Decoding the 2025 OPM Pay Calendar: A Comprehensive Guide for Federal Employees

Related Articles: Decoding the 2025 OPM Pay Calendar: A Comprehensive Guide for Federal Employees

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Decoding the 2025 OPM Pay Calendar: A Comprehensive Guide for Federal Employees. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Decoding the 2025 OPM Pay Calendar: A Comprehensive Guide for Federal Employees

The Office of Personnel Management (OPM) plays a crucial role in the lives of federal employees, setting the stage for their compensation and benefits. Understanding the OPM pay calendar is essential for effective financial planning and budgeting. This article provides a detailed look at the anticipated 2025 OPM pay calendar, offering insights into pay periods, holidays, and important dates to keep in mind. While the precise dates for 2025 will be officially released by the OPM closer to the year, we can extrapolate based on past trends and provide a framework for understanding the system.

Understanding the Fundamentals of the OPM Pay Calendar

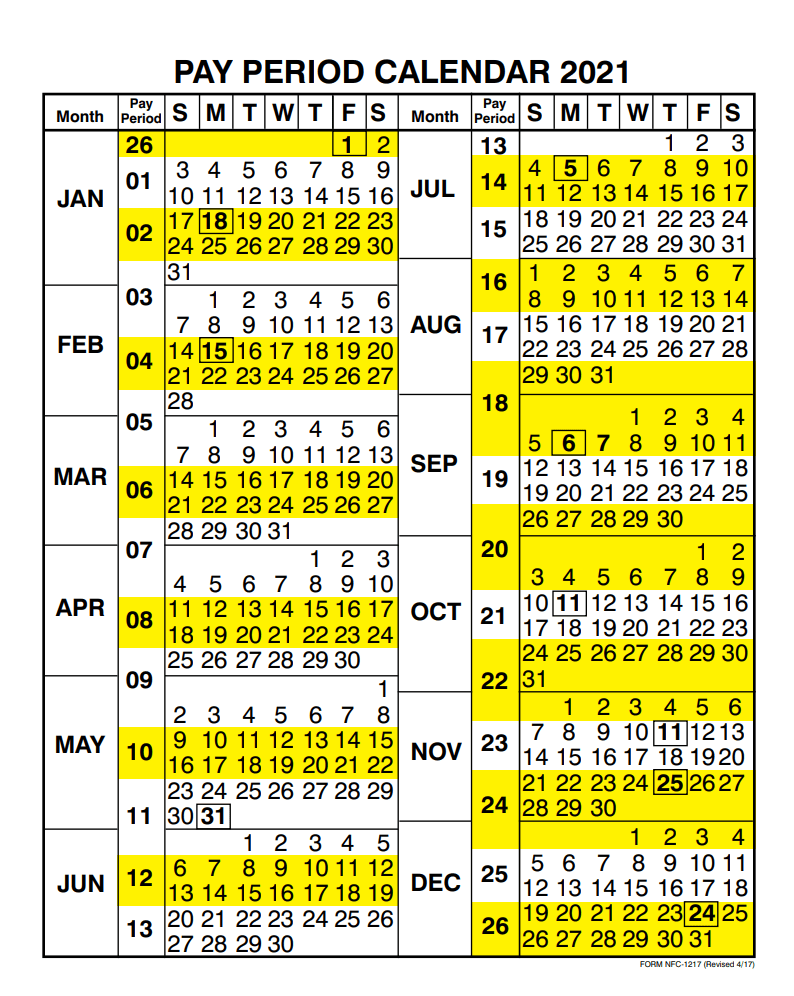

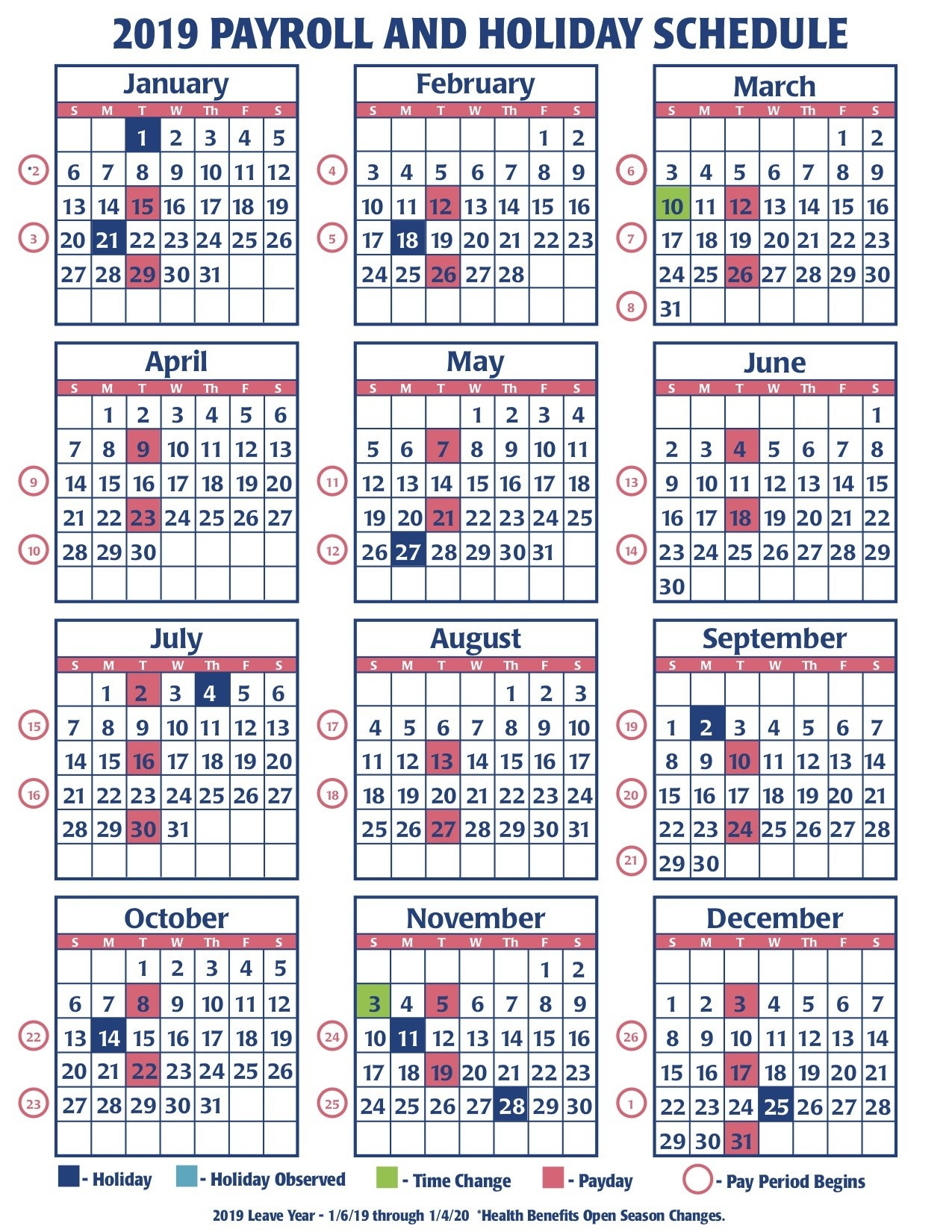

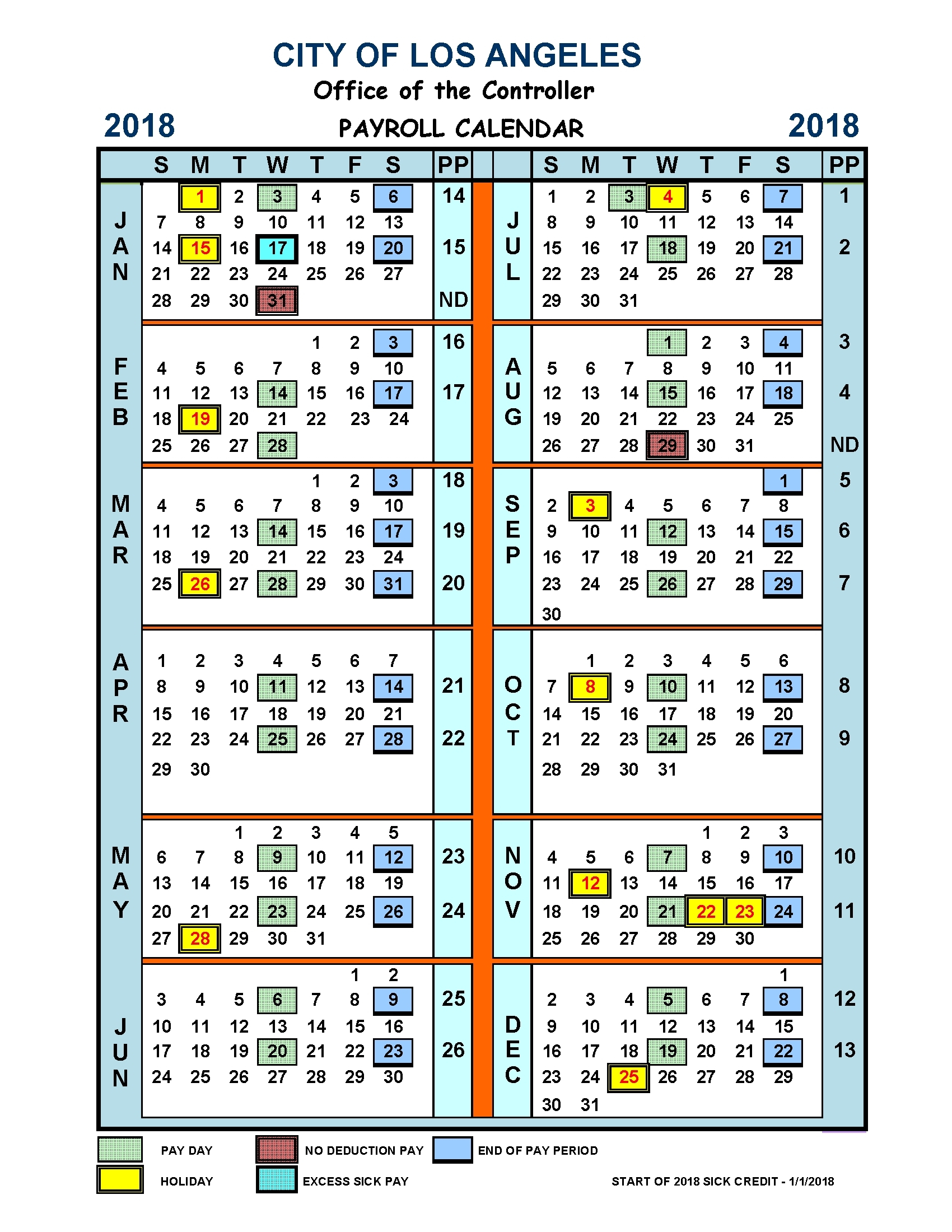

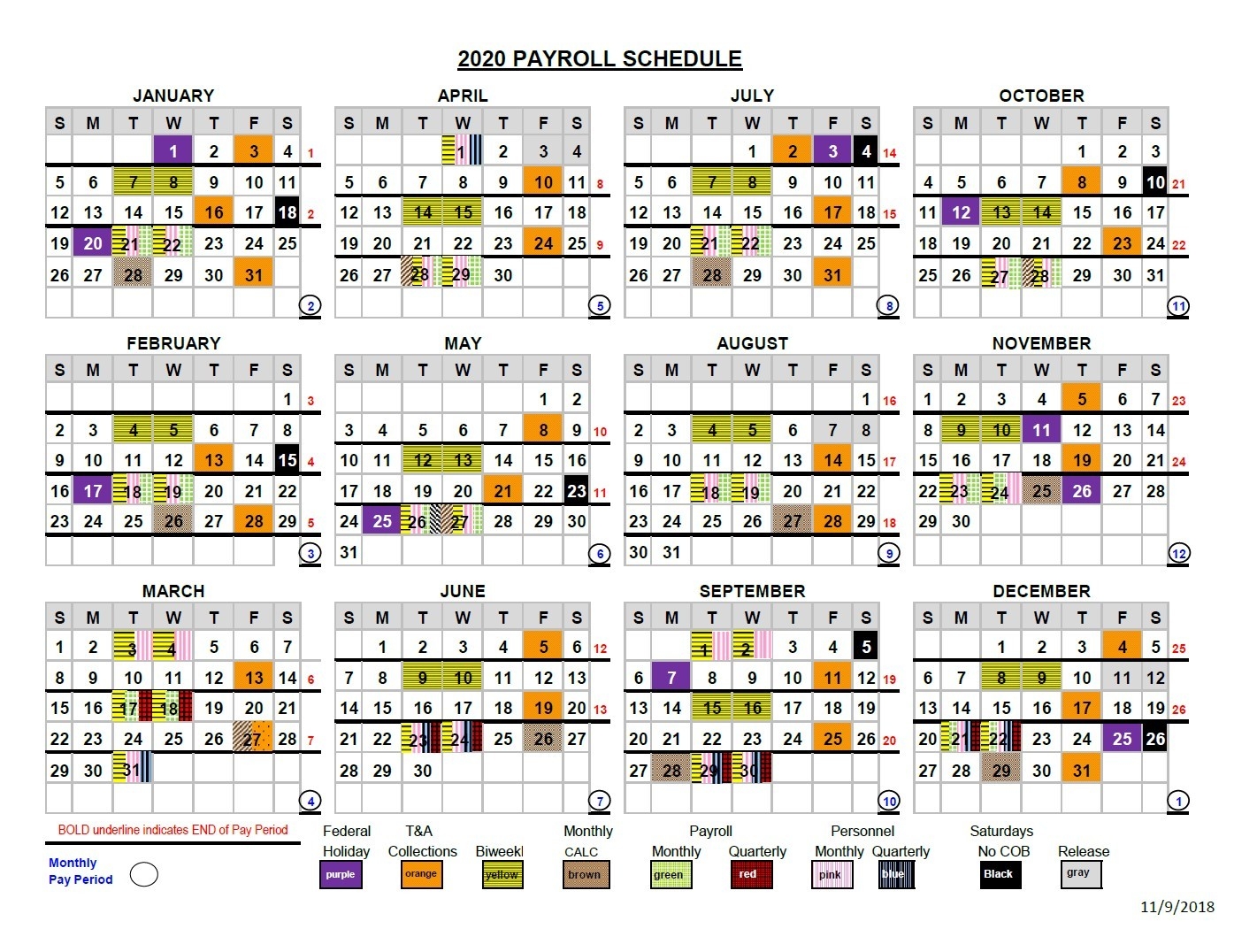

The OPM utilizes a bi-weekly pay schedule, meaning federal employees receive their paychecks twice a month. Each pay period covers a specific timeframe, typically spanning two weeks. These pay periods are numbered consecutively throughout the year. The calendar is meticulously structured to account for weekends, holidays, and other factors that might impact payment processing.

Key Elements of the 2025 Projected OPM Pay Calendar:

While the exact dates remain to be officially published by the OPM, we can anticipate the following elements:

-

Pay Periods: There will be 26 pay periods in 2025, as is standard for the bi-weekly system. Each pay period will have a corresponding pay period number, ranging from 1 to 26. This numbering system is crucial for tracking payments and resolving any discrepancies.

