Mastering Your 2024 Bi-Weekly Payroll: A Comprehensive Guide with Excel Templates

Related Articles: Mastering Your 2024 Bi-Weekly Payroll: A Comprehensive Guide with Excel Templates

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Mastering Your 2024 Bi-Weekly Payroll: A Comprehensive Guide with Excel Templates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Mastering Your 2024 Bi-Weekly Payroll: A Comprehensive Guide with Excel Templates

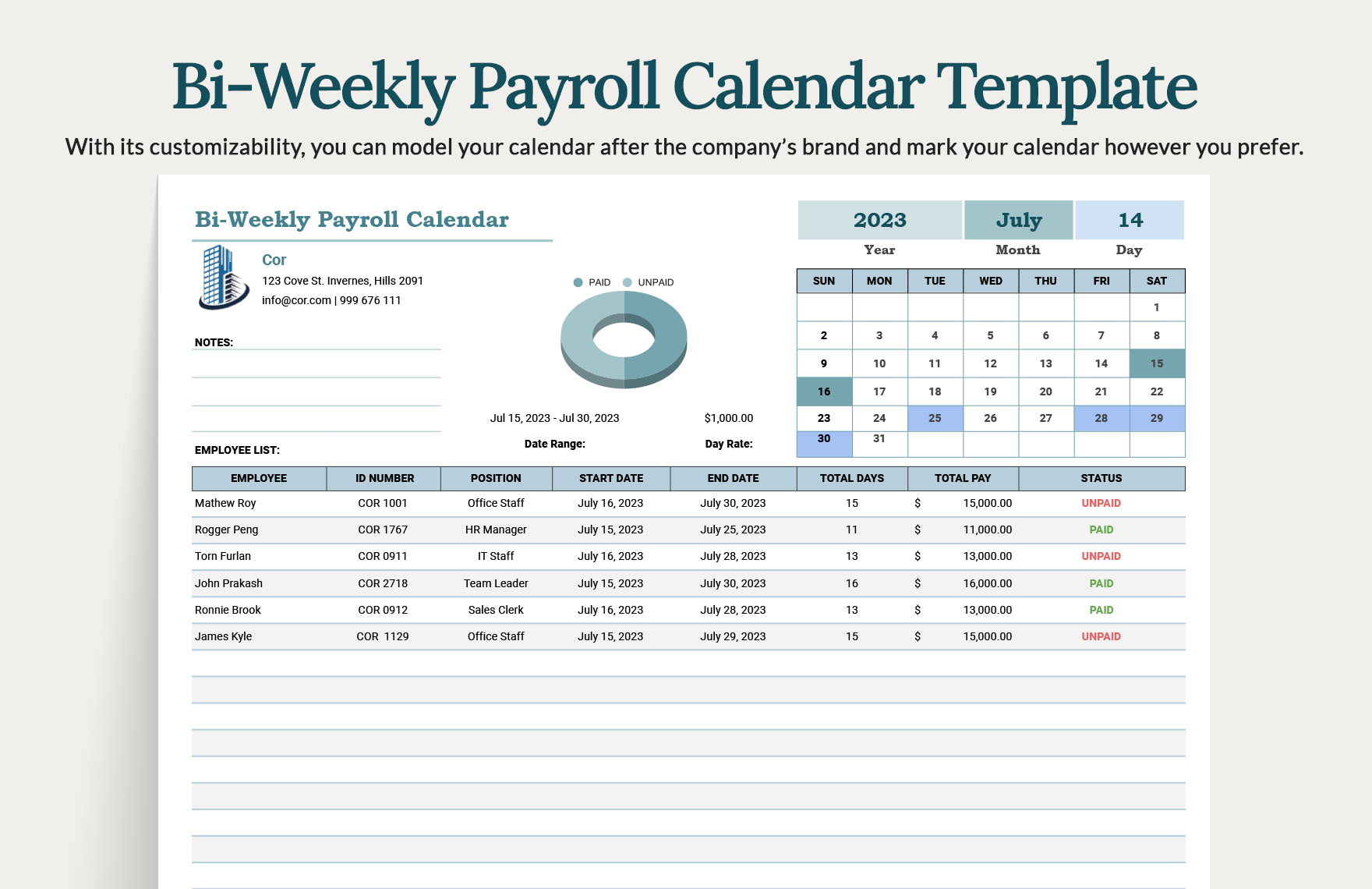

Managing payroll efficiently is crucial for any business, regardless of size. A well-organized system ensures accurate and timely payments, minimizing errors and maintaining employee satisfaction. For businesses operating on a bi-weekly payroll cycle, a dedicated calendar becomes an invaluable tool. This article provides a comprehensive guide to creating and utilizing a 2024 bi-weekly payroll calendar in Excel, along with strategies for optimizing your payroll process.

