Navigating Opportunity: A Comprehensive Guide to the New Markets Tax Credit Map

Related Articles: Navigating Opportunity: A Comprehensive Guide to the New Markets Tax Credit Map

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Opportunity: A Comprehensive Guide to the New Markets Tax Credit Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Opportunity: A Comprehensive Guide to the New Markets Tax Credit Map

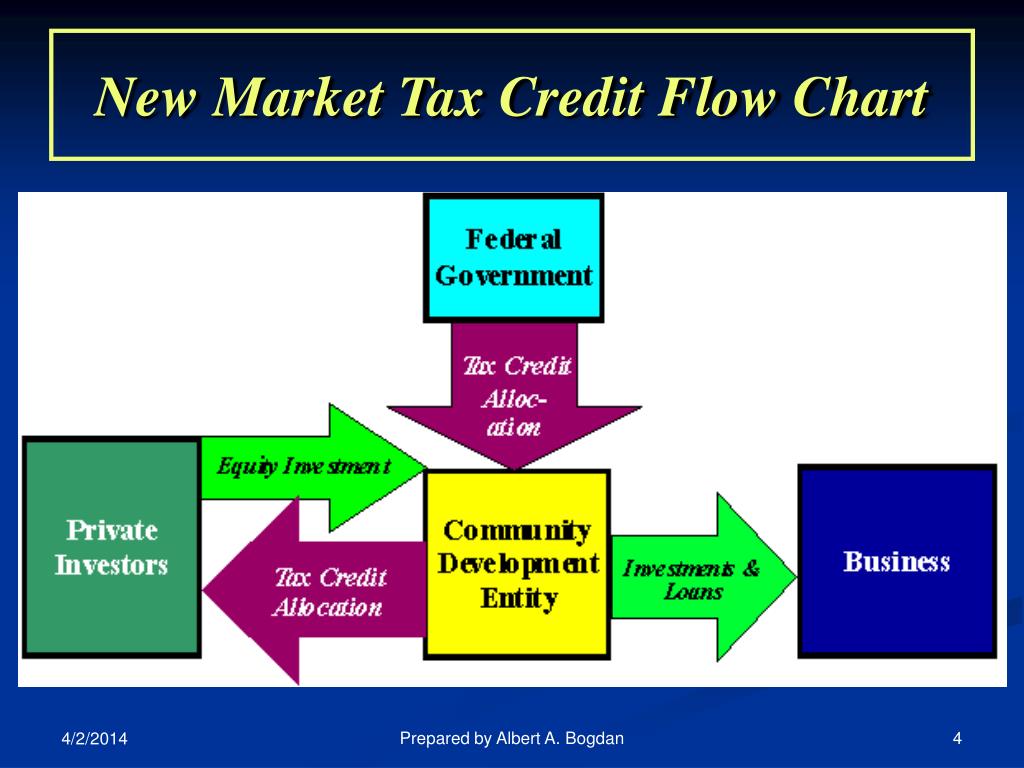

The New Markets Tax Credit (NMTC) program, established in 2000, offers a powerful tool for driving economic development in underserved communities. It incentivizes private investment in low-income census tracts by providing tax credits to investors. The NMTC map, a visual representation of eligible areas, serves as a crucial guide for investors seeking to leverage this program. Understanding the map’s intricacies is essential for both investors and communities seeking to unlock the potential of this impactful program.

Understanding the New Markets Tax Credit Map

The NMTC map is not a static entity. It is updated annually by the Community Development Financial Institutions Fund (CDFI Fund), reflecting the evolving needs and demographics of low-income communities. The map identifies census tracts eligible for NMTC investment based on poverty rate, unemployment rate, and other socioeconomic indicators.

Key Features of the NMTC Map:

- Geographic Scope: The map covers the entire United States, highlighting areas with high concentrations of poverty and unemployment.

- Census Tract Level: The map designates eligibility at the census tract level, providing granular detail for investors seeking specific locations.

- Annual Updates: The CDFI Fund updates the map annually, incorporating new census data and reflecting changes in economic conditions.