-

Pay Dates: Pay dates are typically Fridays, although this can vary slightly depending on the day of the week a pay period ends. The OPM strives for consistency, but occasional shifts might occur due to holidays or other administrative factors. For example, if a pay period ends on a Saturday or Sunday, the payment might be processed on the preceding Friday.

-

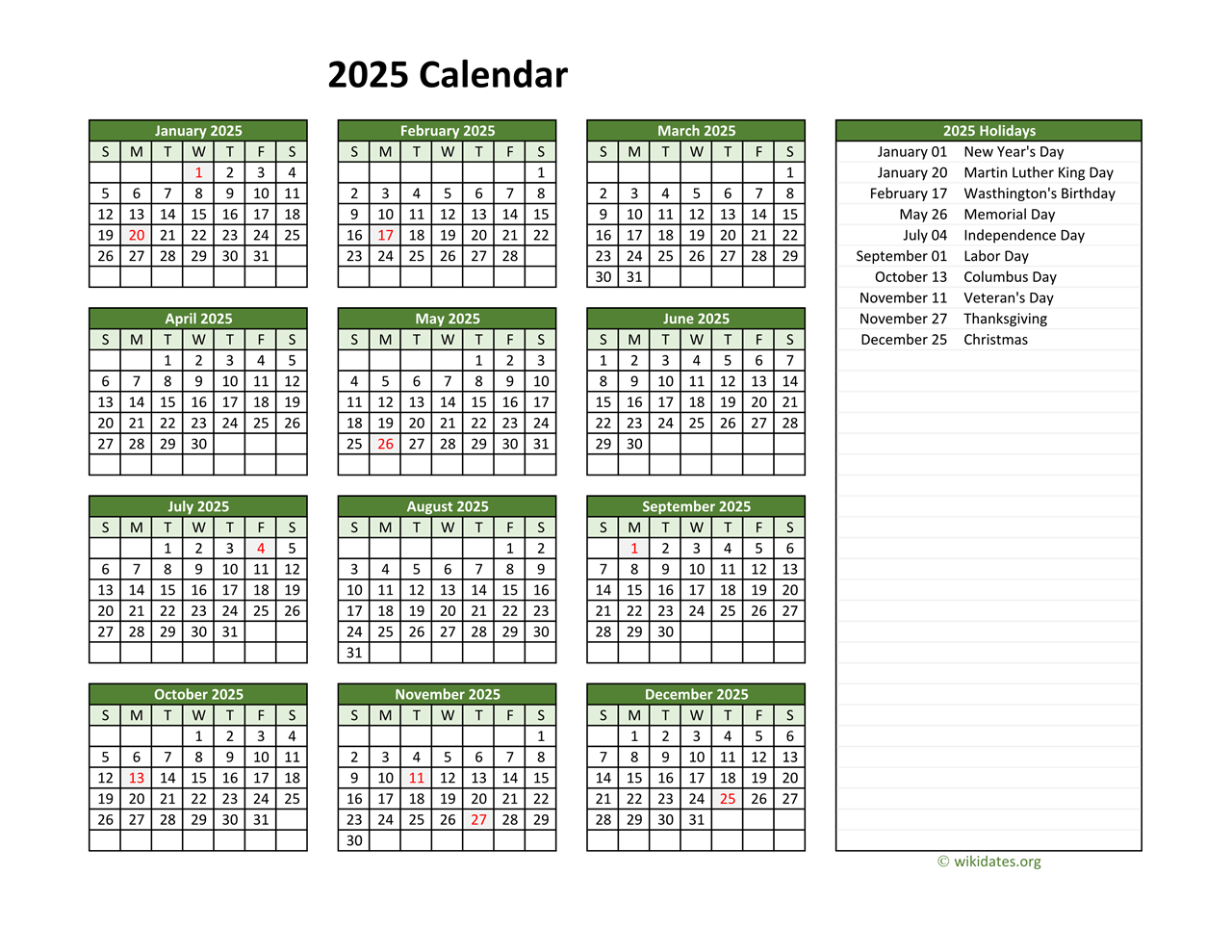

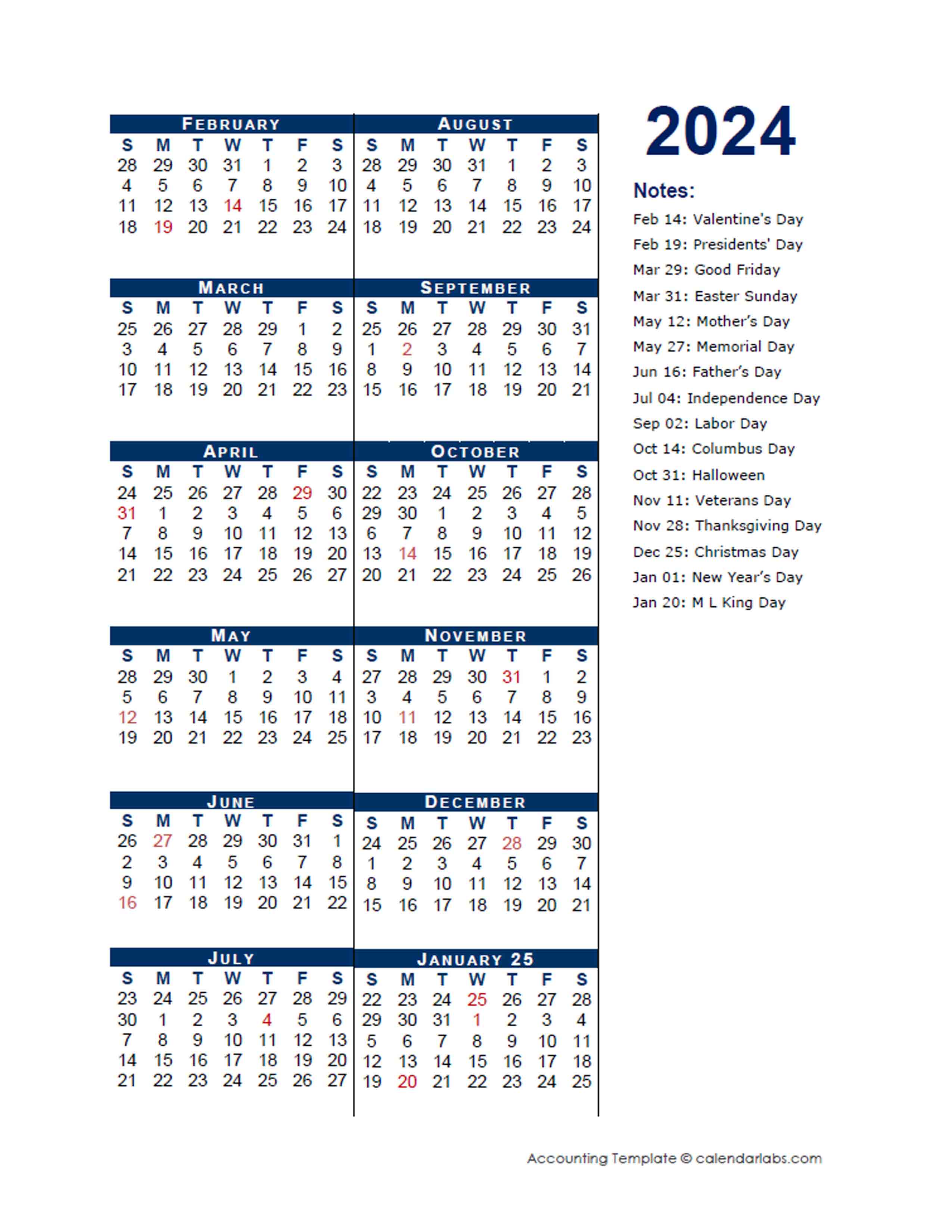

Holidays: Federal holidays are incorporated into the pay calendar. Employees receive paid time off for these holidays, and their paychecks might be adjusted accordingly. The official federal holidays for 2025 will be announced well in advance by the OPM and will significantly influence the pay calendar structure. Expect these holidays to include: New Year’s Day, Martin Luther King Jr. Day, Presidents’ Day, Memorial Day, Juneteenth National Independence Day, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving Day, and Christmas Day.

