [3 Paycheck Months of 2024] - My Worthy](https://myworthypenny.com/wp-content/uploads/2023/03/1-4-1024x576.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2024 Bi-Weekly Payroll Calendar: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!