Navigating the ICE Natural Gas Trading Calendar: A Comprehensive Guide

Related Articles: Navigating the ICE Natural Gas Trading Calendar: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the ICE Natural Gas Trading Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the ICE Natural Gas Trading Calendar: A Comprehensive Guide

The Intercontinental Exchange (ICE) is a global marketplace for a wide range of commodities, including natural gas. Understanding the ICE natural gas trading calendar is crucial for anyone involved in the buying, selling, or analysis of this vital energy source. This calendar dictates trading hours, contract specifications, and settlement procedures, influencing price discovery and risk management strategies. This article provides a comprehensive overview of the ICE natural gas trading calendar, its intricacies, and its significance for market participants.

Understanding the ICE Natural Gas Contracts:

Before diving into the calendar specifics, it’s vital to understand the different ICE natural gas contracts available. The most prominent is the Henry Hub Natural Gas Futures contract, traded on the ICE Futures U.S. exchange. This contract is based on the delivery of natural gas at the Henry Hub natural gas pipeline hub in Erath, Louisiana, a key benchmark for North American natural gas pricing. The contract’s specifications, including contract size, delivery months, and trading units, are critical for understanding the calendar’s relevance.

Other ICE natural gas contracts include:

- ICE Natural Gas Options: These provide buyers and sellers with the right, but not the obligation, to buy or sell natural gas futures contracts at a predetermined price and time. The calendar dictates the expiration dates of these options, significantly impacting their value.

- ICE Natural Gas Swaps: These are privately negotiated over-the-counter (OTC) agreements to exchange cash flows based on the price of natural gas. While not directly governed by the ICE trading calendar in the same way as futures, the underlying futures contracts heavily influence swap pricing and valuation.