-

Leave Accrual: The OPM pay calendar is closely linked to leave accrual. Employees accrue annual and sick leave based on their length of service and pay grade. The calendar helps employees track their leave balances and plan for vacation time.

-

Tax Withholding: The pay calendar is essential for managing tax withholdings. Each paycheck will reflect federal, state, and potentially local taxes deducted based on the employee’s W-4 form.

-

Deductions: Other deductions, such as health insurance premiums, retirement contributions, and union dues, are also factored into the pay calendar. Employees should review their pay stubs regularly to ensure deductions are accurate.

Anticipating Potential Changes in 2025:

While the basic structure of the OPM pay calendar remains consistent year after year, minor adjustments can occur. These adjustments might stem from:

-

Shifting Holiday Dates: The dates of some holidays, such as Thanksgiving and Christmas, vary slightly from year to year. This necessitates adjustments to the pay calendar.

-

Legislative Changes: Any changes in federal law impacting compensation or benefits could lead to modifications in the pay calendar.

-

Administrative Decisions: The OPM might make internal adjustments to improve efficiency or address unforeseen circumstances.

Utilizing the OPM Pay Calendar Effectively:

Federal employees can utilize the OPM pay calendar in several ways:

-

Budgeting: Knowing the precise pay dates allows for accurate budgeting and financial planning.

-

Leave Planning: The calendar aids in coordinating leave requests and ensuring adequate coverage for work responsibilities.

-

Tax Planning: Understanding the pay schedule facilitates efficient tax planning and preparation.

-

Debt Management: The calendar assists in managing debt repayments and avoiding late payments.

-

Retirement Planning: The consistent pay schedule simplifies retirement planning and contributions.

Where to Find the Official 2025 OPM Pay Calendar:

The most reliable source for the official 2025 OPM pay calendar is the OPM’s website. The OPM typically releases the calendar several months before the start of the year. Keep an eye on their official announcements and publications. Additionally, many federal agencies and employee unions provide access to the pay calendar on their websites or intranets.

Beyond the Dates: Understanding Your Pay Stub

The OPM pay calendar provides the framework, but understanding your individual pay stub is crucial. Your pay stub will detail:

- Gross Pay: Your total earnings before taxes and deductions.

- Net Pay: Your take-home pay after all deductions.

- Taxes Withheld: The amount of federal, state, and local taxes withheld from your pay.

- Deductions: The amount deducted for health insurance, retirement contributions, and other items.

- Year-to-Date Totals: Running totals of your earnings, taxes, and deductions for the year.

Regularly reviewing your pay stub ensures accuracy and allows you to identify any potential discrepancies promptly.

Conclusion:

The OPM pay calendar is a fundamental tool for federal employees. Understanding its structure, anticipated dates, and potential adjustments is crucial for effective financial management and personal planning. While this article provides a framework based on past trends, remember to consult the official OPM website for the definitive 2025 pay calendar once it is released. Proactive planning and a clear understanding of the system will empower federal employees to manage their finances efficiently and confidently throughout the year. By staying informed and utilizing the available resources, you can navigate the intricacies of the OPM pay calendar and make the most of your compensation.

Closure

Thus, we hope this article has provided valuable insights into Decoding the 2025 OPM Pay Calendar: A Comprehensive Guide for Federal Employees. We appreciate your attention to our article. See you in our next article!