Mastering Your 2024 Bi-Weekly Payroll: A Comprehensive Guide with Excel Templates

Related Articles: Mastering Your 2024 Bi-Weekly Payroll: A Comprehensive Guide with Excel Templates

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Mastering Your 2024 Bi-Weekly Payroll: A Comprehensive Guide with Excel Templates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Mastering Your 2024 Bi-Weekly Payroll: A Comprehensive Guide with Excel Templates

Payroll processing is the lifeblood of any organization, and accuracy is paramount. A smoothly functioning payroll system ensures employee satisfaction, maintains legal compliance, and contributes to a healthy financial bottom line. For businesses operating on a bi-weekly payroll schedule, meticulous planning and efficient tools are essential. This article delves into the intricacies of creating and utilizing a 2024 bi-weekly payroll calendar in Excel, providing detailed explanations, practical tips, and downloadable template examples to streamline your payroll process.

Understanding the Bi-Weekly Payroll Cycle:

A bi-weekly payroll cycle means employees are paid every two weeks. This differs from semi-monthly (twice a month), which might have varying pay periods depending on the number of days in each month. Bi-weekly pay periods always consist of 14 days, simplifying calculations but requiring careful consideration of pay dates falling on weekends or holidays.

Constructing Your 2024 Bi-Weekly Payroll Calendar in Excel:

Several approaches can be used to create a comprehensive 2024 bi-weekly payroll calendar in Excel. We’ll outline two common methods:

Method 1: Using the DATE Function and Relative References:

This method leverages Excel’s powerful DATE function and relative cell referencing to automatically generate pay periods throughout the year. It’s highly efficient and minimizes manual input, reducing the risk of errors.

-

Setting up the Header: Create a header row with columns for "Pay Period," "Start Date," "End Date," and any other relevant information like "Pay Date" or "Payroll Number."

-

Entering the First Pay Period: In the first row, manually enter the start date of your first pay period in the "Start Date" column (e.g., 01/01/2024). Use the

DATEfunction to calculate the end date:=DATE(YEAR(A2),MONTH(A2),DAY(A2)+13)(assuming the start date is in cell A2). This formula adds 13 days to the start date, resulting in a 14-day pay period. The pay date can be manually entered or calculated based on your company’s policy. -

Auto-Filling Subsequent Pay Periods: Select the cells containing the start and end dates of the first pay period. Drag the small square at the bottom right corner of the selection down to automatically fill subsequent pay periods. Excel will automatically increment the dates based on the 14-day interval.

-

Adjusting for Weekends and Holidays: Manually review the generated dates and adjust the "Pay Date" column as needed to account for weekends or holidays. You might choose to pay employees on the Friday before a weekend or adjust the pay date to the next business day following a holiday. Consider using conditional formatting to highlight pay dates that fall on weekends or holidays.

Method 2: Manual Entry with Data Validation:

This method involves manually entering the start and end dates for each pay period. While less automated, it offers greater control and is suitable for smaller businesses or those with irregular payroll schedules.

-

Create the Header: Similar to Method 1, create a header row with the necessary columns.

-

Manual Data Entry: Manually enter the start and end dates for each bi-weekly pay period. Ensure accuracy and consistency.

-

Data Validation (Optional): To prevent incorrect data entry, use Excel’s data validation feature to restrict the input to dates. This ensures that only valid dates are entered into the "Start Date" and "End Date" columns.

Enhancing Your Excel Payroll Calendar:

To maximize the effectiveness of your Excel payroll calendar, consider these enhancements:

-

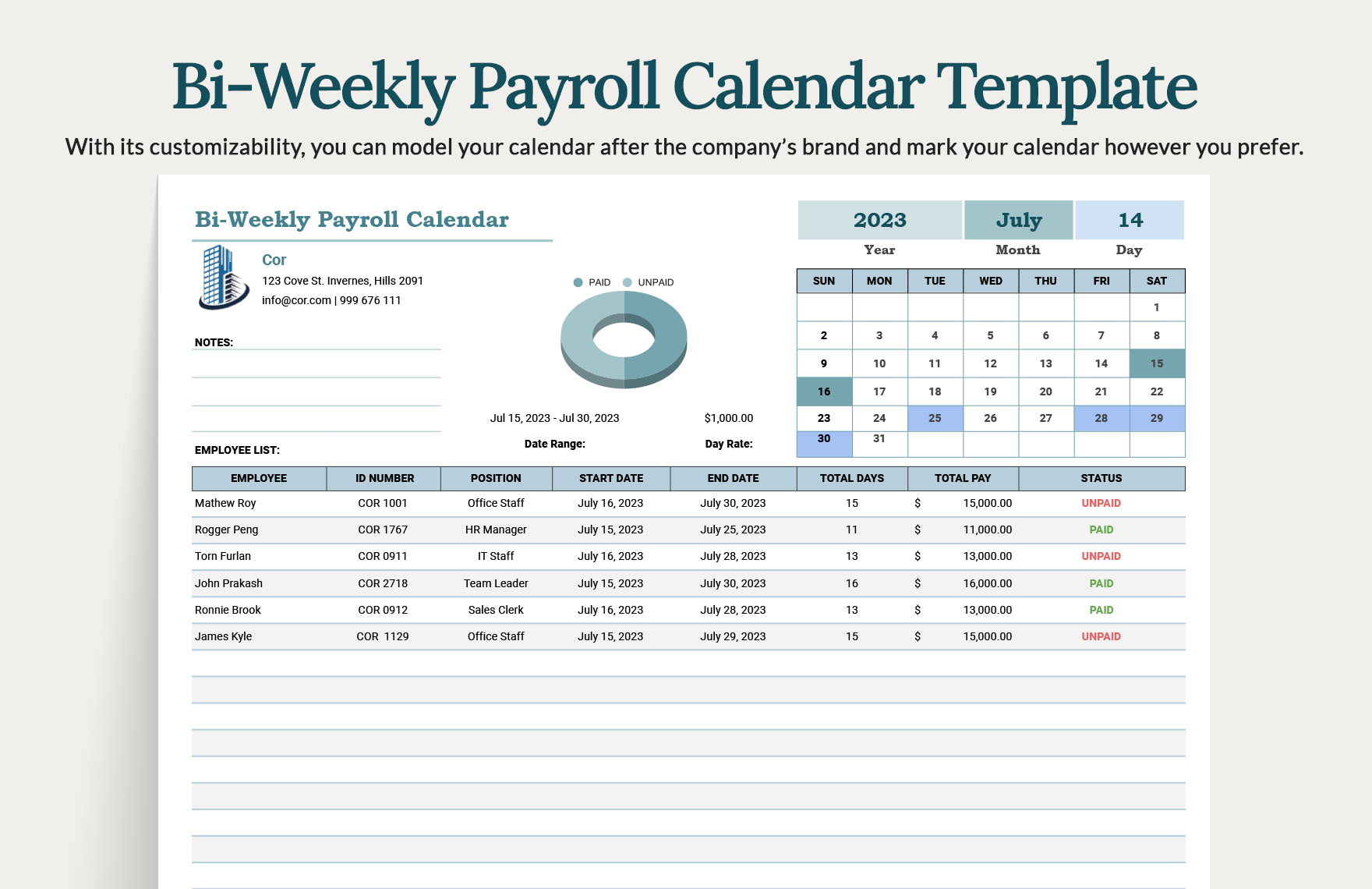

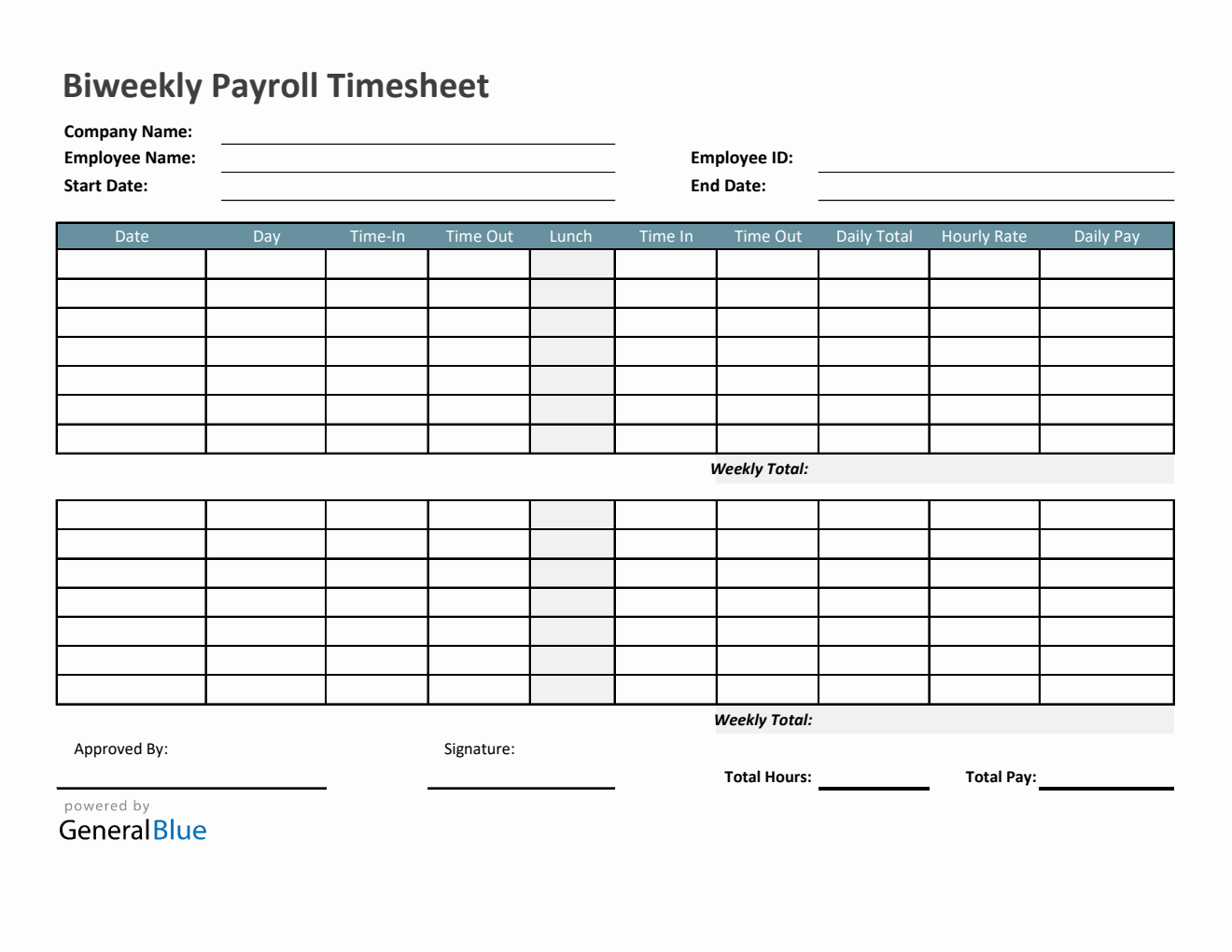

Adding Employee Information: Include columns for employee ID, name, and other relevant details. This allows you to link the calendar to your payroll database for easier processing.

-

Calculating Gross Pay: Integrate formulas to automatically calculate gross pay based on hourly rate, salary, or commission. This eliminates manual calculations and minimizes errors.

-

Deductions and Net Pay: Add columns for various deductions (taxes, insurance, retirement contributions) and calculate net pay.

-

Year-to-Date (YTD) Totals: Include columns to track YTD totals for gross pay, deductions, and net pay. This is crucial for tax reporting and employee record-keeping.

-

Conditional Formatting: Use conditional formatting to highlight important dates, such as pay dates falling on weekends or holidays, or employees who require special attention.

-

Data Protection: Protect your worksheet to prevent accidental modification of formulas and data.

-

Charts and Graphs: Create charts and graphs to visualize payroll data, such as monthly payroll expenses or employee compensation trends.

Downloadable Template Examples:

While providing a full Excel template within this text is impossible, numerous free and paid templates are available online. Search for "bi-weekly payroll calendar Excel template 2024" on search engines or template websites. Choose a template that aligns with your specific needs and company structure. Remember to carefully review and customize any downloaded template before using it for your payroll processing.

Legal Compliance and Best Practices:

Ensure your payroll calendar and processes comply with all applicable federal, state, and local laws and regulations. Consult with a payroll professional or accountant to ensure compliance with tax withholding, minimum wage laws, and other relevant regulations.

Conclusion:

A well-designed 2024 bi-weekly payroll calendar in Excel is an invaluable tool for streamlining your payroll process. By utilizing the methods and enhancements described above, you can create a robust and accurate system that minimizes errors, saves time, and ensures timely and accurate compensation for your employees. Remember to regularly review and update your calendar to account for changes in legislation and company policy. Investing time in creating an efficient payroll system is an investment in the accuracy and smooth operation of your business.

Closure

Thus, we hope this article has provided valuable insights into Mastering Your 2024 Bi-Weekly Payroll: A Comprehensive Guide with Excel Templates. We appreciate your attention to our article. See you in our next article!