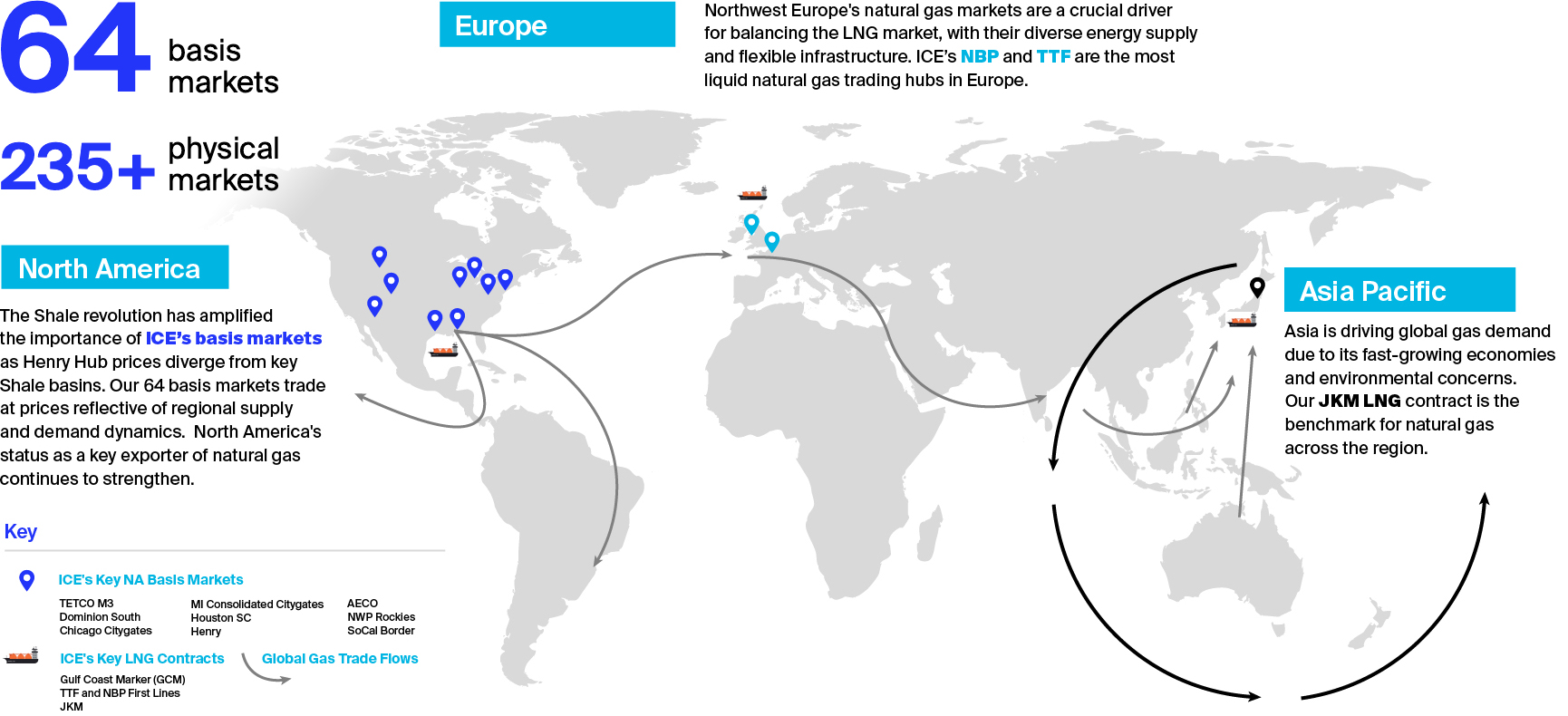

- Regional Natural Gas Contracts: ICE also lists futures contracts tied to specific regional hubs, providing price discovery for natural gas in different geographic areas. These contracts have their own specific calendars, reflecting regional delivery characteristics and trading patterns.

The Structure of the ICE Natural Gas Futures Trading Calendar:

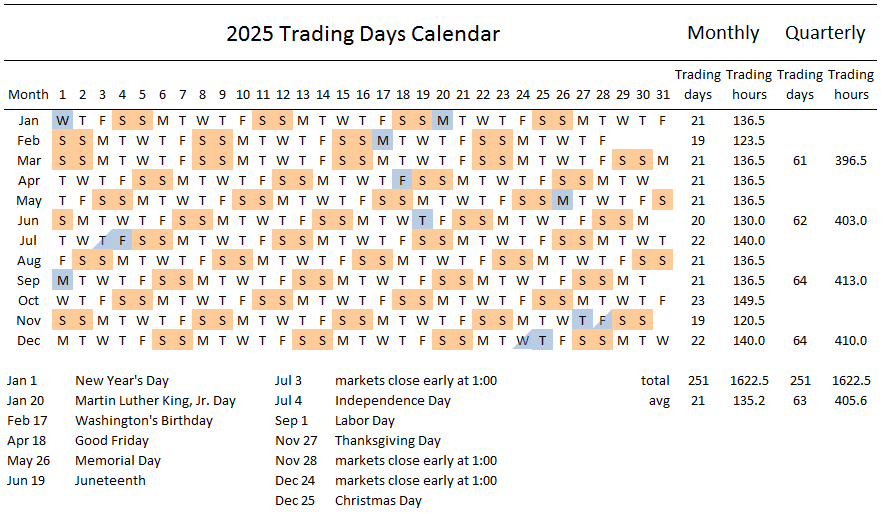

The ICE Henry Hub Natural Gas Futures contract calendar is structured around monthly contracts, each expiring on the last business day of the delivery month. This means there’s a continuous stream of contracts available, ensuring liquidity and allowing for hedging and speculation across various time horizons.

