Navigating the Mount Sinai Payroll Calendar 2025: A Comprehensive Guide

Related Articles: Navigating the Mount Sinai Payroll Calendar 2025: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Mount Sinai Payroll Calendar 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Mount Sinai Payroll Calendar 2025: A Comprehensive Guide

Mount Sinai Health System, a renowned healthcare provider, employs a vast workforce. Understanding their payroll calendar is crucial for employees to accurately budget, plan, and manage their finances. This article serves as a comprehensive guide to navigating the Mount Sinai payroll calendar for 2025, offering insights into payment schedules, important dates, and resources for addressing payroll-related inquiries. Please note: While this article provides general information and strategies for understanding payroll calendars, specific dates for the Mount Sinai 2025 payroll calendar are not publicly available in advance. This is due to the complexity of payroll processing, potential adjustments for holidays, and the need for internal accuracy. The information below focuses on how to access the official calendar and understand its structure once it is released.

Accessing the Official Mount Sinai Payroll Calendar:

The most reliable source for the Mount Sinai payroll calendar for 2025 will be the internal employee portal. This portal typically requires secure login credentials, ensuring data privacy and security. Employees should regularly check their internal communications, emails, and the employee portal for updates regarding the release of the 2025 payroll calendar. Look for announcements from Human Resources (HR), payroll departments, or management.

Understanding the Structure of a Typical Mount Sinai Payroll Calendar:

