The Essential Guide to Jewellery Bills: Understanding the Format and Its Significance

Related Articles: The Essential Guide to Jewellery Bills: Understanding the Format and Its Significance

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Essential Guide to Jewellery Bills: Understanding the Format and Its Significance. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Essential Guide to Jewellery Bills: Understanding the Format and Its Significance

In the realm of precious adornments, a jewellery bill serves as a crucial document, detailing the transaction between a buyer and a seller. This comprehensive guide will delve into the intricacies of jewellery bill format, exploring its key components, significance, and the benefits it offers to both parties involved.

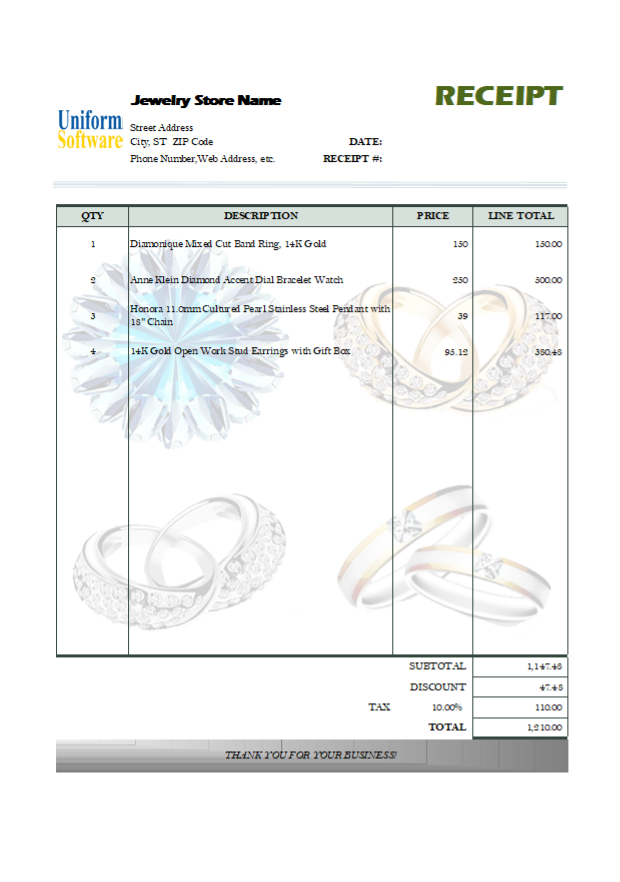

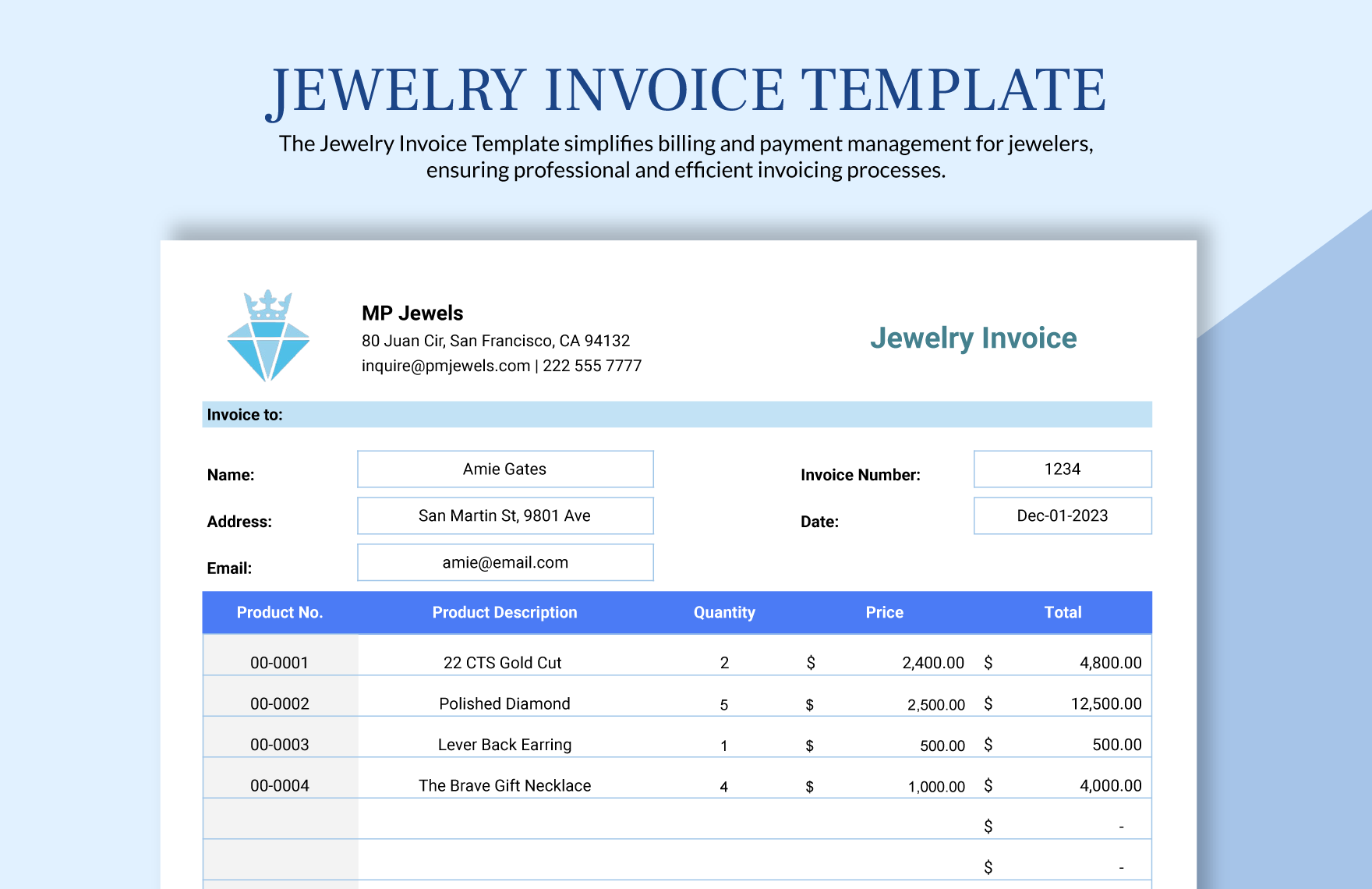

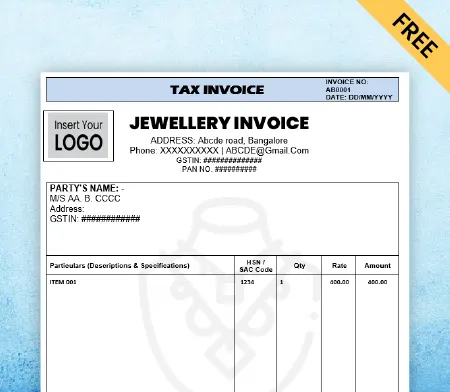

Understanding the Structure of a Jewellery Bill

A well-structured jewellery bill provides a clear and concise record of the purchase, ensuring transparency and accountability. It typically comprises the following sections:

1. Header Information:

- Seller Details: This section includes the name, address, and contact details of the jewellery store or seller. It may also include the seller’s registration number or license information, if applicable.

- Date and Time of Purchase: This indicates the date and time when the transaction occurred, establishing a clear timeline for the purchase.

- Bill Number: A unique identification number assigned to each bill, facilitating easy tracking and reference.

2. Customer Information:

