Mastering Your 2024 Bi-Weekly Payroll: A Comprehensive Guide with a Free Template

Related Articles: Mastering Your 2024 Bi-Weekly Payroll: A Comprehensive Guide with a Free Template

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Mastering Your 2024 Bi-Weekly Payroll: A Comprehensive Guide with a Free Template. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Mastering Your 2024 Bi-Weekly Payroll: A Comprehensive Guide with a Free Template

The cornerstone of any successful business, regardless of size, is efficient payroll management. Accuracy and timeliness are paramount, not only for legal compliance but also for maintaining employee morale and fostering a positive work environment. For businesses operating on a bi-weekly payroll schedule, meticulous planning is key. This article provides a comprehensive guide to navigating the 2024 bi-weekly payroll calendar, offering insights into best practices, potential challenges, and a free downloadable template to streamline your process.

Understanding the Bi-Weekly Payroll Cycle:

A bi-weekly payroll cycle means employees are paid every two weeks. Unlike semi-monthly payroll (twice a month on fixed dates), the pay periods are always 14 days long, regardless of the number of days in a month. This consistency simplifies payroll processing and budgeting. However, it also means that the pay dates will shift throughout the year, falling on different days of the week.

The 2024 Bi-Weekly Payroll Calendar: Navigating the Year:

The 2024 bi-weekly payroll calendar presents a unique set of challenges due to the varying number of days in each month and the shifting pay periods. Accurately calculating pay dates and ensuring timely payments requires careful planning. The following sections outline key considerations:

-

Determining Pay Periods: The first step is establishing your first pay period for 2024. This will dictate all subsequent pay periods throughout the year. Common starting points are the first full pay period of the year or a specific date aligned with your business’s accounting cycle.

-

Calculating Pay Dates: Once your first pay period is established, subsequent pay dates are calculated by adding 14 days to the previous pay date. This straightforward calculation ensures consistency. However, it’s crucial to account for weekends and holidays. Many businesses opt to pay employees on the Friday closest to the calculated pay date, ensuring employees receive their wages before the weekend.

-

Accounting for Holidays: Federal and state holidays can significantly impact your payroll schedule. If a pay date falls on a holiday, you’ll need to decide whether to pay employees early or adjust the pay date accordingly. Clearly communicating this policy to your employees is essential to avoid confusion and maintain transparency.

-

Year-End Considerations: The end of the year requires extra attention. Ensure your final pay period aligns with your year-end reporting requirements. Accurate record-keeping is crucial for tax filings and compliance.

Challenges and Best Practices:

While the bi-weekly payroll cycle offers consistency, it presents some challenges:

-

Inconsistent Pay Dates: The fluctuating pay dates can make budgeting and financial forecasting slightly more complex compared to a semi-monthly schedule.

-

Holiday Adjustments: Managing holiday pay and potential pay date shifts requires careful planning and clear communication.

-

Year-End Processing: Year-end payroll processing involves additional complexities, including year-to-date calculations, tax reporting, and W-2 preparation.

To mitigate these challenges, consider the following best practices:

-

Utilize Payroll Software: Investing in payroll software significantly simplifies the process. Many platforms automate calculations, handle tax deductions, and generate reports, reducing manual errors and saving time.

-

Develop a Detailed Calendar: A well-structured bi-weekly payroll calendar, like the one provided below, is invaluable. It provides a clear overview of pay periods, pay dates, and any potential holiday adjustments.

-

Establish Clear Communication: Communicate your payroll schedule and any adjustments clearly to your employees. This helps prevent misunderstandings and ensures everyone is informed.

-

Regularly Review and Update: Review your payroll calendar regularly to identify any potential issues or adjustments needed. This proactive approach ensures accuracy and prevents last-minute surprises.

-

Maintain Accurate Records: Maintain meticulous records of all payroll transactions, including pay stubs, tax forms, and other relevant documentation. This is crucial for audits and compliance.