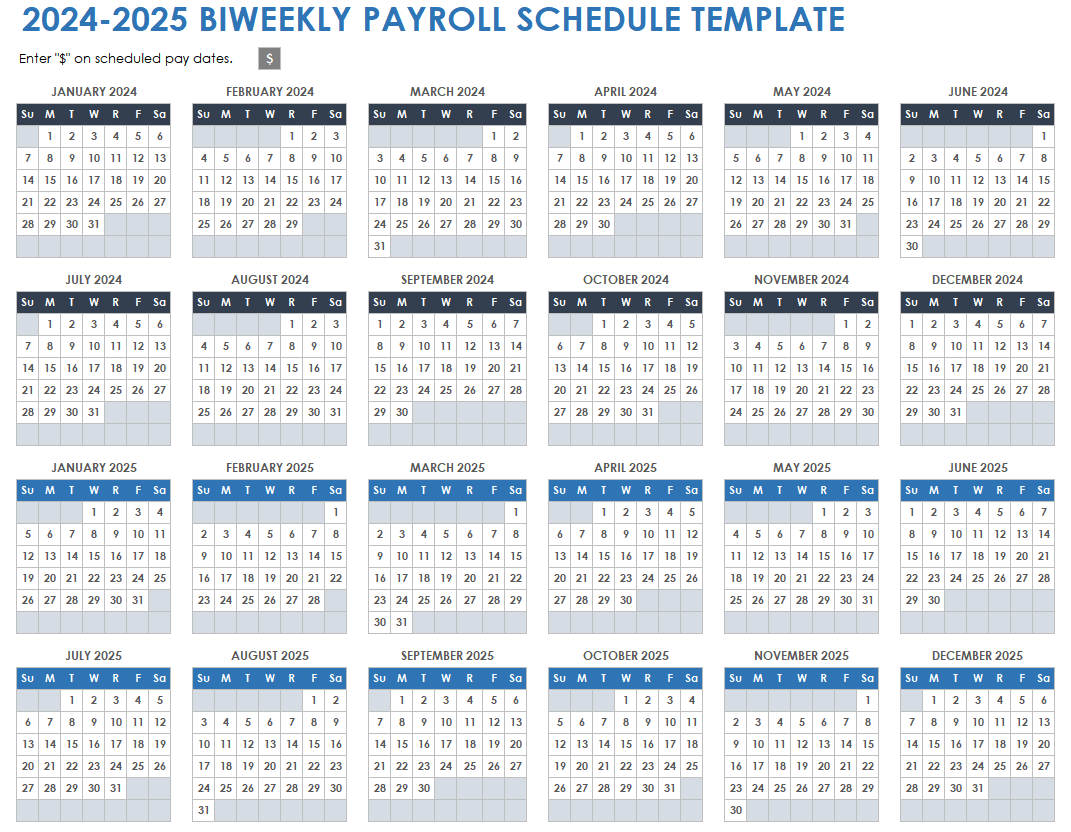

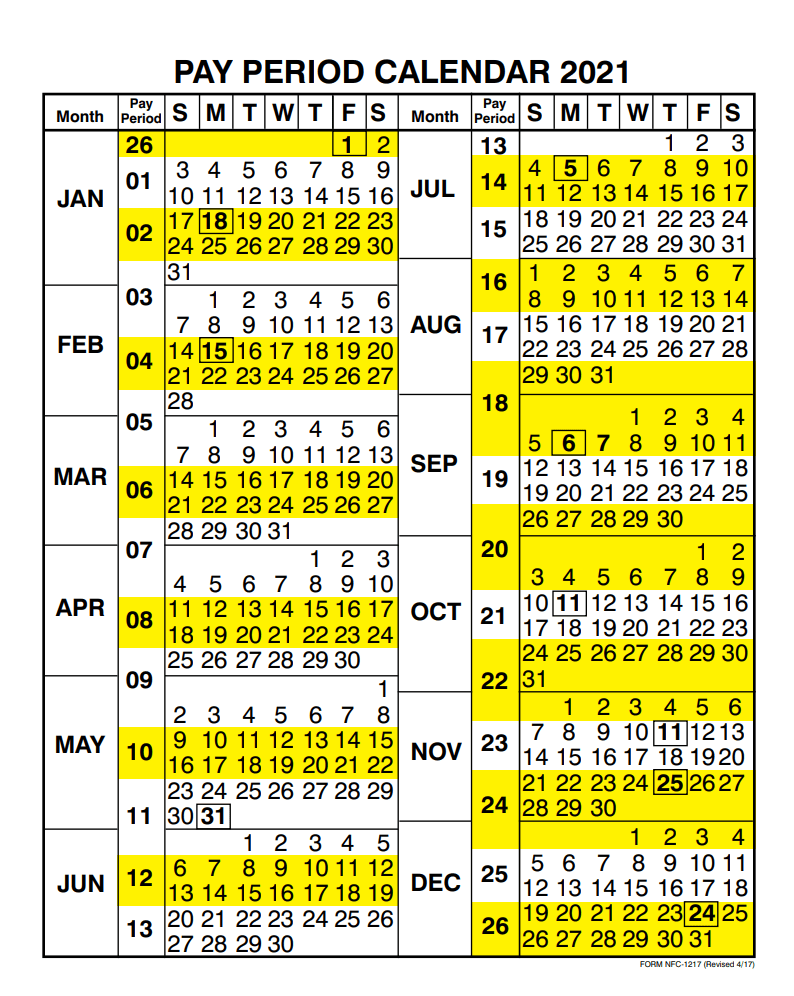

While the specific dates for 2025 are yet to be released, understanding the typical structure of Mount Sinai’s payroll calendar will help employees prepare. Most large organizations, including Mount Sinai, follow a consistent payroll schedule, usually bi-weekly or semi-monthly.

