Navigating the 2024 Semi-Monthly Payroll Calendar: A Comprehensive Guide for Employers

Related Articles: Navigating the 2024 Semi-Monthly Payroll Calendar: A Comprehensive Guide for Employers

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the 2024 Semi-Monthly Payroll Calendar: A Comprehensive Guide for Employers. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2024 Semi-Monthly Payroll Calendar: A Comprehensive Guide for Employers

The year 2024 presents a new set of challenges and opportunities for businesses, and managing payroll efficiently is crucial for success. For companies employing a semi-monthly payroll schedule – paying employees twice a month – understanding and utilizing a precise calendar is paramount. This article provides a detailed exploration of the 2024 semi-monthly payroll calendar, offering insights into its structure, potential complexities, and strategies for seamless payroll processing. We’ll also delve into the importance of accurate record-keeping, compliance considerations, and best practices for effective payroll management.

Understanding the Semi-Monthly Payroll Cycle:

Unlike bi-weekly payrolls (paid every two weeks), semi-monthly payrolls are issued twice a month, typically on a fixed date, regardless of the number of days in each pay period. This consistency offers predictability for both employers and employees. However, the exact dates vary each month, requiring careful planning and a well-organized calendar.

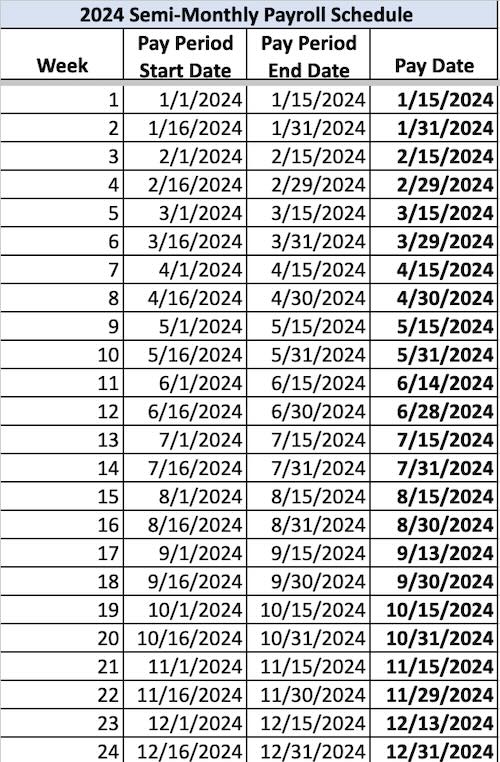

Constructing the 2024 Semi-Monthly Payroll Calendar:

Creating a 2024 semi-monthly payroll calendar requires considering the specific paydays chosen by your company. Common choices include the 1st and 15th, or the 15th and the last day of each month. Regardless of the chosen dates, consistency is key. Here’s a sample calendar assuming paydays on the 1st and 15th of each month:

(Note: This is a sample calendar. Your actual payroll calendar should be customized based on your chosen paydays and any company-specific adjustments.)

| Month | Payday 1 | Payday 2 | Notes |

|---|---|---|---|

| January | January 1 | January 15 | |

| February | February 1 | February 15 | |

| March | March 1 | March 15 | |

| April | April 1 | April 15 | |

| May | May 1 | May 15 | |

| June | June 1 | June 15 | |

| July | July 1 | July 15 | |

| August | August 1 | August 15 | |

| September | September 1 | September 15 | |

| October | October 1 | October 15 | |

| November | November 1 | November 15 | |

| December | December 1 | December 15 |

Addressing Potential Calendar Complications:

While a fixed-date semi-monthly payroll offers simplicity, certain factors require attention:

-

Holidays: If a payday falls on a weekend or holiday, the company must determine whether to pay early or late. Consistent communication with employees regarding holiday pay schedules is vital. This should be clearly outlined in the company’s payroll policy.

-

Year-End Adjustments: The final pay period of the year may require adjustments to accommodate the varying number of days in December and to ensure accurate year-end reporting. Careful calculation is necessary to avoid discrepancies.

-

Accrued Time Off: Accurate tracking of accrued vacation, sick, and other paid time off is crucial, particularly with a semi-monthly payroll. The system must correctly calculate and pay these benefits based on the employee’s accrued time.

-

Payroll Software Integration: Utilizing payroll software designed to handle semi-monthly payrolls can significantly simplify the process. Such software often automatically calculates pay, deducts taxes, and generates necessary reports, minimizing manual errors.

Compliance and Legal Considerations:

Maintaining compliance with federal, state, and local labor laws is paramount. This includes:

-

Minimum Wage Laws: Ensure that all employees receive at least the minimum wage required by law.

-

Overtime Pay: Accurately calculate and pay overtime for hours worked beyond the standard workweek.

-

Tax Withholding: Properly withhold federal, state, and local income taxes, as well as Social Security and Medicare taxes (FICA). Staying updated on tax law changes is crucial.

-

Reporting Requirements: File all necessary payroll tax returns accurately and on time. Penalties for late or inaccurate filings can be substantial.

-

Employee Classification: Correctly classify employees as either exempt or non-exempt to determine eligibility for overtime pay. Misclassifying employees can lead to significant legal and financial penalties.

Best Practices for Effective Payroll Management:

-

Centralized Payroll System: Implement a centralized system for managing payroll data, reducing the risk of errors and ensuring consistency.

-

Regular Audits: Conduct regular audits of payroll records to identify and correct any discrepancies.

-

Employee Self-Service Portals: Provide employees with access to online portals to view pay stubs, update personal information, and submit time-off requests.

-

Robust Documentation: Maintain comprehensive documentation of all payroll processes, including policies, procedures, and records.

-

Training and Development: Provide training to payroll staff on payroll regulations, best practices, and the use of payroll software.

-

Outsourcing: Consider outsourcing payroll processing to a specialized payroll company, particularly for smaller businesses. This can free up internal resources and reduce the administrative burden.

Conclusion:

Successfully managing a semi-monthly payroll in 2024 requires meticulous planning, attention to detail, and a commitment to compliance. By understanding the nuances of the payroll calendar, addressing potential complications, and implementing best practices, businesses can ensure accurate and timely payments to their employees, fostering a positive work environment and minimizing legal and financial risks. Utilizing payroll software, maintaining comprehensive records, and staying abreast of changes in employment law are crucial elements in building a robust and efficient payroll system. The investment in time and resources for effective payroll management will ultimately contribute to a smoother and more successful business operation. Remember to consult with legal and financial professionals to ensure compliance with all applicable laws and regulations.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2024 Semi-Monthly Payroll Calendar: A Comprehensive Guide for Employers. We thank you for taking the time to read this article. See you in our next article!