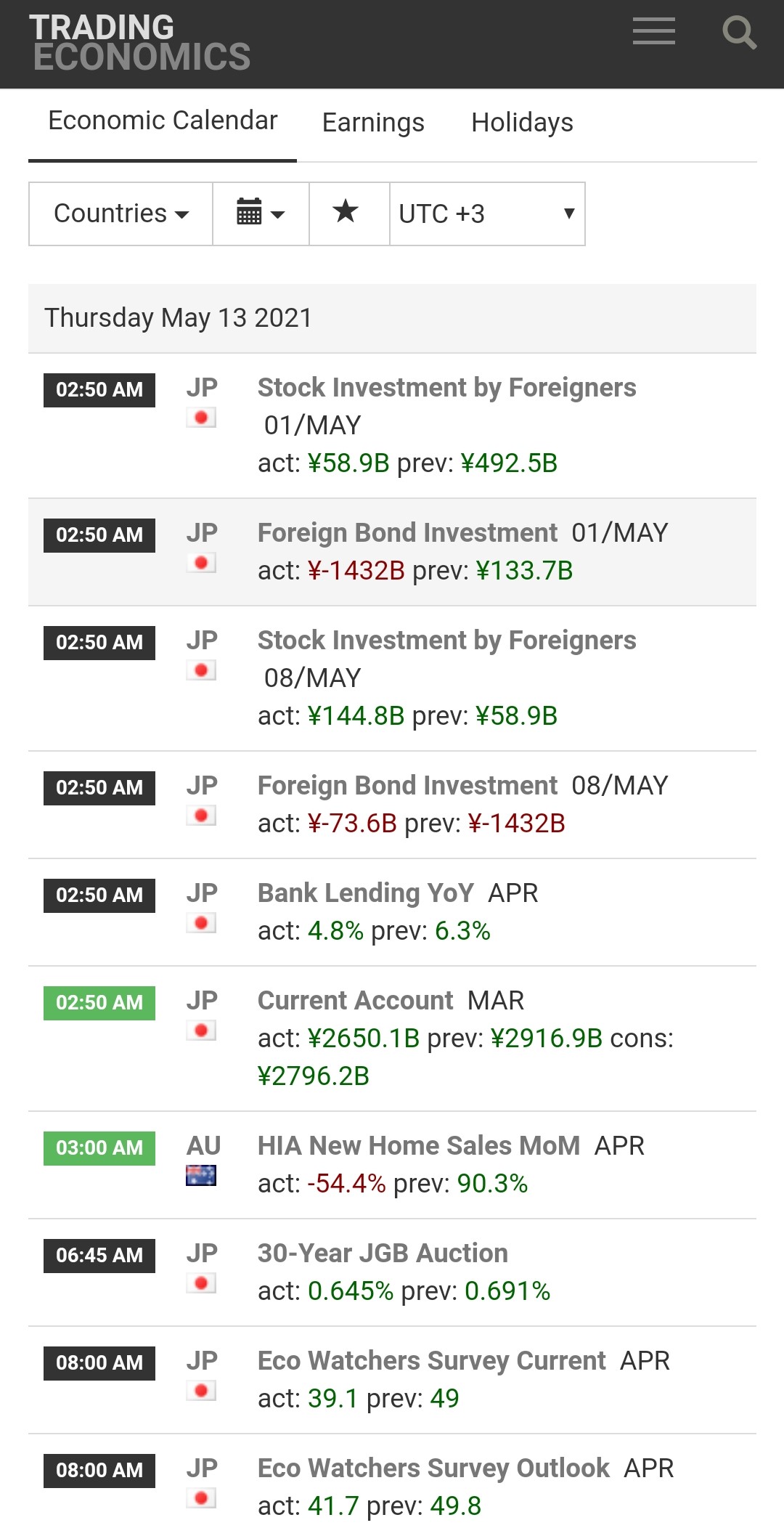

- Trading Hours: The ICE Futures U.S. exchange operates during specific trading hours, typically from 7:00 AM to 1:00 PM CT (Central Time). Understanding these hours is essential for participating in the market and executing trades. However, electronic trading platforms often allow for after-hours trading, albeit with potentially lower liquidity.

