Mastering the Discover it® Cash Back Calendar: A Comprehensive Guide to Maximizing Your Rewards

Related Articles: Mastering the Discover it® Cash Back Calendar: A Comprehensive Guide to Maximizing Your Rewards

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Mastering the Discover it® Cash Back Calendar: A Comprehensive Guide to Maximizing Your Rewards. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Mastering the Discover it® Cash Back Calendar: A Comprehensive Guide to Maximizing Your Rewards

The Discover it® Cash Back credit card is a popular choice for many consumers due to its straightforward rewards program and rotating quarterly categories. However, truly maximizing the card’s potential requires a deep understanding of its unique "cash back calendar," a system that dictates which spending categories earn the highest rewards each quarter. This article dives into the intricacies of the Discover it® Cash Back calendar, offering strategies to optimize your spending and unlock the full value of this rewarding card.

Understanding the Rotating Categories:

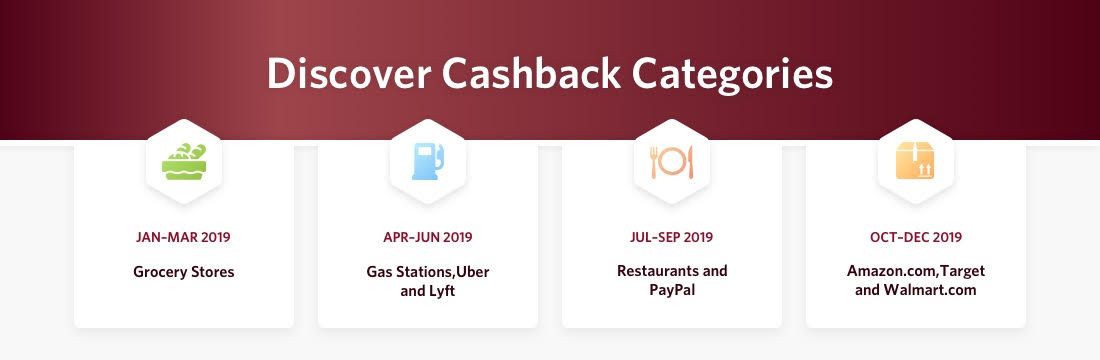

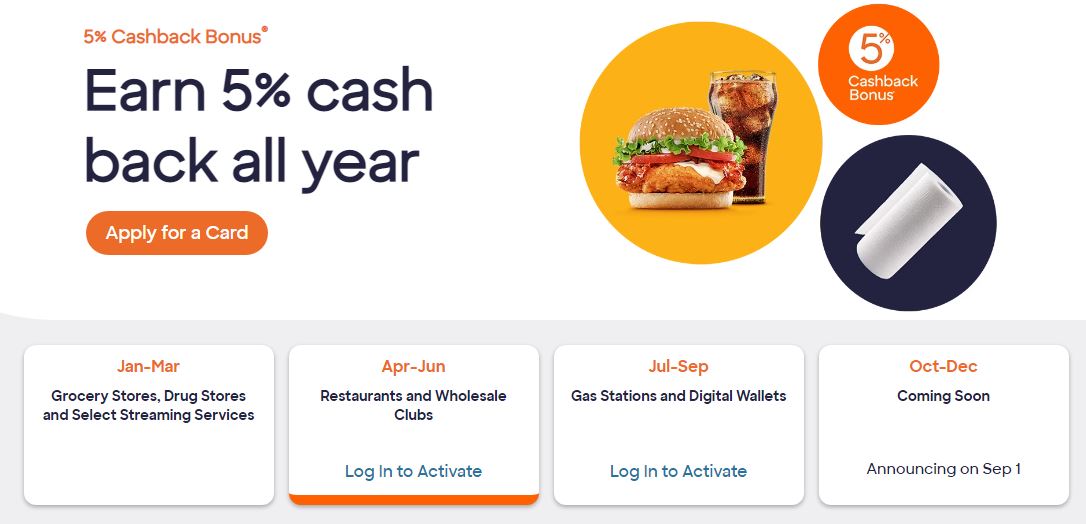

The core of the Discover it® Cash Back card’s appeal lies in its rotating 5% cash back categories. Every three months, Discover announces new categories where cardholders earn 5% cash back on purchases up to a specified limit (typically $1,500 per quarter). This differs from cards offering a flat percentage back on all purchases or fixed categories, making strategic planning crucial. These rotating categories often cover a broad spectrum, including popular retail sectors, online services, and even specific types of merchants. Past examples have included grocery stores, gas stations, restaurants, Amazon.com, and various online retailers.