- Buyer’s Name and Address: This section captures the buyer’s full name and contact details, ensuring accurate identification and delivery of the purchased items.

- Contact Number: Providing the buyer’s phone number allows for easy communication regarding any queries or follow-up actions.

3. Itemized Description:

- Item Name and Description: This section lists each purchased jewellery item, providing a detailed description of the piece, including its material (gold, silver, platinum, etc.), purity (karat, fineness), weight (grams or ounces), and any additional embellishments (stones, diamonds, etc.).

- Quantity: The number of each item purchased is clearly stated, ensuring accurate accounting.

- Unit Price: The price of each item is listed individually, providing transparency regarding the cost of each component.

- Total Price: The sum of all individual item prices, reflecting the total cost of the purchase.

4. Payment Details:

- Mode of Payment: This section specifies the method of payment used, such as cash, credit card, debit card, or online transfer.

- Payment Reference Number: If applicable, the transaction reference number for the chosen payment method is provided, enabling verification and tracking.

- Discount/Offers: Any discounts or promotional offers applied to the purchase are outlined here, ensuring clarity regarding the final price.

5. Tax Information:

- Tax Rate: The applicable tax rate for the purchase is clearly stated, ensuring compliance with local regulations.

- Tax Amount: The calculated tax amount is displayed separately, providing a breakdown of the total cost.