-

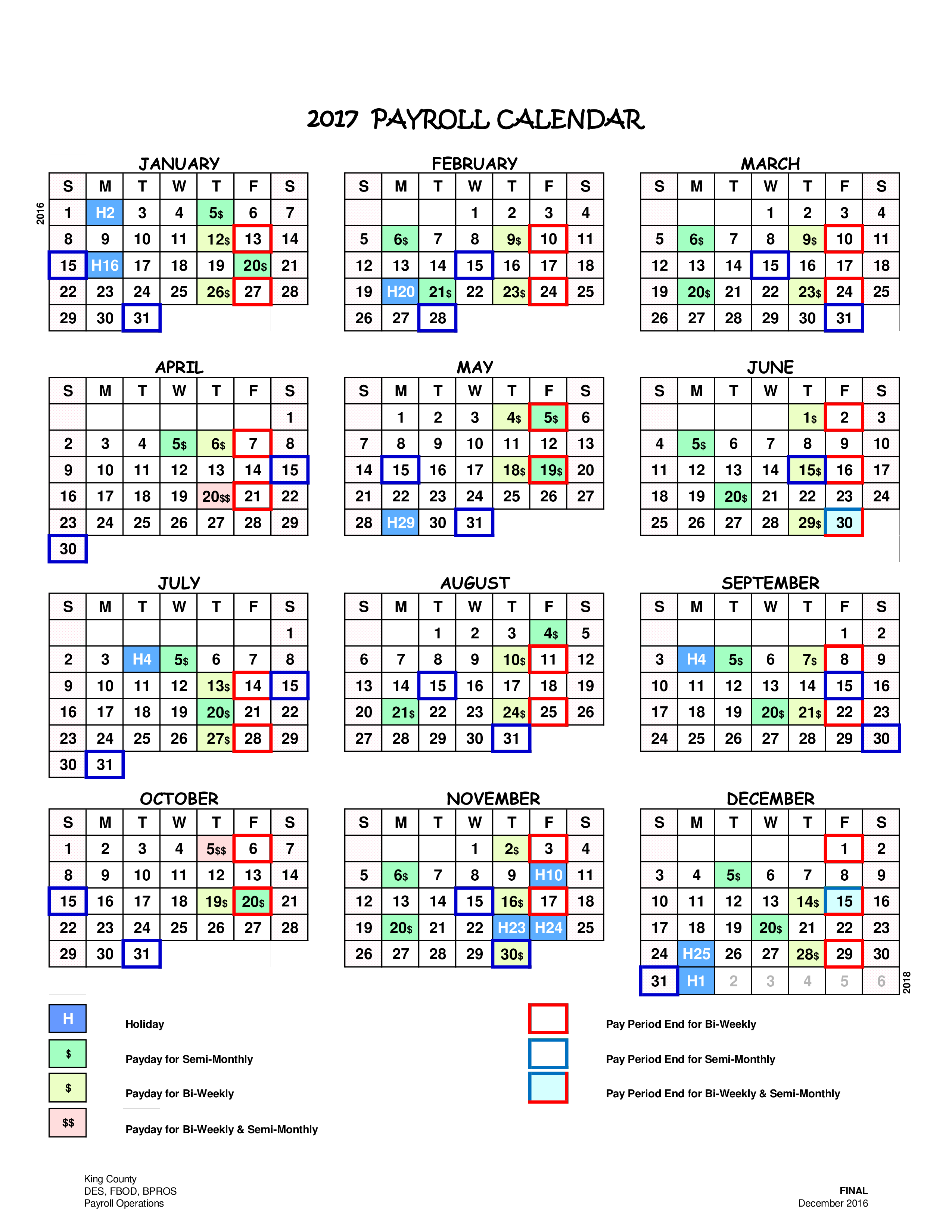

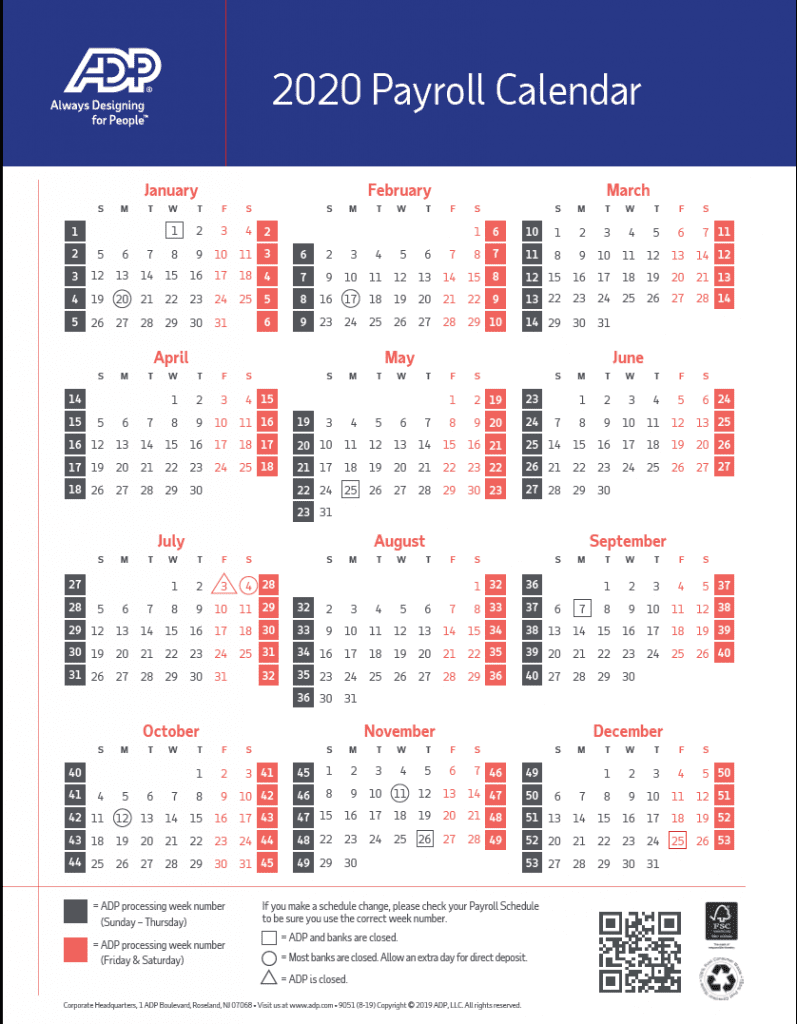

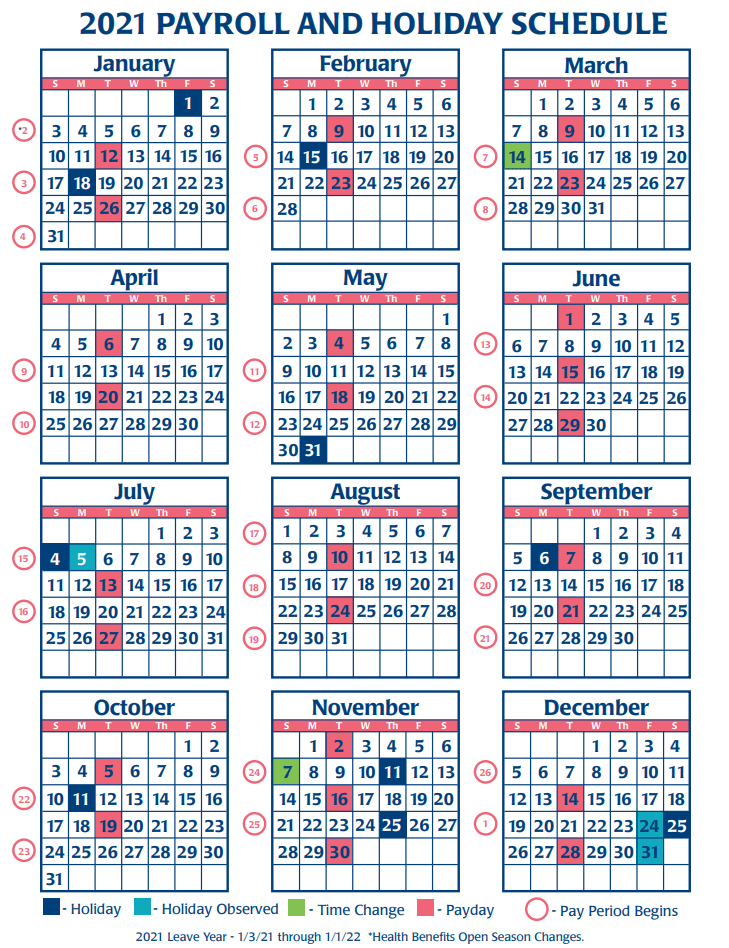

Bi-weekly Payroll: This system pays employees every two weeks, resulting in 26 pay periods per year. The pay dates are typically consistent, with minor adjustments for holidays.

-

Semi-monthly Payroll: This system pays employees twice a month, usually on the 15th and the last day of the month. However, variations might occur due to weekend or holiday fallouts.

Regardless of the chosen payroll frequency, the Mount Sinai calendar will clearly indicate:

-

Pay Dates: The specific dates when employees can expect their payments to be deposited into their designated accounts.

-

Pay Periods: The timeframe for which each paycheck covers. This is crucial for tracking hours worked and ensuring accurate payment.