Understanding the Bi-Weekly Payroll Cycle

A bi-weekly payroll cycle means employees are paid every two weeks. This differs from semi-monthly pay, which occurs twice a month (typically on the 15th and the last day of the month). The bi-weekly cycle results in 26 pay periods annually, sometimes leading to slightly uneven distribution of paydays across the year. Understanding this nuance is vital for accurate calendar creation and budgeting.

Why an Excel Calendar is Essential

While some businesses might use dedicated payroll software, an Excel-based calendar provides a readily accessible and customizable solution, especially for smaller businesses or those starting out. An Excel calendar allows you to:

- Visualize Pay Periods: A clear visual representation of pay periods simplifies scheduling and tracking.

- Plan Ahead: Knowing your payroll dates in advance allows for better budgeting and financial planning.

- Integrate with other Data: Excel allows easy integration with other financial data, streamlining the payroll process.

- Track Important Dates: You can add holidays, deadlines, and other relevant dates to your calendar.

- Customize to Your Needs: Excel templates offer flexibility to tailor the calendar to your specific requirements.

Creating Your 2024 Bi-Weekly Payroll Calendar in Excel: A Step-by-Step Guide

Here’s a step-by-step guide to creating a functional and efficient 2024 bi-weekly payroll calendar in Excel:

Step 1: Setting Up the Spreadsheet

- Open a new Excel workbook.