6. Total Amount Due:

- Final Total: The final amount payable, inclusive of all taxes and fees, is prominently displayed, confirming the total cost of the purchase.

7. Additional Information:

- Warranty/Guarantee: If the jewellery comes with a warranty or guarantee, the duration and terms are included, providing assurance and peace of mind to the buyer.

- Delivery Information: If the purchase involves delivery, the delivery address and estimated delivery time are provided, ensuring timely and accurate delivery.

- Return Policy: Information regarding the store’s return policy, including the time frame and conditions for returns or exchanges, is outlined here, enhancing customer transparency.

The Importance of a Detailed Jewellery Bill

A well-structured jewellery bill holds significant value for both the buyer and the seller:

For the Buyer:

- Proof of Purchase: The bill serves as legal documentation of the purchase, providing evidence of ownership in case of any disputes or claims.

- Transparency and Accountability: The detailed breakdown of the purchase allows the buyer to verify the price, quality, and authenticity of the jewellery.

- Warranty and Guarantee Information: The bill clearly outlines the terms of any warranty or guarantee associated with the purchase, safeguarding the buyer’s rights.

- Tax Deduction: In some cases, the bill can be used as proof of purchase for tax deduction purposes, offering potential financial benefits.

For the Seller:

- Accurate Record Keeping: The bill provides a comprehensive record of the transaction, facilitating efficient inventory management, accounting, and tax reporting.

- Legal Compliance: The bill ensures compliance with relevant legal requirements, including consumer protection laws and tax regulations.

- Customer Satisfaction: A clear and informative bill enhances transparency and trust, contributing to customer satisfaction and loyalty.

- Business Efficiency: The bill simplifies the sales process, reducing the risk of errors and streamlining transactions.

Beyond the Basic Format: Additional Considerations

While the standard format outlined above provides a solid foundation, certain additional elements can enhance the value and usefulness of a jewellery bill:

- Product Images: Including high-quality images of the purchased jewellery items can provide visual confirmation of the purchase and enhance the bill’s informative value.

- Certificate of Authenticity: If the jewellery comes with a certificate of authenticity from a reputable organization, the bill should include details of the certificate, including its number and issuing body.

- Gemological Report: For jewellery containing precious stones, a gemological report detailing the stone’s characteristics (carat weight, clarity, color, cut) can be included for added transparency and value.

- Digital Bill: Providing a digital copy of the bill via email or a mobile app allows for easy access and storage, enhancing convenience for the buyer.

FAQs Regarding Jewellery Bills

1. What if I lose my jewellery bill?

- In case of a lost bill, contact the jewellery store where the purchase was made. They may be able to provide a duplicate bill or a copy of the transaction details.

2. Can I return jewellery without a bill?

- Most jewellery stores require the original bill for returns or exchanges. It serves as proof of purchase and helps verify the item’s authenticity.

3. What if the price on the bill is different from the price I paid?

- If there is a discrepancy between the bill and the actual price paid, immediately contact the jewellery store to resolve the issue. Ensure you have all relevant documentation, such as receipts or bank statements.

4. How do I ensure the authenticity of a jewellery bill?

- Look for official letterheads, contact details, and tax information on the bill. Verify the store’s registration or license details, if applicable.

5. Is it necessary to keep the jewellery bill after purchase?

- It is highly recommended to retain the bill for future reference, especially in case of warranty claims, returns, or any other issues related to the purchased jewellery.

Tips for Effective Jewellery Bill Management

- Keep Bills Organized: Store jewellery bills in a safe and organized manner, preferably in a dedicated folder or file system.

- Scan or Photograph Bills: Create digital copies of your jewellery bills to ensure easy access and backup in case of physical loss.

- Check for Accuracy: Always carefully review the details on the bill before signing or accepting it.

- Retain Bills for Warranty Period: Keep bills for the duration of the warranty period, ensuring easy access to warranty information.

Conclusion

A jewellery bill serves as a vital document, ensuring transparency, accountability, and legal compliance in jewellery transactions. Understanding its format, components, and significance empowers both buyers and sellers to navigate the world of precious adornments with confidence. By embracing the principles outlined in this guide, individuals can ensure a smooth and satisfactory experience in the purchase and ownership of jewellery, safeguarding their investment and ensuring a lasting appreciation of their treasured pieces.

Closure

Thus, we hope this article has provided valuable insights into The Essential Guide to Jewellery Bills: Understanding the Format and Its Significance. We thank you for taking the time to read this article. See you in our next article!