Navigating the Payroll Tax Calendar: 2025/21 – A Comprehensive Guide

Related Articles: Navigating the Payroll Tax Calendar: 2025/21 – A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Payroll Tax Calendar: 2025/21 – A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Payroll Tax Calendar: 2025/21 – A Comprehensive Guide

The payroll tax calendar is a crucial document for businesses of all sizes. It dictates the deadlines for remitting various payroll taxes to the relevant authorities, ensuring compliance and avoiding penalties. While the year "2025/21" presented in the prompt appears to be a typographical error, likely intending to refer to a specific tax year spanning two years (perhaps a fiscal year) or a range of years encompassing 2021 and potentially extending to 2025, this article will provide a comprehensive overview of payroll tax calendars, addressing the key elements and considerations regardless of the specific year combination. We will focus on the principles applicable across various jurisdictions and timeframes, enabling readers to adapt the information to their specific context.

Understanding the Components of a Payroll Tax Calendar:

A typical payroll tax calendar encompasses several key components:

-

Tax Type: This specifies the type of payroll tax due, such as Social Security tax (FICA), Medicare tax, federal income tax withholding, state income tax withholding, unemployment insurance tax (FUTA and SUTA), and local taxes (if applicable). Each tax has its own unique filing frequency and deadlines.

-

Payment Due Date: This indicates the exact date by which the payroll taxes must be remitted to the relevant tax authority. Late payments typically incur penalties and interest.

-

Filing Frequency: This specifies how often the payroll taxes must be filed. Some taxes might require monthly filings, while others might be quarterly or annual. The frequency often depends on the size of the business and the total amount of taxes withheld.

-

Reporting Requirements: Beyond payment, many jurisdictions require detailed reporting of payroll data. This might involve submitting electronic files, completing specific forms, or providing summary information. The calendar should indicate these reporting deadlines as well.

-

Tax Year: This clarifies the tax period covered by the calendar. For example, it might cover a calendar year (January 1st to December 31st), a fiscal year, or another defined period.

-

Jurisdictional Differences: It’s crucial to understand that payroll tax requirements vary significantly by location. Federal taxes apply across the United States, but state and local taxes have their own regulations and deadlines, leading to considerable complexity. A comprehensive calendar will account for these variations.

Key Payroll Taxes and Their General Deadlines (Illustrative):

While specific deadlines change annually, the following illustrates the common types of payroll taxes and their general filing frequencies:

-

Federal Income Tax Withholding: This is deducted from employee wages and remitted to the IRS. The frequency of payment often depends on the amount withheld; smaller businesses might pay monthly or quarterly, while larger businesses often pay more frequently.

-

Social Security and Medicare Taxes (FICA): These are also withheld from employee wages and matched by the employer. Similar to federal income tax withholding, the payment frequency depends on the total tax amount.

-

Federal Unemployment Tax (FUTA): This tax funds unemployment benefits and is paid by employers. It’s typically filed and paid quarterly.

-

State Unemployment Tax (SUTA): This tax is similar to FUTA but is levied at the state level. Deadlines and filing frequencies vary by state.

-

State Income Tax Withholding: This is withheld from employee wages and remitted to the state tax authority. Deadlines and frequencies vary widely by state.

-

Local Taxes: Some localities impose additional payroll taxes, such as local income taxes or business taxes. These have their own specific deadlines.

Building and Maintaining Your Payroll Tax Calendar:

Creating and maintaining an accurate payroll tax calendar is essential for compliance. Here are some steps to follow:

-

Identify Applicable Taxes: Determine all federal, state, and local taxes that apply to your business based on its location and employee count.

-

Consult Official Sources: Refer to the official websites of the IRS, your state’s tax agency, and any relevant local authorities for the most up-to-date information on tax rates, deadlines, and filing requirements.