-

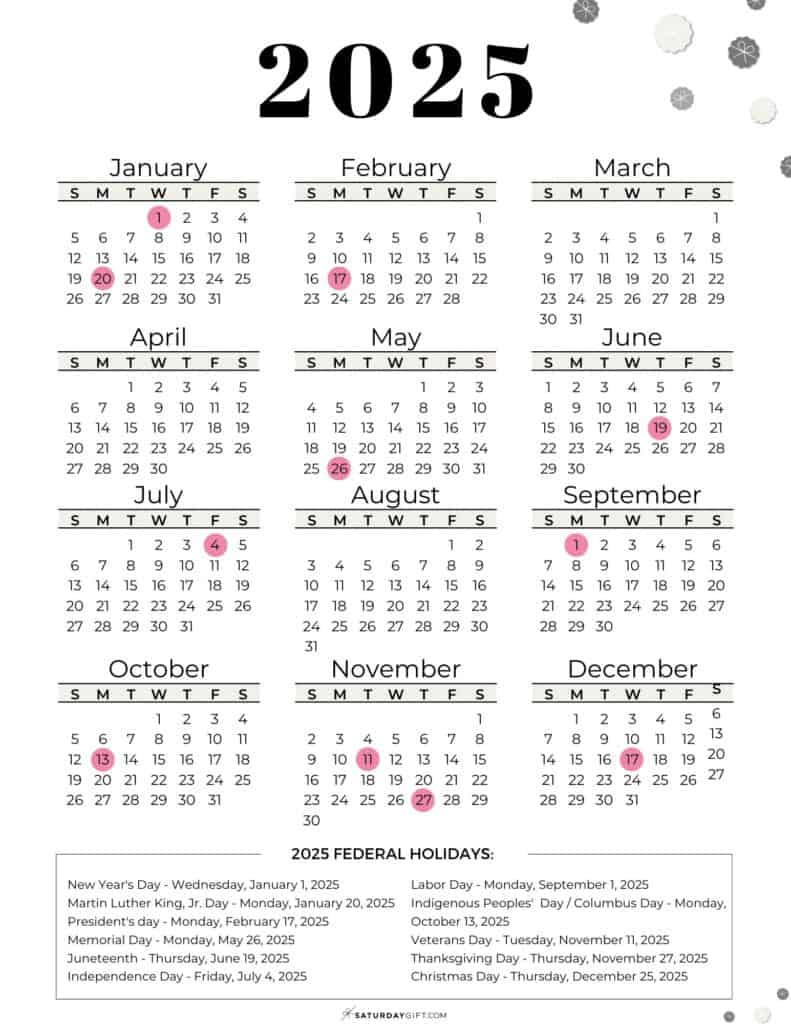

Holiday Adjustments: The calendar will reflect any adjustments to pay dates due to holidays falling within a pay period. This might involve early or late payments to accommodate holiday closures.

-

Important Deadlines: The calendar may also include deadlines for submitting timesheets, expense reports, or other payroll-related documentation. Meeting these deadlines is crucial for timely and accurate payment processing.

Strategies for Managing Your Finances with the Mount Sinai Payroll Calendar:

Once you access the 2025 calendar, utilize these strategies for effective financial management:

-

Budgeting: Use the calendar to create a detailed budget. Knowing the exact pay dates allows for accurate allocation of funds for essential expenses, savings goals, and debt payments. Budgeting apps and spreadsheets can be helpful tools.

-

Automatic Payments: Set up automatic payments for recurring bills, such as rent, utilities, and loan repayments. This ensures timely payments and avoids late fees. Scheduling these payments to coincide with your pay dates minimizes the risk of missed payments.

-

Emergency Fund: Allocate a portion of each paycheck to an emergency fund. This fund serves as a safety net for unexpected expenses or financial emergencies.

-

Savings Goals: Use the payroll calendar to track progress towards your savings goals. Whether it’s a down payment on a house, a vacation, or retirement, knowing your pay dates allows for disciplined savings.

-

Tax Planning: The payroll calendar helps in tax planning. Understanding your pay schedule helps you estimate your annual income and plan for tax obligations. Consult a financial advisor for personalized tax planning.

-

Tracking Expenses: Use a budgeting app or spreadsheet to track your expenses throughout each pay period. This helps identify areas where you can potentially reduce spending and improve your financial health.

Addressing Payroll-Related Inquiries:

If you have any questions or concerns regarding your Mount Sinai payroll, utilize the resources available to you:

-

Employee Portal: The employee portal is typically the first point of contact for payroll-related questions. It may offer FAQs, self-service tools, and contact information for payroll support.

-

HR Department: The HR department is a valuable resource for addressing payroll-related inquiries. Contact them via phone, email, or in person to seek clarification or assistance.

-

Payroll Department: The dedicated payroll department is specifically equipped to handle payroll-related issues. Contact them directly for assistance with specific payment concerns.

-

Union Representative (if applicable): If you are a union member, your union representative can provide support and guidance on payroll-related matters.

Proactive Approach:

Proactive engagement with your payroll information is crucial. Don’t wait until the last minute to address any concerns. Review your pay stubs regularly to ensure accuracy and identify any discrepancies promptly. By staying informed and proactive, you can ensure a smooth and hassle-free payroll experience throughout 2025.

In conclusion, while the specific dates for the Mount Sinai payroll calendar 2025 are not yet available, understanding the typical structure, utilizing available resources, and adopting proactive financial management strategies will significantly contribute to a stress-free financial year. Remember to regularly check the internal employee portal and company communications for the official release of the 2025 payroll calendar. This information will empower you to plan effectively and manage your finances responsibly.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Mount Sinai Payroll Calendar 2025: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!