- Visual Representation: The map is presented visually, allowing investors to quickly identify eligible areas and assess their potential for investment.

Navigating the NMTC Map: A Practical Guide

The NMTC map serves as a valuable tool for investors seeking to allocate capital effectively and maximize their impact. Here’s how to navigate the map for successful investment:

- Target Area Identification: Use the map to pinpoint specific census tracts that align with your investment goals and criteria. Consider factors such as industry focus, community needs, and potential for economic growth.

- Understanding Eligibility Criteria: Familiarize yourself with the eligibility criteria for NMTC investments. This includes factors such as poverty rate, unemployment rate, and the type of business activities eligible for funding.

- Identifying Potential Partners: Collaborate with local community development organizations, Community Development Financial Institutions (CDFIs), and other stakeholders to identify potential projects and partners.

- Assessing Project Viability: Conduct thorough due diligence on potential projects, considering factors such as financial feasibility, market demand, and environmental impact.

- Leveraging the NMTC Program: Explore the benefits of the NMTC program and its potential to enhance project returns and create a positive social impact.

Benefits of Utilizing the NMTC Map

The NMTC map offers numerous benefits for investors and communities alike:

For Investors:

- Enhanced Returns: The tax credits offered by the NMTC program can significantly boost project returns, making investments in underserved communities more attractive.

- Social Impact: Investing in NMTC-eligible areas allows investors to contribute to economic development and social change in communities facing significant challenges.

- Diversification: The map helps investors diversify their portfolios by investing in sectors and regions that may not be traditionally considered.

For Communities:

- Economic Growth: NMTC investments can create jobs, attract new businesses, and revitalize local economies.

- Improved Infrastructure: The program can support the development of essential infrastructure, such as affordable housing, healthcare facilities, and transportation networks.

- Community Empowerment: NMTC investments can empower residents by providing access to essential services, education, and job training opportunities.

FAQs about the New Markets Tax Credit Map

Q: How often is the NMTC map updated?

A: The map is updated annually by the CDFI Fund, incorporating new census data and reflecting changes in economic conditions.

Q: What are the eligibility criteria for NMTC investments?

A: Investments must be located in census tracts designated as eligible for NMTC funding based on poverty rate, unemployment rate, and other socioeconomic indicators.

Q: How can I find more information about specific census tracts on the map?

A: The CDFI Fund website provides detailed information about each census tract, including its poverty rate, unemployment rate, and other relevant data.

Q: Are there any limitations on the types of projects eligible for NMTC funding?

A: Yes, NMTC investments are typically limited to projects that benefit low-income communities and promote economic development, such as affordable housing, healthcare facilities, and community centers.

Q: How can I get involved in NMTC investments?

A: You can connect with CDFIs, community development organizations, and other stakeholders to learn more about NMTC investment opportunities and potential projects.

Tips for Effective Utilization of the NMTC Map

- Partner with Local Experts: Collaborate with community development organizations, CDFIs, and other stakeholders to gain insights into local needs and opportunities.

- Conduct Thorough Due Diligence: Assess the financial viability, market demand, and environmental impact of potential projects before making investments.

- Utilize the CDFI Fund Resources: The CDFI Fund website provides valuable resources and information on the NMTC program, including guidelines, data, and case studies.

- Track Investment Performance: Monitor the impact of your NMTC investments and assess their contribution to economic development and social change.

Conclusion

The New Markets Tax Credit map is a powerful tool for unlocking economic opportunity in underserved communities. By understanding its intricacies and utilizing it strategically, investors can align their capital with social impact and create a positive ripple effect in communities across the nation. As the NMTC program continues to evolve, the map will remain a vital resource for investors seeking to bridge the gap between capital and opportunity, empowering communities to achieve sustainable economic growth and prosperity.

Closure

Thus, we hope this article has provided valuable insights into Navigating Opportunity: A Comprehensive Guide to the New Markets Tax Credit Map. We appreciate your attention to our article. See you in our next article!