-

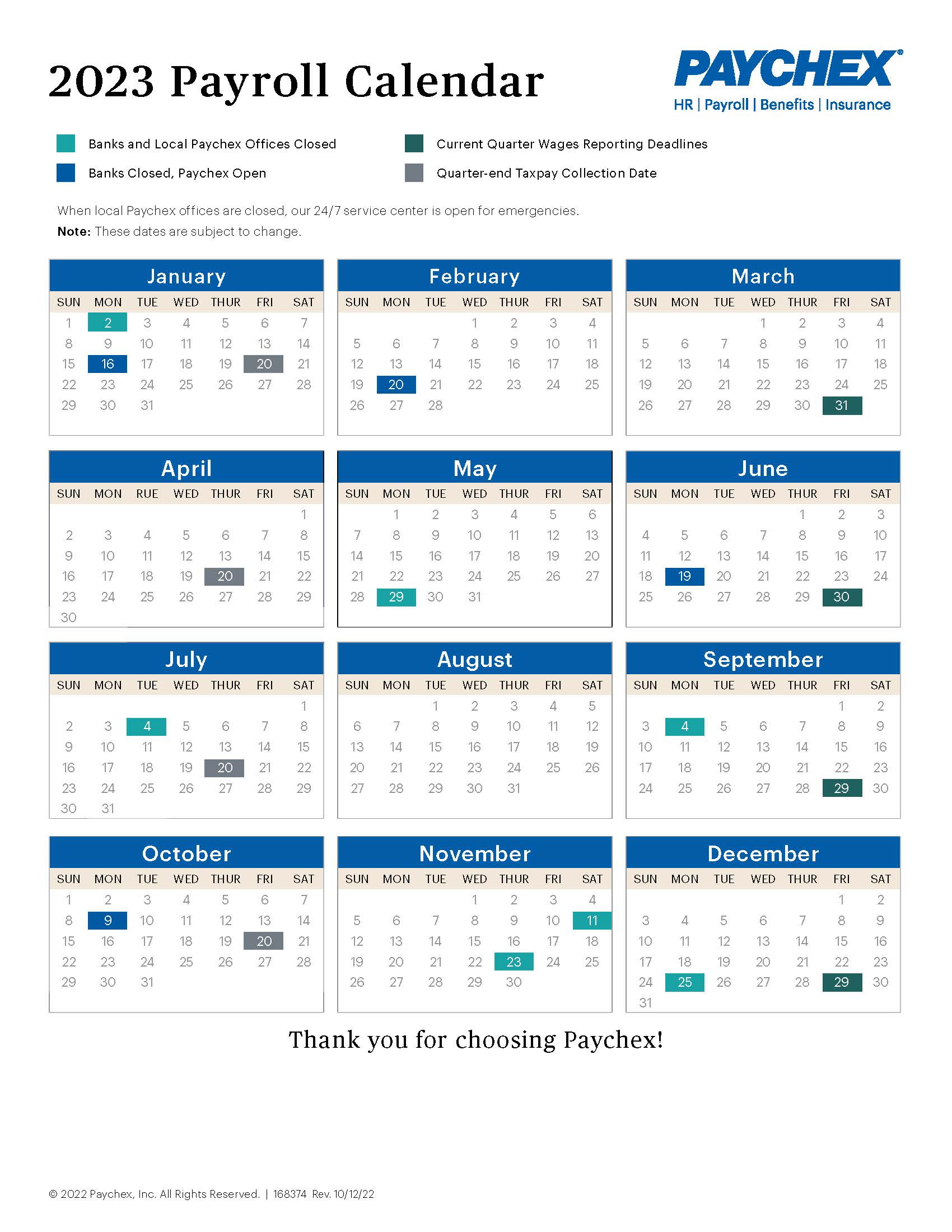

Utilize Payroll Software: Payroll software packages often incorporate built-in tax calendars and automated filing capabilities, simplifying the process considerably.