Beyond the 5% cash back categories, the Discover it® Cash Back card offers 1% cash back on all other purchases. This consistent baseline reward ensures you’re earning something back on every transaction, regardless of whether you’re actively targeting a 5% category.

Accessing the Cash Back Calendar:

The official Discover website is the primary source for the current and upcoming quarterly cash back calendar. You can easily find this information by logging into your Discover account online or through the Discover mobile app. The calendar clearly outlines the 5% cash back categories for the current quarter and the upcoming quarters, allowing you to plan your spending accordingly. It’s essential to check the calendar regularly, as the categories change every three months. Failing to do so could mean missing out on significant cash back opportunities.

Strategies for Maximizing Your Discover it® Cash Back:

Successfully navigating the Discover it® Cash Back calendar requires a proactive approach. Here are several strategies to ensure you’re maximizing your rewards:

-

Plan Ahead: The key to maximizing your rewards is planning. Once the next quarter’s categories are announced, review your upcoming expenses and adjust your spending habits accordingly. If possible, shift larger purchases, such as furniture or electronics, to align with the 5% cash back categories. This requires some foresight but can significantly boost your overall cash back earnings.

-

Utilize Online Tools and Budgeting Apps: Numerous budgeting and personal finance apps can help track your spending and ensure you’re staying within the $1,500 spending limit for the 5% cash back categories. These tools can provide valuable insights into your spending habits, allowing you to make informed decisions about where to focus your spending.

-

Consider Gift Cards: Purchasing gift cards for retailers included in the 5% cash back categories can be a clever strategy. This allows you to earn maximum rewards even if you don’t plan on making a large purchase immediately. However, always ensure you’re purchasing gift cards from authorized retailers to avoid scams.

-

Track Your Progress: Regularly monitor your spending against the $1,500 limit for each 5% category. This prevents you from exceeding the limit and losing out on the enhanced rewards. The Discover website and app provide tools to track your progress, making it easy to stay on top of your spending.

-

Combine with Other Rewards Programs: Don’t limit yourself to only the Discover it® Cash Back card. If a purchase qualifies for both a Discover 5% category and another rewards program (e.g., store loyalty points), strategically use both to maximize your overall rewards.

-

Be Mindful of Fees: While the Discover it® Cash Back card doesn’t have an annual fee, always be aware of potential interest charges if you carry a balance. Pay your balance in full each month to avoid interest and maximize your cash back earnings.

-

Consider the "Match" Feature: Discover offers a unique "Match" feature where they match all the cash back you’ve earned at the end of your first year. This effectively doubles your rewards for the first year, making it a significant benefit for new cardholders. This doubles the impact of strategically planning your spending during the first year.

Potential Downsides and Considerations:

While the Discover it® Cash Back card offers many advantages, it’s essential to consider potential drawbacks:

-

Rotating Categories: The rotating nature of the 5% cash back categories requires consistent monitoring and planning. Failure to pay attention to the calendar could lead to missed opportunities.

-

Spending Limit: The $1,500 spending limit per category per quarter might not be sufficient for all large purchases. You might need to spread your spending across multiple quarters to maximize the 5% cash back.

-

Limited Category Selection: The specific categories offered each quarter may not always align perfectly with your spending habits. Some quarters might offer categories less relevant to your usual expenses.

Comparison with Other Cash Back Cards:

The Discover it® Cash Back card’s rotating categories differentiate it from other cash back cards that offer a flat percentage or fixed categories. Cards offering a flat percentage back, such as the Chase Freedom Unlimited®, provide consistent rewards regardless of spending habits, but typically at a lower percentage. Cards with fixed categories, such as the Citi® Double Cash Card, offer a predictable structure but might not always align with individual spending patterns. The best choice depends on individual spending habits and preferences.

Conclusion:

The Discover it® Cash Back card, with its rotating 5% cash back calendar, offers a compelling rewards program for those willing to engage in strategic planning. By understanding the calendar, utilizing available tools, and employing the strategies outlined above, you can effectively maximize your cash back earnings and make the most of this rewarding credit card. Remember to consistently monitor the calendar, track your spending, and pay your balance in full each month to fully realize the potential of the Discover it® Cash Back card and enjoy the benefits of its flexible and potentially lucrative rewards system. The key to success lies in proactive planning and consistent engagement with the program.

Closure

Thus, we hope this article has provided valuable insights into Mastering the Discover it® Cash Back Calendar: A Comprehensive Guide to Maximizing Your Rewards. We thank you for taking the time to read this article. See you in our next article!