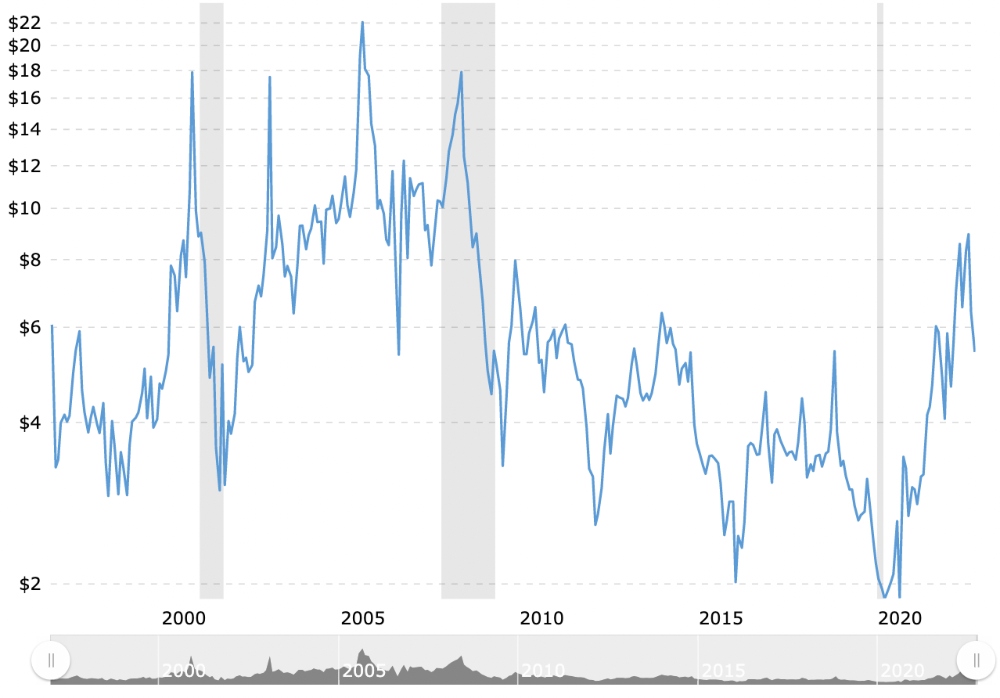

- Delivery Months: Contracts are available for delivery in the current month and up to approximately two years into the future. The calendar clearly defines the delivery months and the last trading day for each contract. The further out the contract’s delivery date, the more the price reflects forward expectations of supply and demand.

- Contract Expiry: As mentioned, contracts expire on the last business day of the delivery month. This is a crucial date for market participants, as positions must be closed or settled by this point. Failure to do so can result in physical delivery of natural gas, a process that requires significant logistical coordination and is generally avoided by most traders.

- Holidays and Weekends: The ICE trading calendar takes into account U.S. holidays and weekends. Trading is typically suspended on these days, impacting market activity and potentially leading to price gaps upon reopening.

The Significance of the ICE Natural Gas Trading Calendar for Market Participants:

The ICE natural gas trading calendar plays a crucial role for various market players:

- Hedgers: Companies involved in the production, transportation, or consumption of natural gas use the calendar to hedge against price fluctuations. They utilize futures and options contracts to lock in prices for future deliveries, mitigating risk associated with price volatility. Understanding the expiry dates is vital for effective hedging strategies.

- Speculators: Traders who speculate on price movements utilize the calendar to time their entries and exits from the market. They leverage the calendar to analyze price trends and identify potential trading opportunities based on contract expiry and upcoming events.

- Arbitrageurs: These traders exploit price discrepancies between different contracts or markets. The calendar aids them in identifying arbitrage opportunities by comparing prices across different delivery months and regional hubs.

- Analysts: Market analysts use the calendar to track price movements, analyze supply and demand dynamics, and forecast future price trends. The calendar provides a framework for understanding market behavior and interpreting price signals.

- Financial Institutions: Banks and other financial institutions use the calendar to manage their risk exposure related to natural gas trading. They employ sophisticated models to assess the value of their positions based on the calendar and market conditions.

Challenges and Considerations:

Despite its structured nature, the ICE natural gas trading calendar presents certain challenges:

- Liquidity Variations: Liquidity varies across different contract months. The most liquid contracts are typically those closest to expiry, while longer-dated contracts may exhibit lower trading volumes.

- Seasonal Factors: Natural gas prices are subject to significant seasonal variations, influenced by heating and cooling demands. The calendar must be analyzed in conjunction with seasonal factors to accurately assess price movements.

- Geopolitical Events: Unexpected geopolitical events, such as disruptions to supply chains or changes in government regulations, can significantly impact natural gas prices and create volatility beyond the typical calendar-based patterns.

- Technological Disruptions: Technical glitches or disruptions to the ICE trading platform can temporarily halt trading, impacting market liquidity and price discovery.

Conclusion:

The ICE natural gas trading calendar is a cornerstone of the North American natural gas market. A thorough understanding of its structure, contract specifications, and implications for different market participants is essential for successful participation in this dynamic and crucial energy market. By carefully analyzing the calendar in conjunction with fundamental and technical factors, traders, hedgers, and analysts can make informed decisions and navigate the complexities of natural gas trading. Staying updated on any changes or announcements regarding the calendar from ICE is crucial for maintaining a competitive edge in the market. Utilizing resources provided by ICE, including their official website and market data platforms, ensures access to the most current and accurate information. Furthermore, continuous learning and adaptation to evolving market dynamics are key to successful navigation of the ICE natural gas trading calendar.

Closure

Thus, we hope this article has provided valuable insights into Navigating the ICE Natural Gas Trading Calendar: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!