-

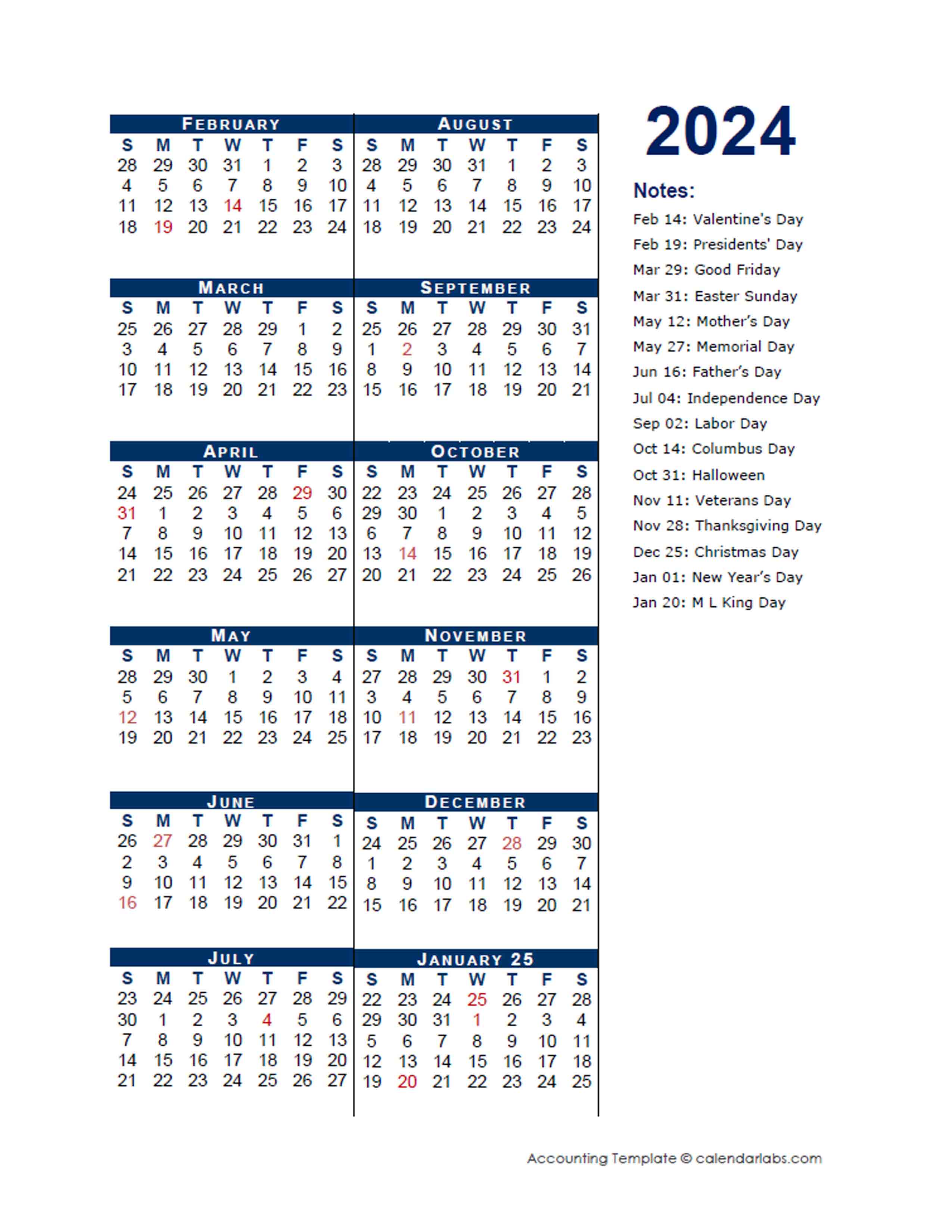

Establish a Filing System: Create a system for tracking all tax payments and filings. This could involve a spreadsheet, a dedicated calendar, or a specialized software solution.

-

Set Reminders: Use reminders (email alerts, calendar notifications) to ensure that all deadlines are met promptly.

-

Regularly Review and Update: Payroll tax laws and regulations can change, so it’s crucial to review and update your calendar regularly to ensure accuracy.

Consequences of Non-Compliance:

Failure to meet payroll tax deadlines can lead to severe consequences:

-

Penalties and Interest: Late payments typically incur penalties and interest charges, which can significantly increase the total tax liability.

-

Legal Action: In cases of persistent non-compliance, tax authorities may take legal action, potentially leading to fines, liens, and even criminal charges.

-

Reputational Damage: Non-compliance can damage a business’s reputation and make it difficult to secure financing or attract new clients.

Conclusion:

Navigating the complexities of payroll taxes requires careful planning and diligent record-keeping. A well-maintained payroll tax calendar is an indispensable tool for ensuring compliance, avoiding penalties, and maintaining a healthy financial standing. By understanding the various tax types, deadlines, and reporting requirements, businesses can proactively manage their tax obligations and focus on their core operations. Remember to always consult official sources and seek professional advice when needed, particularly if dealing with complex tax situations or jurisdictional nuances. While the specific year combination "2025/21" in the prompt is unclear, the principles outlined in this article remain universally applicable, regardless of the specific tax year or period involved. The key is consistent vigilance and adherence to the relevant regulations.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Payroll Tax Calendar: 2025/21 – A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!