Mastering the Chase Freedom Unlimited® and Chase Freedom Flex℠ Cash Back Calendars for 2024: Maximize Your Rewards

Related Articles: Mastering the Chase Freedom Unlimited® and Chase Freedom Flex℠ Cash Back Calendars for 2024: Maximize Your Rewards

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Mastering the Chase Freedom Unlimited® and Chase Freedom Flex℠ Cash Back Calendars for 2024: Maximize Your Rewards. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Mastering the Chase Freedom Unlimited® and Chase Freedom Flex℠ Cash Back Calendars for 2024: Maximize Your Rewards

The Chase Freedom Unlimited® and Chase Freedom Flex℠ cards are popular choices for consumers seeking a flexible cash back rewards program. Their rotating quarterly bonus categories, however, require careful planning to maximize earnings. This comprehensive guide delves into understanding the 2024 Chase Freedom cash back calendar, offering strategies to optimize your spending and unlock the full potential of these rewarding credit cards. While Chase hasn’t officially released the 2024 calendar as of this writing, we’ll analyze past trends and provide proactive strategies to prepare you for the year ahead.

Understanding the Chase Freedom Rotating Categories:

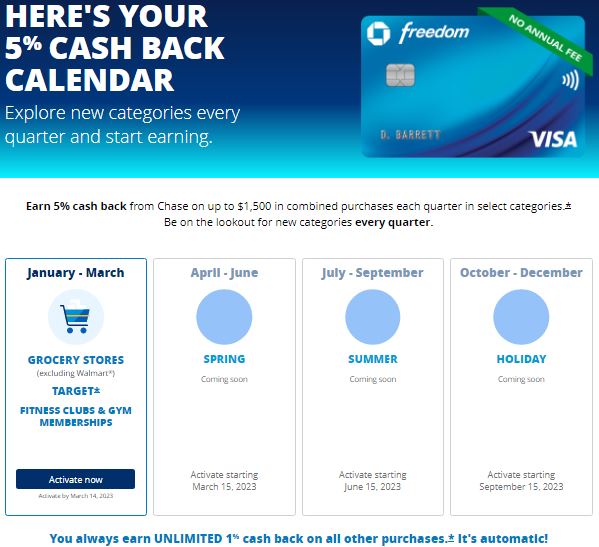

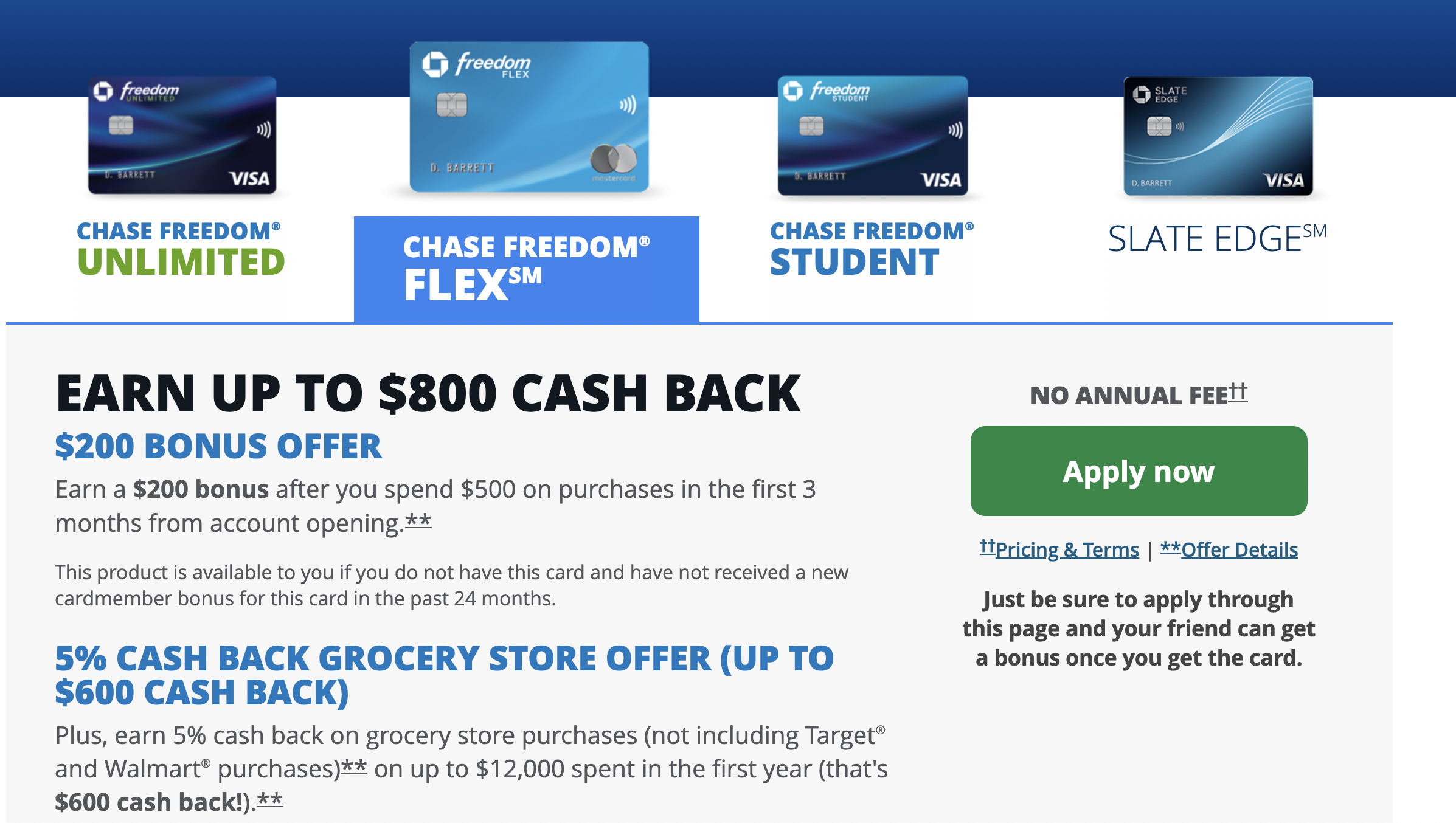

Both the Chase Freedom Unlimited® and Chase Freedom Flex℠ cards operate on a similar system. While the Unlimited card offers a flat 1.5% cash back on all purchases, the real value comes from activating the quarterly bonus categories offered by both cards. These categories typically focus on popular spending areas like grocery stores, gas stations, online shopping, or specific retailers. By strategically aligning your spending with these rotating categories, you can earn significantly higher cash back percentages, often 5% or even more during promotional periods.

Analyzing Past Trends to Predict 2024:

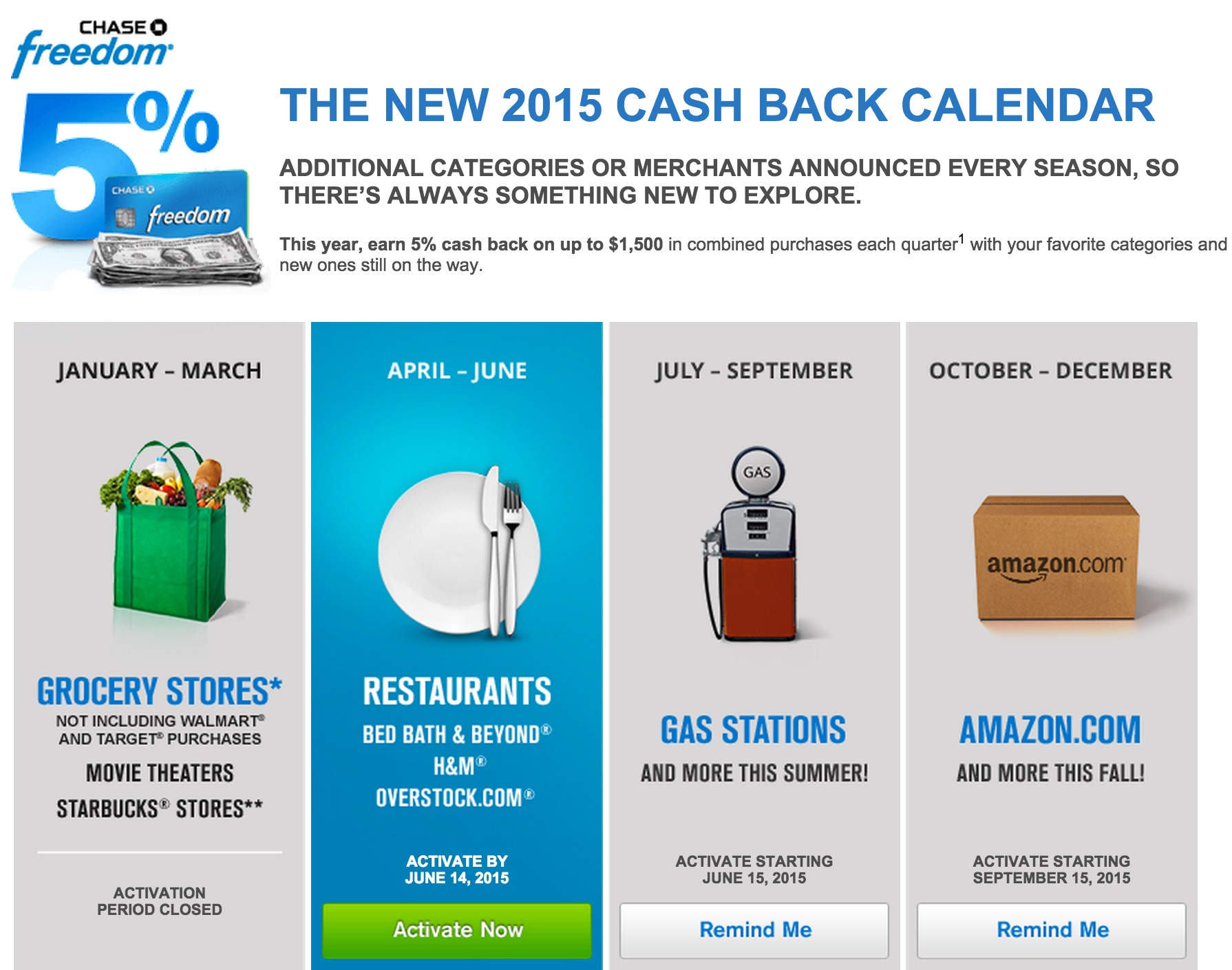

Predicting the exact categories for 2024 is impossible without official announcements from Chase. However, analyzing past trends can provide valuable insights. Chase has historically included a mix of broad categories (like grocery stores and gas stations) and more niche categories (like specific online retailers or dining establishments). Consider these past trends when planning your spending for 2024:

- Recurring Categories: Grocery stores and drugstores frequently appear as bonus categories. These are consistent spending areas for most households, making them ideal targets for maximizing cash back.

- Seasonal Categories: Categories often reflect seasonal spending patterns. For instance, we might see travel or holiday shopping categories during the peak seasons.

- Variety and Balance: Chase typically aims for a balance in categories, avoiding too much repetition. While some categories reappear, they are usually spaced out throughout the year.

- Online vs. In-Person: A mix of online and in-person spending categories usually emerges, catering to diverse consumer habits.

Developing a Proactive Spending Strategy for 2024:

While we lack the precise 2024 calendar, we can create a proactive spending strategy based on probable categories and past patterns. This strategy involves:

-

Tracking Your Spending: Begin by analyzing your current spending habits. Identify your major expense categories and their average monthly amounts. This will help you determine which bonus categories are most relevant to you.

-

Creating a Flexible Budget: A flexible budget allows you to shift spending towards bonus categories when they align with your needs. For example, if you anticipate a "home improvement" category, you might delay larger purchases until that quarter.

-

Utilizing Online Tools: Several websites and apps track the Chase Freedom bonus categories and offer spending calendars. These tools can help you stay informed and plan your spending accordingly.

-

Considering Category Overlap: Pay attention to potential overlaps between categories. For instance, if one quarter features "grocery stores" and another features "drugstores," you can consolidate purchases to maximize your rewards.

-

Early Activation: Remember to activate the bonus categories before making eligible purchases. Failure to activate will result in earning only the standard cash back rate. Check the Chase website or app regularly for updates.

-

Combining with Other Chase Cards: Consider using other Chase cards in conjunction with the Freedom cards. For example, you could use the Chase Sapphire Preferred® card for travel purchases and the Chase Freedom Unlimited® or Chase Freedom Flex℠ for bonus categories.

Maximizing Cash Back with Specific Examples (Hypothetical 2024 Categories):

Let’s illustrate how to maximize cash back with hypothetical 2024 categories. Remember, these are examples based on past trends and are not official Chase announcements.

Scenario 1: Q1 2024 – Streaming Services, Gas Stations, Online Shopping

- Strategy: If you subscribe to streaming services, pay your bills during this quarter. Consolidate gas purchases and shift online shopping to take advantage of the 5% cash back.

Scenario 2: Q2 2024 – Grocery Stores, Drugstores, Restaurants

- Strategy: Stock up on groceries and non-perishable items during this quarter. Combine drugstore and restaurant spending to optimize the bonus.

Scenario 3: Q3 2024 – Home Improvement Stores, Department Stores, Travel

- Strategy: Delay larger home improvement projects or back-to-school shopping until this quarter. If you have travel plans, book them during this period.

Scenario 4: Q4 2024 – Holiday Shopping, Electronics, Gift Cards

- Strategy: Plan your holiday shopping around this quarter to maximize rewards on gifts and electronics. Purchase gift cards strategically if offered within the bonus category.

Important Considerations:

- Spending Limits: While the bonus categories offer high cash back percentages, remember that there are usually spending limits. Exceeding these limits will result in earning the standard cash back rate on the remaining purchases.

- Annual Fee: The Chase Freedom Unlimited® card has no annual fee, making it an excellent choice for budget-conscious consumers. The Chase Freedom Flex℠ card also has no annual fee.

- Redemption Options: Chase offers various redemption options for your cash back, including direct deposit to your bank account, statement credit, or gift cards. Choose the option that best suits your needs.

Conclusion:

While the official 2024 Chase Freedom cash back calendar remains unknown, proactive planning and understanding past trends can significantly enhance your rewards. By meticulously tracking your spending, creating a flexible budget, and utilizing online tools, you can optimize your spending and unlock the full potential of the Chase Freedom Unlimited® and Chase Freedom Flex℠ cards. Remember to activate the bonus categories and stay informed about any changes or updates announced by Chase throughout the year. With a well-defined strategy, you can turn your everyday spending into substantial cash back rewards in 2024. Remember to always review the terms and conditions of your credit card agreement for the most up-to-date information.

:max_bytes(150000):strip_icc()/chase-freedom-unlimited_blue-90aa9a715e0641a692dc08bb21d71f8b.jpg)

Closure

Thus, we hope this article has provided valuable insights into Mastering the Chase Freedom Unlimited® and Chase Freedom Flex℠ Cash Back Calendars for 2024: Maximize Your Rewards. We appreciate your attention to our article. See you in our next article!