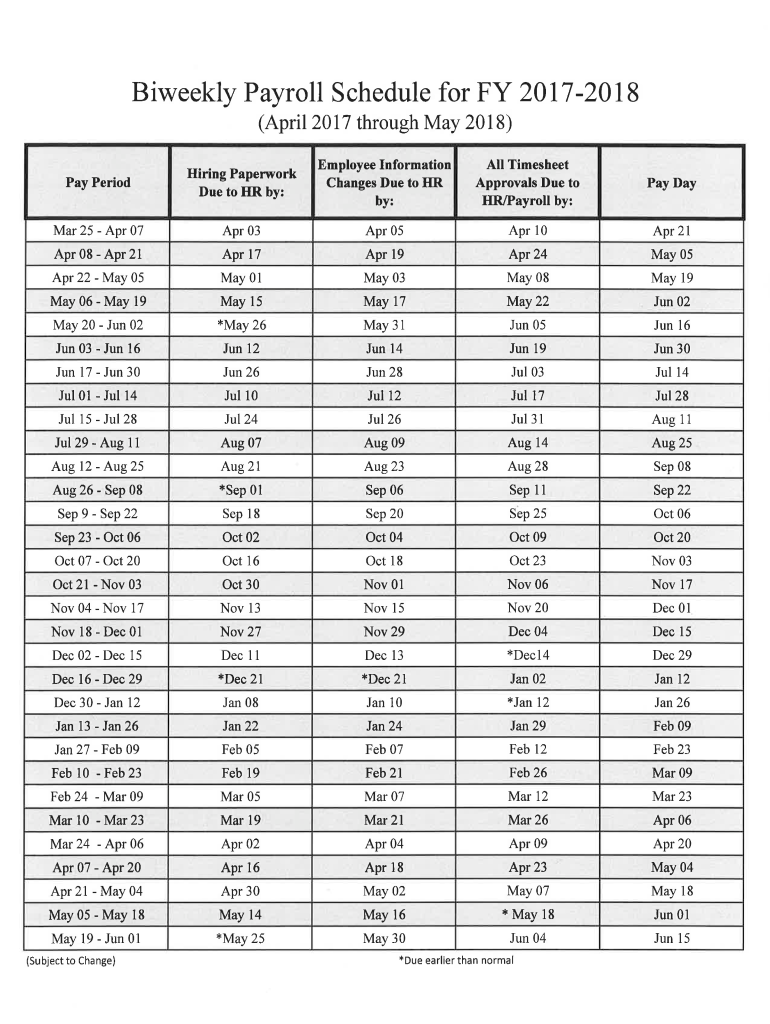

Free Downloadable 2024 Bi-Weekly Payroll Calendar Template:

[Here you would insert a downloadable link to a spreadsheet or PDF file containing a detailed 2024 bi-weekly payroll calendar. The calendar should include columns for: Pay Period Number, Pay Period Start Date, Pay Period End Date, Pay Date, and Notes (for holidays or other relevant information). This template should be formatted clearly and easily understandable.]

Example of a section of the calendar:

| Pay Period Number | Pay Period Start Date | Pay Period End Date | Pay Date | Notes |

|---|---|---|---|---|

| 1 | January 1, 2024 | January 14, 2024 | January 12, 2024 | |

| 2 | January 15, 2024 | January 28, 2024 | January 26, 2024 | |

| 3 | January 29, 2024 | February 11, 2024 | February 9, 2024 | |

| 4 | February 12, 2024 | February 25, 2024 | February 23, 2024 | |

| … | … | … | … | … |

Conclusion:

Efficient payroll management is vital for any business. By understanding the intricacies of the bi-weekly payroll cycle, utilizing a well-structured calendar, and employing best practices, businesses can ensure accurate, timely, and compliant payroll processing throughout 2024. The downloadable template provided will serve as a valuable tool in streamlining this crucial aspect of your business operations. Remember to adapt the template to your specific needs and always consult with payroll professionals or legal advisors to ensure full compliance with all applicable regulations. Proper payroll management isn’t just about numbers; it’s about fostering a positive and productive work environment for your employees.

Closure

Thus, we hope this article has provided valuable insights into Mastering Your 2024 Bi-Weekly Payroll: A Comprehensive Guide with a Free Template. We thank you for taking the time to read this article. See you in our next article!