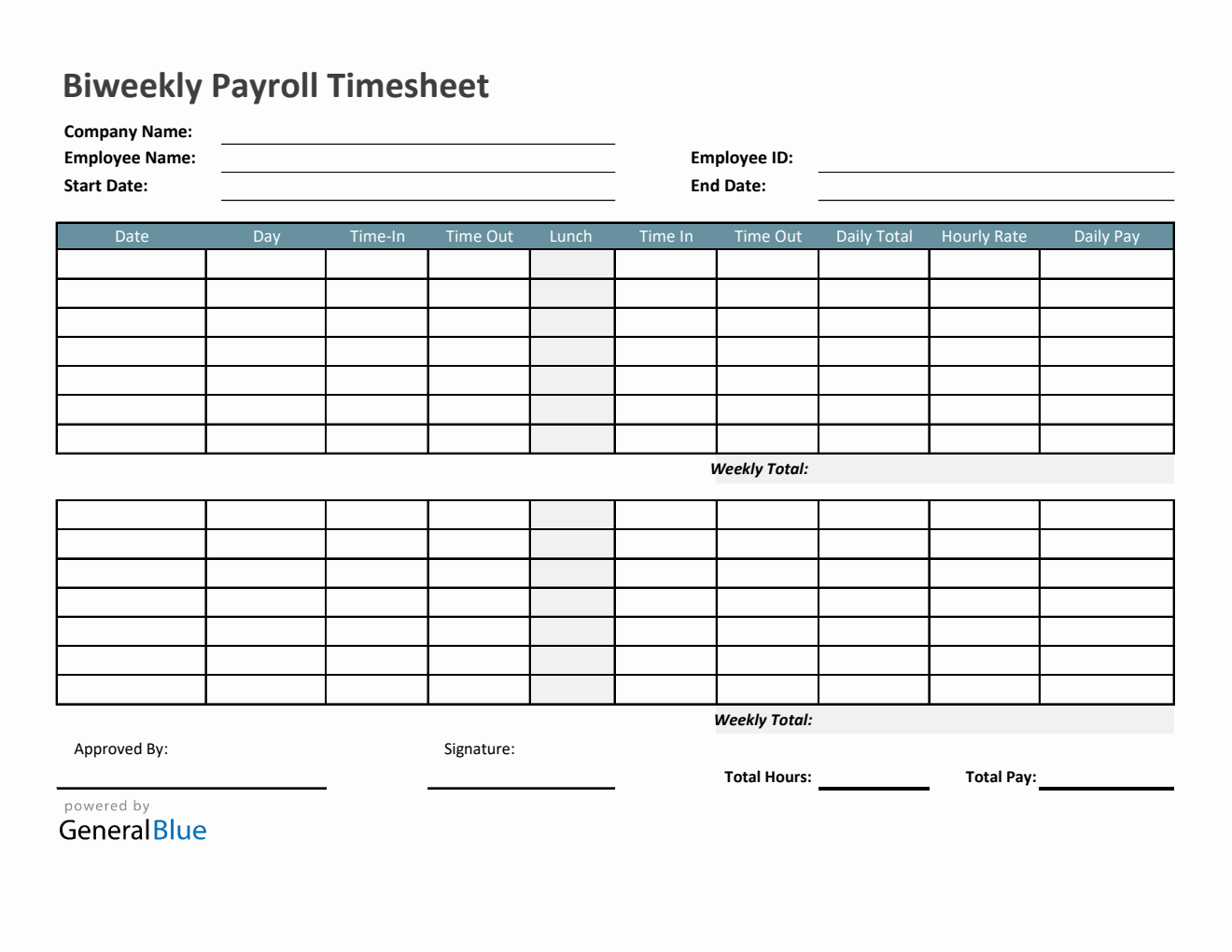

- Create column headers: In the first row, create columns for "Pay Period," "Start Date," "End Date," "Pay Date," "Notes." You can add more columns as needed, such as "Total Hours," "Gross Pay," "Net Pay," or employee names.

- Format the Dates: Format the "Start Date," "End Date," and "Pay Date" columns as dates. This ensures accurate date calculations.

Step 2: Determining the First Pay Period

- Choose your first pay period’s start date. This is crucial as it dictates all subsequent pay periods. Consider factors like your existing payroll cycle or the start of your fiscal year. Let’s assume, for this example, the first pay period starts on January 6th, 2024.

Step 3: Calculating Subsequent Pay Periods

- Enter the start date (January 6th, 2024) in the "Start Date" column for Pay Period 1.

- Calculate the end date: For a bi-weekly cycle, add 13 days to the start date (January 6th + 13 days = January 19th). Enter this in the "End Date" column.

- Determine the pay date: This usually follows a set number of days after the end date. Let’s assume a 3-day processing period. Therefore, the pay date for Pay Period 1 would be January 22nd (January 19th + 3 days). Enter this in the "Pay Date" column.

- Repeat the process: For Pay Period 2, the start date is January 20th (the day after the previous end date). Calculate the end date (January 20th + 13 days = February 2nd) and the pay date (February 2nd + 3 days = February 5th). Continue this process for all 26 pay periods of 2024.

Step 4: Utilizing Excel Formulas for Efficiency

Instead of manually calculating each date, utilize Excel’s powerful formulas:

- Start Date: In cell B2 (assuming "Start Date" is column B and Pay Period 1 is row 2), enter your first start date (e.g., 06/01/2024).

- End Date: In cell C2, enter the formula

=B2+13. - Pay Date: In cell D2, enter the formula

=C2+3. - Subsequent Pay Periods: In cell B3, enter the formula

=C2+1. This automatically calculates the start date of the next pay period. Then, copy the formulas in cells C2 and D2 down to automatically calculate the end date and pay date for all subsequent pay periods.

Step 5: Adding Notes and Customization

- Add notes: Utilize the "Notes" column to record important information, such as holidays falling within a pay period, special payment arrangements, or any other relevant details.

- Conditional Formatting: Use conditional formatting to highlight holidays, weekends, or specific pay periods.

- Data Validation: Implement data validation to ensure accurate data entry and prevent errors.

Step 6: Advanced Features and Integration

- Employee Data: Add columns for employee names, ID numbers, hours worked, hourly rate, deductions, and other relevant payroll information. You can use formulas to calculate gross pay, net pay, and other deductions.

- Charts and Graphs: Create charts and graphs to visualize payroll data, such as total payroll expenses per pay period or trends in employee hours.

- Integration with other software: Explore the possibility of integrating your Excel calendar with other payroll software or accounting systems to streamline your workflow.

Example of a 2024 Bi-Weekly Payroll Calendar Snippet (Excel Formulas Shown):

| Pay Period | Start Date | End Date | Pay Date | Notes |

|---|---|---|---|---|

| 1 | 06/01/2024 | 19/01/2024 | 22/01/2024 | |

| 2 | =C2+1 | =B3+13 | =C3+3 | |

| 3 | =C3+1 | =B4+13 | =C4+3 | |

| … | … | … | … | … |

| 26 | … | … | … |

Troubleshooting and Best Practices

- Leap Year: Remember to adjust your formulas if the pay period spans across a leap year.

- Holidays: Accurately account for holidays that may affect pay dates or working days.

- Regular Review: Regularly review and update your calendar to ensure accuracy and reflect any changes in your payroll process.

- Data Backup: Regularly back up your Excel file to prevent data loss.

By following this comprehensive guide, you can create a robust and efficient 2024 bi-weekly payroll calendar in Excel. Remember to tailor your template to your specific business needs, regularly review and update it, and consider integrating it with other systems for optimal efficiency. A well-organized payroll system is not just about accurate payments; it’s about fostering a positive work environment and ensuring the financial health of your business.

Closure

Thus, we hope this article has provided valuable insights into Mastering Your 2024 Bi-Weekly Payroll: A Comprehensive Guide with Excel Templates. We appreciate your attention to our article. See you in our next article!